Trustnet users have increasingly been researching the funds run by Artemis Fund Managers this year, as the group jumps to the top of the performance tables in several sectors.

Over the first half of 2025, the most-viewed funds by Trustnet users were Vanguard LifeStrategy 80% Equity, Vanguard LifeStrategy 60% Equity, Fundsmith Equity, Artemis Global Income and Vanguard LifeStrategy 100% Equity.

Many of these funds are consistently popular with investors, but a closer look at Trustnet’s factsheet pageview data shows there has been some movement in the amount of overall research activity individual funds have been attracting.

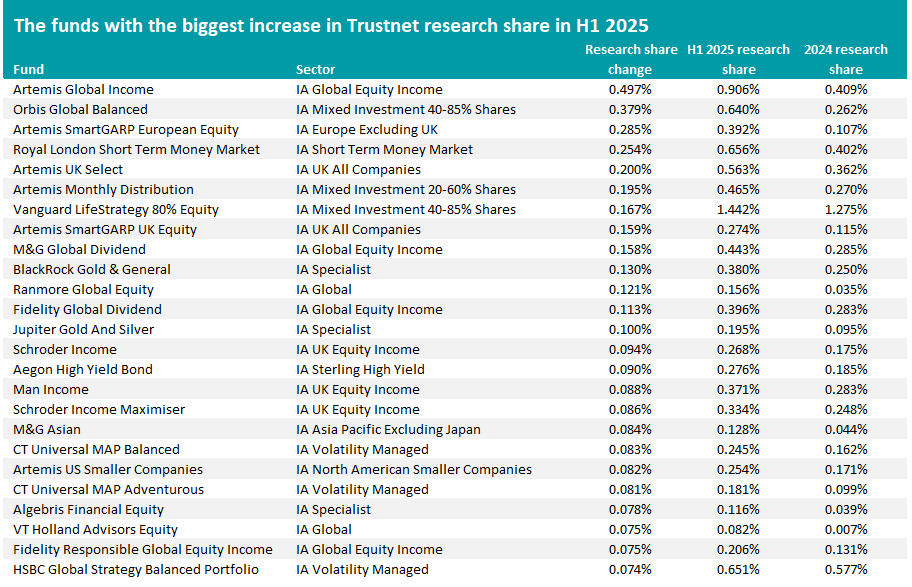

Source: Trustnet, Google Analytics

The fund with the largest uptick in research by Trustnet readers is Artemis Global Income, which accounted for 0.91% of all factsheet views in the first half of the year. This is up significantly from the 0.41% it won in 2024.

This means the fund has become the fourth most-popular fund on Trustnet, rising from 20th place last year.

Artemis Global Income has been managed by Jacob de Tusch-Lec since inception 15 years ago in July 2010; he was joined by fund manager James Davidson in 2018 and analyst Yin Loke in 2023.

The fund is run with a contrarian approach, looking beyond ‘traditional’ income stocks to less well-known holding such as Japanese and Spanish banks, defence contractors and pork suppliers in emerging markets.

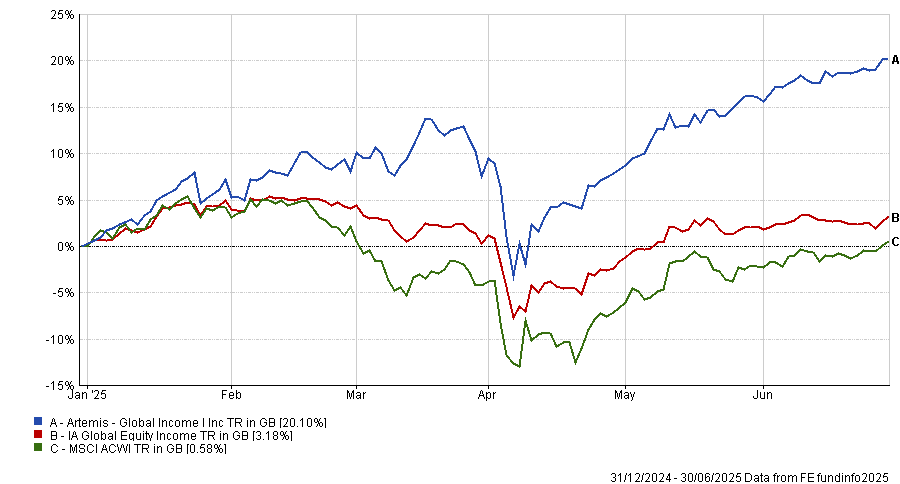

This contrarian tilt, which includes an underweight to the US, is part of the reason why the fund has grabbed investors’ attention in 2025 with its strong performance. At the end of 2025’s first half, Artemis Global Income was the highest-returning fund in the IA Global Equity Income sector over one, three and five years.

De Tusch-Lec explained: “We try to skate towards where we think the puck will go and we started this year with some big themes running through the portfolio.

“We took the view that there would be increased spending on defence that was not fully reflected in prices, the global economy was not going into recession and interest rates would remain reasonably high. The world is going through a regime change towards higher inflation, geopolitical conflict and more government intervention.”

