JPMorgan US Smaller Companies and Aberdeen Asian Income are some of the UK investment trusts posting some of the highest Sharpe ratios of their sectors over the past decade, Trustnet research shows.

Investors use the Sharpe ratio – which calculates the excess return earned per unit of volatility – to determine if an investment’s returns are worth the level of risk. A higher Sharpe ratio means it has delivered more return for each unit of risk.

In this article, Trustnet is looking for investment trusts in the Association of Investment Companies’ regional sectors that have made a top-quartile Sharpe ratio in at least five of the full calendar years of the past decade.

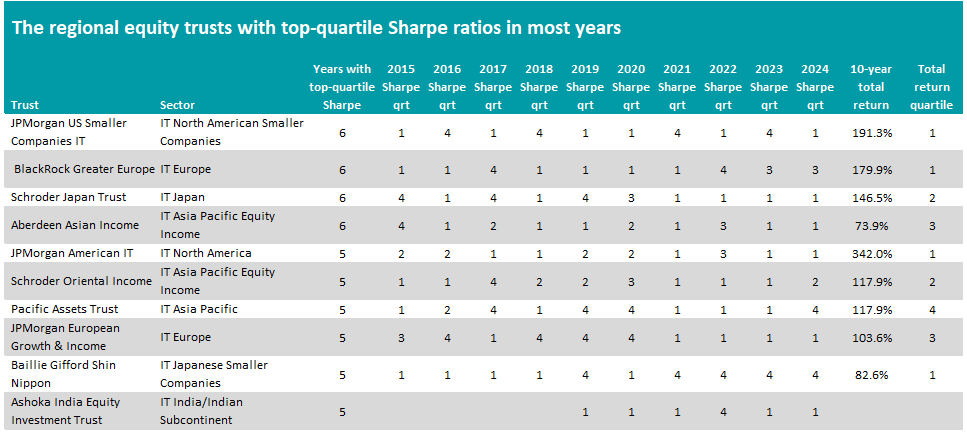

All the trusts that made the cut in this research can be seen in the table below, which is first ranked by the number of years in the top quartile for Sharpe ratio then by their 10-year returns.

Source: FE Analytics. Total return in sterling between 1 Jan 2015 and 31 Dec 2024.

There are 50 or so investment trusts in the regional sectors and 10 of those have been in their peer group’s top quartile for Sharpe ratio in at least five of the past 10 years.

At the top of the table is JPMorgan US Smaller Companies IT, which was top quartile in six of the years and made a 191.3% total return over the entire period under consideration.

Managed by Don San Jose, Daniel Percella and Jon Brachle, the trust focuses on quality-growth US small-caps. The managers believe this part of the market is undervalued when compared with the soaring performance of US mega-caps over recent years.

JPMorgan US Smaller Companies’ largest overweight is to industrials with safety equipment firm MSA, storage containers and modular building supplier Willscot and water, sewer and fire protection product distributor Core & Main being among its biggest holdings.

Analysts at Kepler said: “Smaller companies generally offer investors the opportunity to invest in less well-researched companies, often more domestically focussed and operating in niches that may not be covered by larger companies.

“US smaller companies are no different, but with the addition of a continental-sized economy, even a domestically focused company may have significant growth potential within its home market.”

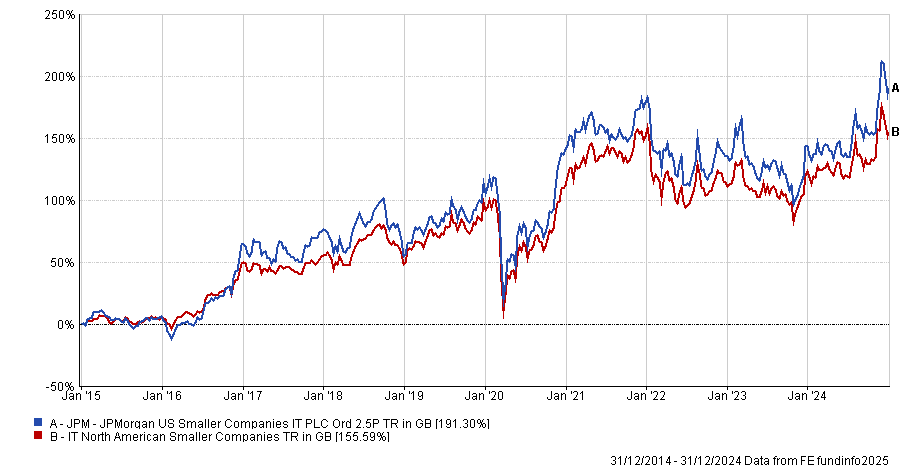

Performance of JPMorgan US Smaller Companies vs sector over 10yrs to end of 2024

Source: FE Analytics. Total return in sterling between 1 Jan 2015 and 31 Dec 2024.

Next is BlackRock Greater Europe, with six years in the top quartile for Sharpe ratio and a 10-year total return of 179.9%.

It is managed by Stefan Gries and Alexandra Dangoor, who run a concentrated portfolio where the 10 largest holdings account for more than half of the assets. These include RELX, Safran, Hermès, SAP and Ferrari.

The managers can invest in small-, mid- and large-cap companies but tend to focus on larger companies. They also have a preference for quality-growth companies, which have performed strongly for much of the past decade.

In third is Schroder Japan Trust, managed by Masaki Taketsume. It has a top-quartile Sharpe ratio for six of the past 10 years, with a total return of 146.5%.

Taketsume has a high-conviction, bottom-up approach that looks for high-quality but undervalued companies across the market cap spectrum, with a meaningful allocation to smaller companies. Top holdings include Asahi Group, Hitachi, T&D Holdings and Miura.

Kepler’s analysts noted that the manager has outperformed the Topix benchmark since becoming lead manager five years ago.

“We think this reflects his deep experience and understanding of the Japanese market,” they added. “Moving forward, we think improvements from corporate governance reforms and the fact value continues to outperform growth, could remain supportive factors for Schroder Japan’s performance, given Masaki’s value-oriented and high-quality investment approach.”

Aberdeen Asian Income is the only other trust to have spent six of the past 10 years in the top quartile for Sharpe ratio. Over this time, it made a 73.9% total return.

It is managed by Aberdeen’s Singapore-based Asian equities team, which has around 40 analysts based in six locations in the Asia-Pacific region. The team tends to invest in quality companies with strong balance sheets and activities in structural growth areas.

Analysts at Edison said: “Aberdeen Asian Income can be considered as a core fund for investors seeking exposure to Asia-Pacific companies, which in aggregate have stronger balance sheets than businesses in developed markets.

“Aberdeen Asian Income’s quality portfolio with its yield bias means that the company should be resilient during periods of share price weakness, but is likely to lag a strong equity market.”