Last year saw a surge in investor research into Artemis’ sector-topping equity funds while strategies focused on equity income, gold and Europe stocks also proved to be popular, analysis of Trustnet traffic data shows.

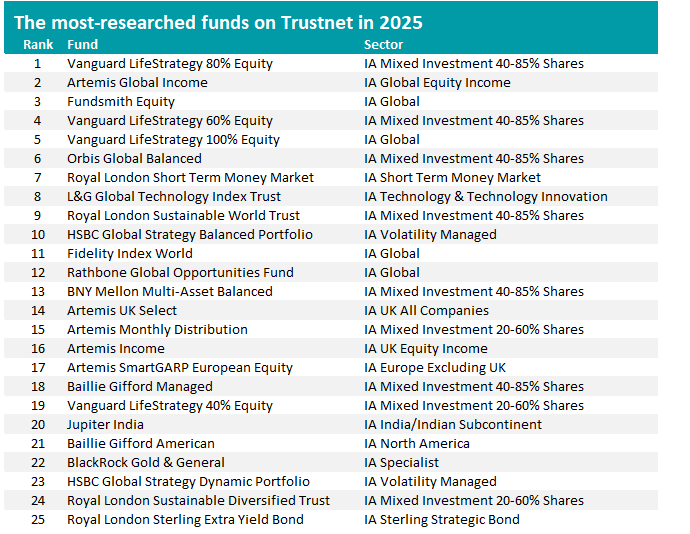

Vanguard LifeStrategy 80% Equity remains the most researched fund on Trustnet. In 2025, its research share was 1.33% of factsheet views in the entire Investment Association universe. This is down from 1.28% in 2024, when it was also the most-researched fund.

Stablemates Vanguard LifeStrategy 60% Equity and Vanguard LifeStrategy 100% Equity were the fourth and fifth most-popular funds, but they were pushed out of the top three by Artemis Global Income and Fundsmith Equity.

Source: Trustnet, Google Analytics

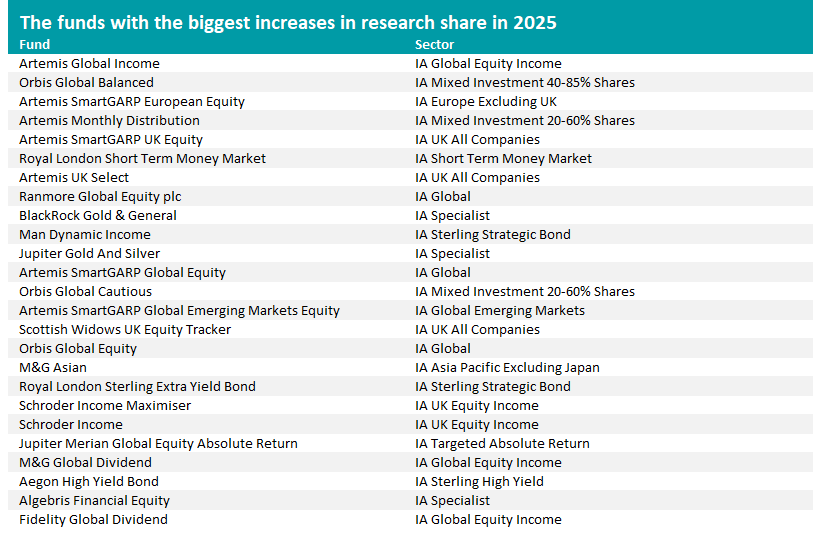

However, a more insightful view of investor sentiment can be gained by looking beyond the funds with the most pageviews to discover those that have witnessed large increases or falls in their overall research share. To do this, we take the research share of each fund in 2025 and compare it with its share for 2024 to identify the relative winners and losers over the past 12 months.

Under this approach, Artemis Global Income had its best year as it increased its research share from 0.41% in 2024 to 1.24% in 2024. At the same time, it went from being the 20th most-viewed fund in the Investment Association universe to the second.

Managed by Jacob de Tusch-Lec and James Davidson, the £4.4bn fund made a 45.2% total return in 2025, significantly outperforming the IA Global Equity Income sector (where the average fund made 12.8%) and the MSCI AC World index (up 13.9%). It is also the sector’s best performer over three and five years.

In an update last year, de Tusch-Lec said: “It would not be surprising if the ‘winning’ asset classes, regions, currencies and stocks of recent years do not have such a stranglehold over returns going forward, while other areas are experiencing a renaissance.”

He pointed out that European banks have more than doubled the return of the Nasdaq over the last three years, South Korea was well ahead of the Nasdaq over 2025, and German defence company Rheinmetall has outperformed Nvidia since August 2022.

“We skewed our portfolio towards many of these new areas of outperformance a couple of years ago and reaped the rewards from doing so,” the manager added.

Source: Trustnet, Google Analytics

Artemis Global Income is not the only fund run by Artemis to benefit from greater interest from investors last year, thanks to top performance in 2025. The asset management house had a strong 2025 after its active, long-term approach, which often has a preference for value stocks, came back into favour.

Artemis SmartGARP European Equity, Artemis Monthly Distribution, Artemis SmartGARP UK Equity, Artemis UK Select, Artemis SmartGARP Global Equity and Artemis SmartGARP Global Emerging Markets Equity all had some of the largest increases in research share; most of the funds are in their sector’s top decile for 2025 (aside from the emerging markets fund, which made second-decile returns).

