More investment trusts are trading above their net asset value (NAV) this year compared to 2024, as investors grow more willing to pay extra for dependable income, a proven track record or access to rare opportunities.

According to data from AJ Bell and the Association of Investment Companies (AIC), 24 investment trusts now trade at a premium, compared with 19 this time last year – still a far cry from the 88 premium-rated trusts in 2015, but a noticeable shift in sentiment after years of discount dominance.

For Dan Coatsworth, investment analyst at AJ Bell, investors are showing greater willingness to pay up for certain strategies.

He said: “Trusts currently commanding a premium rating are ones that either specialise in income, have a track record of beating the market or provide access to unique, unusual or scarce assets.”

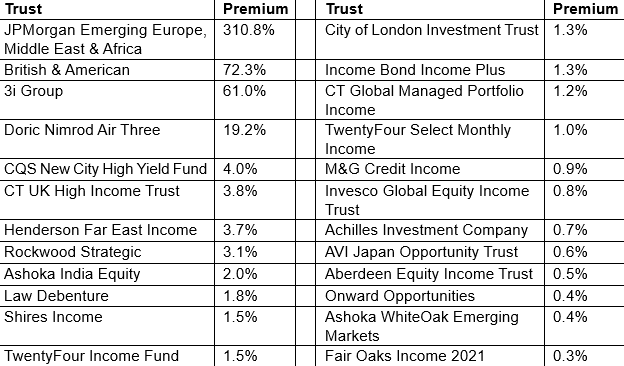

Investment trusts trading on a premium to NAV

Source: AJ Bell, AIC. Data as of 23 Jun 2025

One of the most consistent themes among premium-rated trusts is income, which has been driven by falling interest rates and the repercussions on the cash market.

“Rates are starting to come down on cash savings accounts and that’s driving more income-hungry individuals back into equities and bonds in search of better yields,” said Coatsworth.

“Furthermore, the investment trust structure also enables a smooth ride with dividends as trusts can keep money in reserve to top up income payments in harder times.”

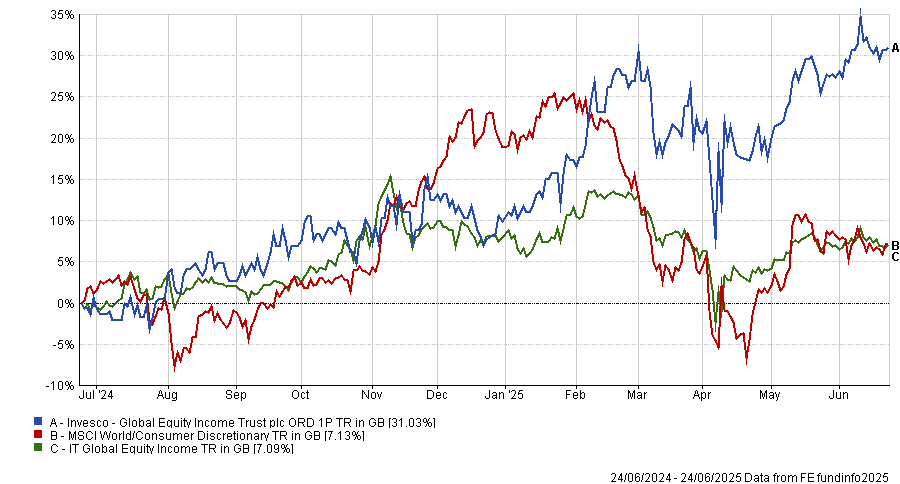

Some of the most prominent examples include CQS New City High Yield, CT UK High Income and Invesco Global Equity Income.

The latter in particular shows how sharply investor sentiment has turned, as it traded at about 12% discount in 2023 and 2024 and has now jumped to slightly above NAV – a status it hasn’t seen for four years.

That shift also partly reflects a 2024 restructuring that merged several Invesco Select strategies into a single, more focused vehicle, said Coatsworth.

