No team of fund managers should ever be entirely bullish on even their highest conviction holding, according to Finn Provan, co-manager of the £6.1bn Royal London Global Equity Diversified fund.

While a high-conviction process can be praised, even talented managers can make mistakes. For Provan, the biggest example over the past year was UnitedHealth Group, a stock that “everyone in the room was bullish on” going into the year.

This meant that when the stock slid dramatically following the death of the chief executive of one of its subsidiaries in December, the team did not move to downsize it fast enough, convinced that the market would correct itself.

When UnitedHealth Group instead dropped 45%, its high allocation dragged Royal London Global Equity Diversified down. While the team would have never sold out of it entirely, not bringing it down fast enough was a mistake, she explained.

“Poor year-to-date performance is really a story of UNH,” she said.

While Provan has been on the fund as an analyst for over five years, she became co-manager when Matt Kirby and Paul Schofield officially took over Royal London Global Equity Diversified in November last year, following the departure of Peter Rutter and his team.

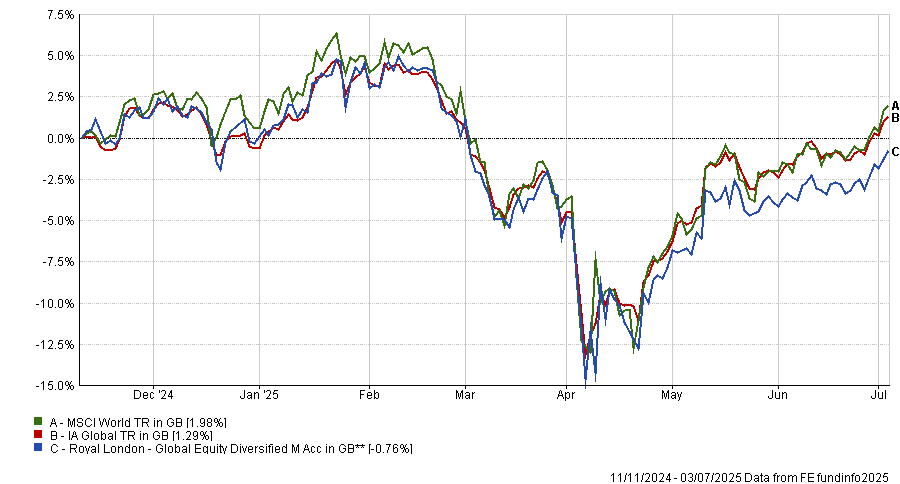

Performance of Royal London Global Equity Diversified vs the sector and benchmark under new managers

Source: FE Analytics.

Below, Provan explains why the quantitative approach makes it a suitable all-weather portfolio, how the ‘benchmark relative’ approach can still provide value in a world of passives and why some of their favourite opportunities are in areas people have never heard of.

What is Royal London Global Equity Diversified’s philosophy?

It’s a fund of data-enabled stock-picking. We’re a team of sector and regional generalists equipped with data to filter the noise and find good stocks.

We want to maximise stock-specific returns and minimise factor risk through an almost 200-stock portfolio. We believe that you can make a good investment in a company at any stage of its corporate life cycle by using data.

What differentiates the fund?

Because it’s a very balanced portfolio of stocks, we want it to function as something of an all-weather portfolio, which you don’t need to chop and change depending on macro events or whether we’re in a growth or value market.

We’re a benchmark relative approach, but we’re not narrative-driven. Because of our methodology and data tools, we have clear ideas of what makes a good company based on where it is in the corporate life cycle. We want to stick to that, instead of letting ourselves get distracted by news and narratives.

Why should investors use a benchmark relative approach instead of a passive?

The way we think about it is that we don’t want to replicate the benchmark’s performance; we want to replicate its risk profile. So, for example, we want our allocation to European banks to match the risk profile of European banks within the index.

But within that, we want to let the stocks do the talking, so if there’s a company within a sector that we think is strong from a wealth creation standpoint or a valuation perspective, we want to push that to be a slight overweight to show we have conviction in those stocks. The allocation can be similar, but we want the stocks to look quite different.

The performance target is 1-2% ahead of the benchmark and we used to get even better than that, but we’ve only got a tracking error that is also only about 1-2%. We think we manage our risk similarly to the benchmark by not taking factor risk, but can still be the active stock pickers we say we are.

What you want is to be getting active style returns, because it’s a stockpicker portfolio, with passive levels of risk.

How do you find new opportunities?

We have a few considerations: we like to look where we haven’t looked in a while, what sectors have changed since the last time we looked, what areas have momentum and what the fund needs to balance its risks.

We call it turning over rocks. We have 6,000 companies we can invest in and over three years we want to have turned over all those rocks, brushed over them to make sure we’ve not missed anything.

I think for me, the perfect situation is where we look at a certain subsector and find companies that make their cash in a similar way to bigger companies, but that aren’t even in the benchmark.

For example, we own a Japanese Pachinko machine maker that’s up 350% since we bought, but it's unlocking its balance sheet and giving cash back to shareholders. We always aim to have those idiosyncratic stocks within the portfolio.

What was your best call over the past year?

The best call was probably selling Delta Airlines in early Q4 last year. It was bought in 2022 based on the assumption that it was a turnaround company that could benefit from the post-Covid period.

We made the call that the turnaround story had happened and we sold it when it was still up over 100% for us, right before it slid massively at the start of the year.

What do you do outside of fund management?

I like reading! I’m in several book clubs and I’m a massive fan of anything written by Toni Morrison, Joan Didion or Gabriel Garcia Marquez.

Other than that, I’ve gotten into running, but I suppose that’s because everyone else on the team is always running marathons.