Performance of Artemis Global Income vs sector and index in H1 2025

Source: FE Analytics

However, this is not the only Artemis fund that investors have been more interested in this year as the fund house experiences a period of strong returns. FE fundinfo data shows 54% of Artemis’ funds are in their sector’s first quartile over one year, 61% over three years and 71% over five years.

Joining Artemis Global Income in the top 25 funds with a higher research share on Trustnet this year are another five funds by the group: Artemis SmartGARP European Equity, Artemis UK Select, Artemis Monthly Distribution, Artemis SmartGARP UK Equity and Artemis US Smaller Companies.

All of these funds are also in the top quartile of their respective sector over one and three years, with all but Artemis US Smaller Companies holding this rank over 2025 so far as well.

Another common theme of the funds being researched more this year is a value approach. While growth investing has tended to hold market leadership since the 2008 global financial crisis, value has outperformed at times in recent years as inflation surged and central banks increased interest rates from their historic lows.

Some of the funds in the above table that take a more value or contrarian approach to investing include many of the Artemis strategies, Orbis Global Balanced, M&G Global Dividend, Ranmore Global Equity, Schroder Income and Man Income.

Of course, not all funds can be increasing their share of research activity. Those being hit with the largest falls in interest over the past six months compared with last year include Jupiter India, Royal London Global Equity Select, Baillie Gifford Managed, CFP SDL UK Buffettology, Fidelity UK Smaller Companies, Fundsmith Equity and L&G Global Technology Index Trust.

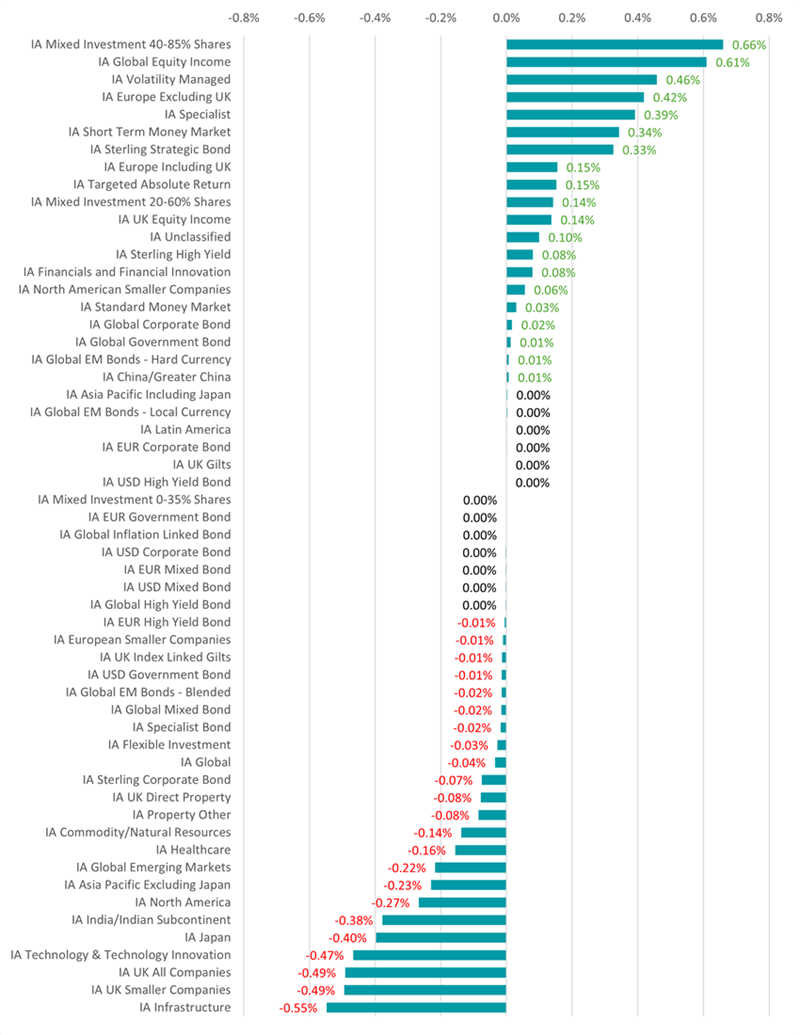

Change in Trustnet research share by sector over H1 2025

Source: Trustnet, Google Analytics

When it comes to how investor interest has changed towards Investment Association sectors, IA Mixed Investment 40-85% Shares saw the biggest jump. In 2024, the peer group accounted for 9% of factsheet views on Trustnet but this has increased to 9.66% this year.

Orbis Global Balanced benefitted from the largest increase in factsheet views this year, to the point where it went from being the 52nd most popular fund with Trustnet users to the 11th.

This is one of the funds with a contrarian approach, seeking out undervalued companies and investing in them with high conviction. This approach has worked in the recent years, with Orbis Global Balanced the highest-returning member of the sector over one, three and five years as well as over 2025 to date.

Investors have also been researching European equity funds more, driven by the continent’s improving economy and cracks in the ‘US exceptionalism’ narrative.

Equity income is also a theme as investor continued to make their money work harder amid higher inflation, with more research going into both the IA Global Equity Income and IA UK Equity Income sectors.