Discretionary fund management firm IBOSS has launched a new managed portfolio service (MPS) for clients, with a roughly 50/50 split between its Core MPS and its Passive MPS offering.

Total costs will be 30% lower than its go-anywhere Core range, keeping weightings between the two strategies in a band between 43% and 58% in favour of one or the other.

The new portfolios will be made up of between 40 and 50 names and will have a maximum 8% allocation to individual holdings.

It is “particularly relevant in today’s market, where volatility and structural change require more than just passive exposure,” the firm said.

Chris Metcalfe, managing director at IBOSS, part of Kingswood Group, said: “Market conditions have changed significantly in recent years. The era of ultra-low interest rates and momentum-led markets has given way to a much more nuanced environment – one that demands active input, but also careful cost control.

“We’ve created the Blended MPS to reflect exactly that. It offers advisers a middle ground: a well-diversified, cost-effective solution that retains the active oversight clients increasingly need in a fast-moving world.”

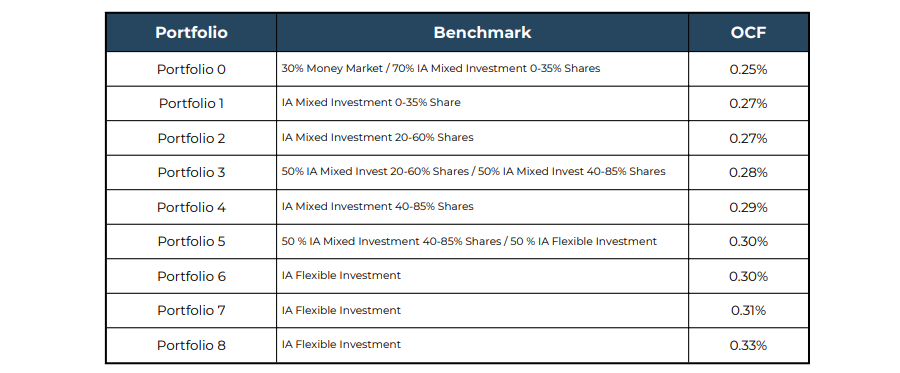

The new IBOSS Blended range

Source: IBOSS