In a period when the medium-term fiscal outlook seemed increasingly misty in many regions, Aviva Investors' multi-asset team has pivoted away from government bonds.

One of the biggest reductions this year was in the team’s gilt exposure, where it reduced duration to neutral following a long-held overweight.

Dean Cook, multi-asset manager at Aviva Investors, explained that this decision was partially based on the “changing playbook” of the gilt market. With the budget looming in Autumn, he argued that long-duration bond yields could become unstable as markets become concerned about potential fiscal policy changes.

These concerns have become a reality much faster than he initially expected, he added.

The gilt market has already proven unstable this year, with government bonds aggressively selling off earlier this month on rumours that chancellor Rachel Reeves would be replaced.

Darius McDermott, managing director at Chelsea Financial Services, commented: “The real concern for investors is that a potential replacement will push the party further to the left at a time when markets are desperate for signs of credible fiscal leadership”.

This follows an earlier gilt market sell-off in January, when the 30-year gilt yield peaked at the highest level since the global financial crisis.

“We didn’t expect that fiscal concerns would rear their head as fast as they did, but it was certainly something we had been considering,” Cook explained.

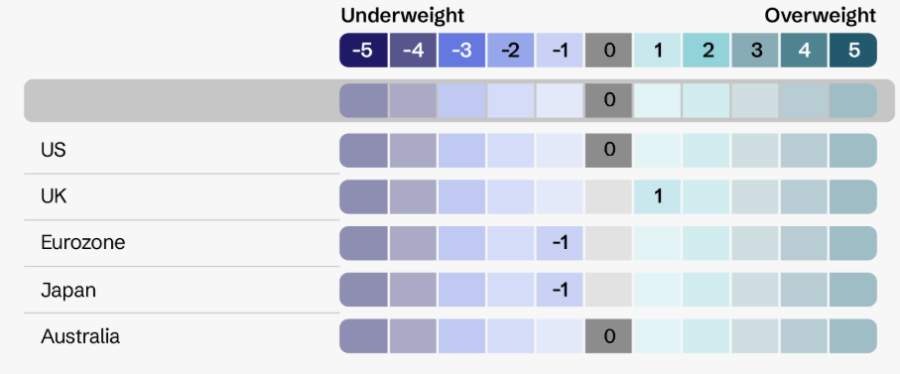

However, UK government bonds are still a slight overweight in their portfolios, as seen in the chart below.

Aviva Investors multi-asset government bond allocation

Source: Aviva Investors. Data as of 30 June

Michael Grady, head of investment strategy and chief economist at Aviva Investors, said this is because the Bank of England has more capacity for interest rate cuts this year than other central banks.

The outlook for government bonds did not seem much better in other regions, Cook explained. “In a few markets, we think it’s more two-sided on how inflation dynamics, monetary policy and economic growth will play out this year,” he said.

For example, the team has also reduced a “long-held position” in Japanese government bonds. Concerns over tariffs and trade have introduced a significant level of uncertainty into the Japanese economy, he explained, making the forecast challenging.

“Despite all the evidence that inflation is entrenched in Japan and that they could move to a more normal economic policy, there are enough question marks on the horizon that we thought the Bank of Japan would pause on interest rate rises,” he said.

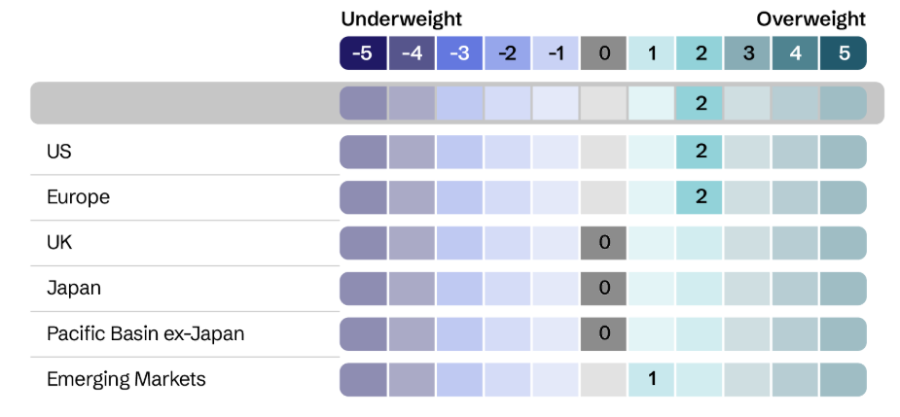

However, while Aviva Investors' multi-asset team has reduced fixed income, it remains bullish on equities.

In the UK, the team has initiated a new position in UK mid-caps.

Cook said: “Expectations towards UK economic growth are on the pessimistic side, but we don’t think it will take much to swing the dial towards optimism.”

Recent trade deals, such as those between the UK and US, India and Europe, demonstrate an “intentionality towards economic growth” that is reassuring. Because better economic growth could lead to a stronger sterling, domestic companies are best positioned compared to the more international large caps.

As a result, the team has taken some profits from UK large-caps to fund this mid-cap position, maintaining a neutral position in UK equities.

Additionally, despite the S&P 500 posting a negative total return so far this year (down 1.9% in sterling), the Aviva Investors team increased its US allocation in May. Cook said: “It’s probably fair to say that it’s difficult to get the quality and pace of earnings growth that the US equity market offers elsewhere.”

The big example of this is still the US hyper-scalers such as the ‘Magnificent Seven’, which have proven very resilient in 2025, despite being shaken by DeepSeek earlier this year or the announcement of tariffs.

Microsoft, Meta and Nvidia have all experienced a rise in share price this year and Cook argued that due to their strong fundamentals, they could continue to beat expectations.

“Equivalent quality companies exposed to similar themes are at similar valuations almost anywhere else in the world. It’s not like you can get a bargain anywhere,” he added.

But it is not just concentrated on hyper-scalers, with US banks and telecom companies, among others, receiving upgrades to their earnings forecast this year.

“The environment is supportive of equities: earnings growth is robust despite the tariffs, profit margins are historically high, and balance sheets are healthy”, head of investment strategy and chief economist Grady added.

However, while they remain overweight on European equities, Cook said the team is watching the market with caution.

Eurozone equities are benefiting from macro developments such as the rotation away from the US and defence spending pledges from eurozone countries. However, “we’ve seen quite a lot of pledges in Europe, but not a lot of action”, Cook noted, with it still unclear how many of these promises come through in company earnings.

“Having outperformed the US equity market by 10% in local terms this year, we are keen to ensure that European equity earnings expectations are appropriately calibrated”, Cook concluded.

Aviva Investors multi-asset equity allocation

Source: Aviva Investors. Data as of 30 June