Equity income investing is another theme of the funds with the biggest increase in research from Trustnet users, with Artemis Global Income being joined on the table by M&G Global Dividend, Fidelity Global Dividend, Schroder Income and Schroder Income Maximiser.

There was also more interest in gold funds, following the strong rally in the price of the yellow metal as investors looked for safe havens and hedged against a weaker US dollar. BlackRock Gold & General and Jupiter Gold And Silver are among the funds with the largest upticks in research share.

Of course, some funds will have been losing research share as others get more popular. Jupiter India, Royal London Global Equity Select, Baillie Gifford Managed, Vanguard LifeStrategy 60% Equity and Fundsmith Equity are among those being researched less in 2025 than they were in the previous year.

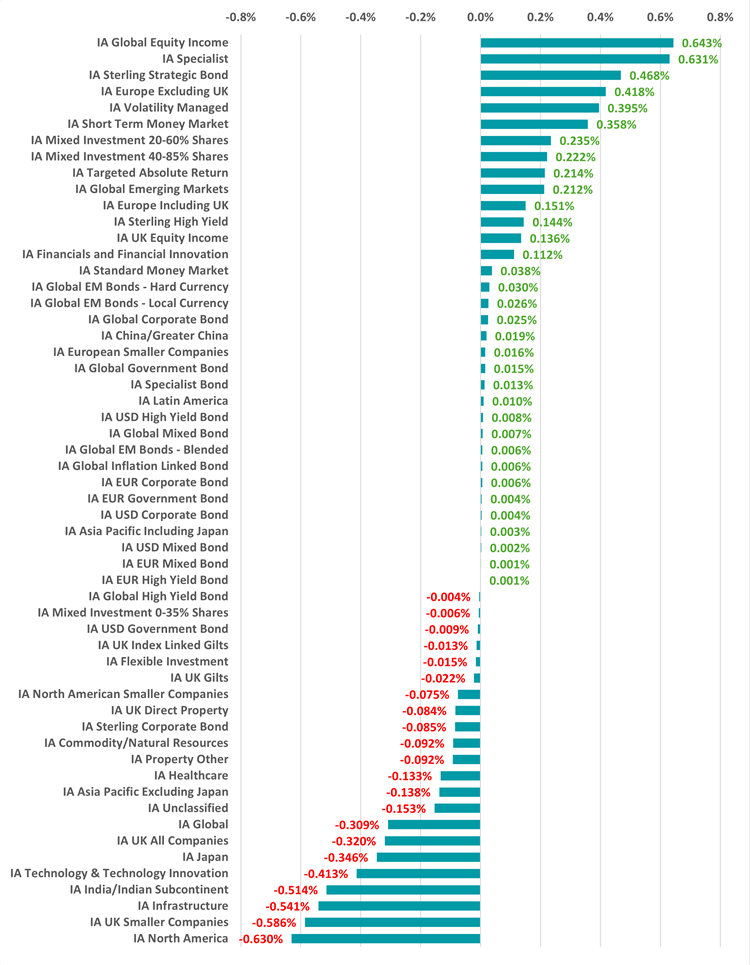

On a sector level, the most popular peer groups in absolute terms in 2025 were IA Global, IA Mixed Investment 40-85% Shares, IA UK All Companies, IA Volatility Managed and IA Mixed Investment 20-60% Shares.

Change in research share by Investment Association sector

Source: Trustnet, Google Analytics

But it was the IA Global Equity Income peer group that captured the highest increase in research. In 2024, it accounted for 4.04% of fund factsheet views in the Investment Association universe; this grew to 4.68% last year.

Last year, the IA Global Equity Income sector made an average return of 12.8%, outpacing the 11.2% from the IA Global sector, although – as seen above with the example of Artemis Global Income – some funds were able to generate much higher gains.

Investors also paid a lot more attention to the IA Specialist sector, which is a very diverse mix of funds. The five funds here with the biggest increases in research share, however, were BlackRock Gold & General, Jupiter Gold and Silver, Algebris Financial Equity, Ninety One Global Gold and SVS Baker Steel Gold & Precious Metals, reflecting the surge in interest in precious metals.

The IA Europe Excluding UK sector was a beneficiary of a rebound in investor sentiment towards the region, as investors were cheered by pledges of higher defence and infrastructure spending and looked to diversify away from the US.

Artemis SmartGARP European Equity, WS Ardtur Continental European, Waverton European Dividend Growth, WS Lightman European and JPM Europe Dynamic Ex UK recorded the largest improvements in research share.

Meanwhile, the presence of IA Sterling Strategic Bond, IA Volatility Managed, IA Short Term Money Market, IA Mixed Investment 20-60% Shares, IA Mixed Investment 40-85% Shares and IA Targeted Absolute Return towards the top of the chart hints at investor caution during the years of often turbulent geopolitical backdrop.

Finally, investors increased research into the IA Global Emerging Markets sector (through funds like Artemis SmartGARP Global Emerging Markets Equity, Lazard Emerging Markets, Redwheel Next Generation Emerging Markets Equity, Invesco Global Emerging Markets and Ninety One Emerging Markets Equity) after the asset class started to outperform developed markets.