Performance of trust against index and sector over 1yr

Source: FE Analytics

Some investors are also willing to pay a premium for reliability. In a volatile global environment, “they are happy to pay up for names that can demonstrate success wasn’t simply down to one lucky year”.

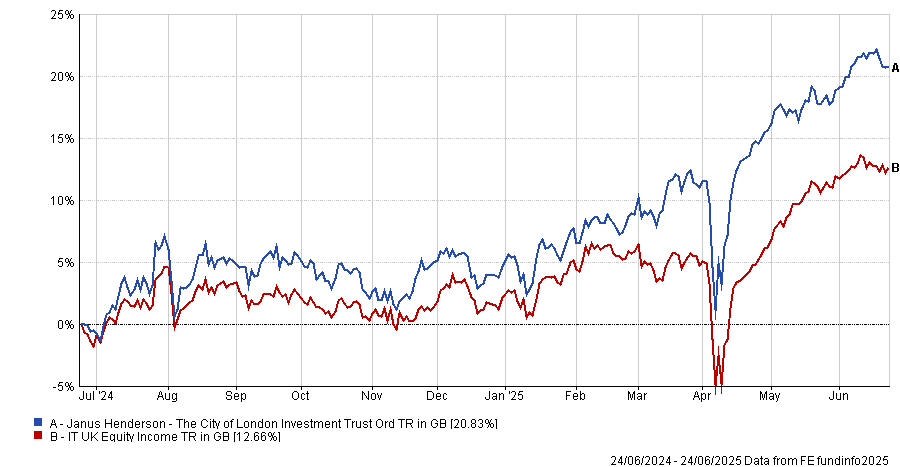

One example is the City of London Investment Trust, which is back on a premium after falling to a discount last year. Its appeal, according to Coatsworth, lies in both its strong yield and long-term track record of outperformance.

Over the past 20 years, City of London has delivered a 418% total return versus 283% from the broader UK stock market, but the strategy also achieved first-quartile returns in 2024, as the chart below shows.

Performance of trust against sector over 1yr

Source: FE Analytics

Its return to favour also reflects a broader recovery in sentiment toward UK equities, which have outperformed many global markets so far in 2025. This was an advantage because the trust is “effectively a ‘best ideas of the FTSE 100’ vehicle, which benefited from owning many of this year’s best-performing UK stocks”.

A smaller group of trusts are trading at a premium because they offer something that’s otherwise hard to access.

Private-equity trust 3i Group is a case in point. Its shares are priced more than 60% above NAV, largely due to its exposure to Dutch discount retailer Action, a private company that has become a rare source of fast growth in European retail.

“Action is growing fast and has all the hallmarks of Amazon in its early days,” Coatsworth said. “Its products are considerably cheaper than those of competitors and it constantly reinvests money back into the business.”

3i owns a 57.9% stake in Action and, for investors, buying the trust is effectively a long-term bet on the retailer’s continued expansion.

But there are other names in more unusual territory, such as the JPMorgan Emerging Europe, Middle East & Africa, which currently trades on an extraordinary 310% premium, up from 167% of January last year.

The trust, previously known as JPMorgan Russian, drastically wrote down its Russian holdings after the 2022 invasion of Ukraine, while some remain frozen. For Coatsworth, its premium rating indicates that some investors may be speculating on a potential thaw in geopolitical tensions.

“There is a suggestion that investors have recently been piling into the trust as a bet on Donald Trump ending the war in Ukraine and that Russian assets will be unfrozen,” he said.

In a recent update, the board of the trust said it believes that this premium “arises because of the uncertainty of what value if any should be attributed to the Russian assets and should not be interpreted as an indication that investors are more likely to derive any value from these assets”.

Despite the general uptick in investment trust premiums, Coatsworth noted that overall premiums remain far below historical levels. At the end of May 2015, nearly a third of investment trusts traded above NAV. Today, only 24 out of 435 trusts – about 5.5% – carry a premium.