July rewarded investors who stuck through thick and thin with strategies that have underperformed for a long time: China, clean energy and biotechnology.

All three areas have been in the doldrums but staged an impressive comeback last month, much to the surprise of industry experts, including Fairview Investing director Ben Yearsley.

In particular, Biotech and solar energy are “interesting, as they’ve been unloved and shunned for much of the past three years – in fact since interest rates started rising post Covid,” he said. All of these themes last month could be considered “cheap value plays”.

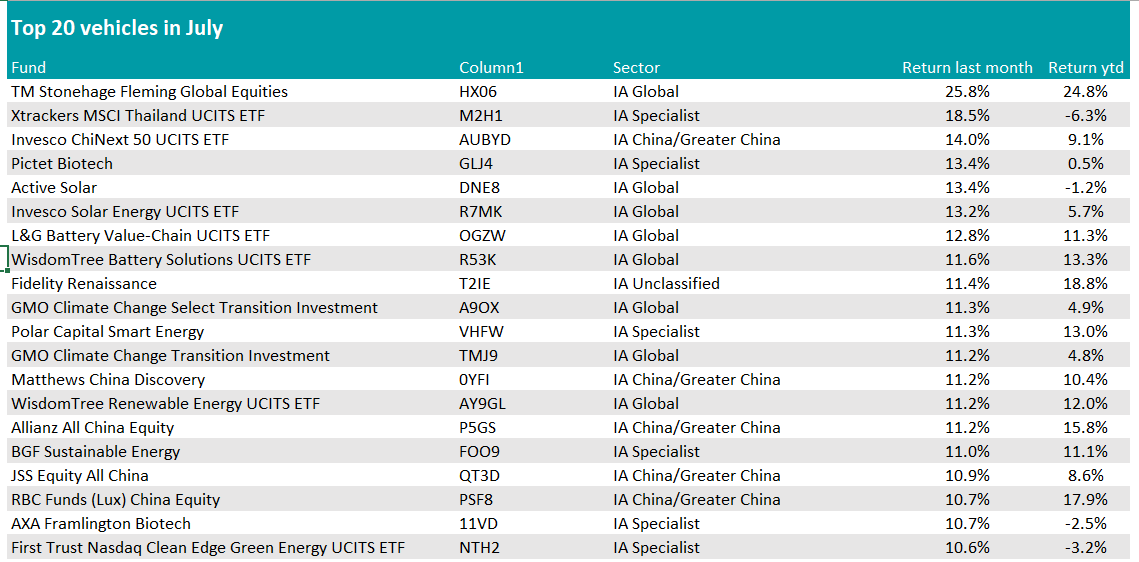

The most successful funds in these areas were Pictet Biotech and Active Solar, both with a return of 13.4%. The latter has repeatedly appeared in the worst performing funds for various months in recent years, Yearsley noted.

Pictet’s was the only biotech-focused fund in the top 10, but there were many more health-related funds a few positions below it, including AXA Framlington Biotech, Candriam Equities L Biotechnology and the L&G Pharma Breakthrough UCITS ETF (exchange-traded fund).

As for clean energy, the theme occupied half of the top 10, as evidenced by the below table.

Source: FE Analytics

Most of the best performers were ETFs such as Invesco Solar Energy UCITS ETF, L&G Battery Value-Chain UCITS ETF and WisdomTree Battery Solutions UCITS ETF, but some actively managed portfolios also took centre stage, including two GMO strategies (Climate Change Select Transition and Climate Change Transition), as well as BGF Sustainable Energy.

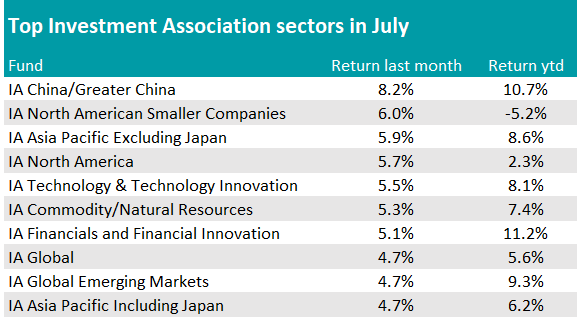

China was the other pick of the month, but it didn’t surprise Yearsley, as the country has had a strong 2025 overall, with the IA China/Greater China sector leading the pack with a two percentage-point advantage over the next-best sector last month. It has also posed a strong performance year to date, as the table below shows.

Source: FE Analytics

The main funds to gain from the trend were Invesco ChiNext 50 UCITS ETF (with a 14% return), Matthews China Discovery (11.2%) and Allianz All China Equity (11.2%).

The two US sectors also featured, but “partially on the back of the strong rise in the dollar versus sterling”, which clearly helped UK investors, said Yearsley.

The absolute top performer didn’t belong to any of these areas, however.

July’s best performer was the multi-manager fund TM Stonehage Fleming Global Equities, which posted a 25.8% return by investing in a selection of funds.

Its top 10 holdings include the Vanguard S&P 500 ETF, Vanguard FTSE Developed Europe Excluding UK, Man Undervalued Assets and Sector Healthcare Value – all of which focus on areas that have shined in the past 30 days.

It was followed by Xtrackers MSCI Thailand UCITS ETF, which gained 18.5% and ranked second-best over the month.

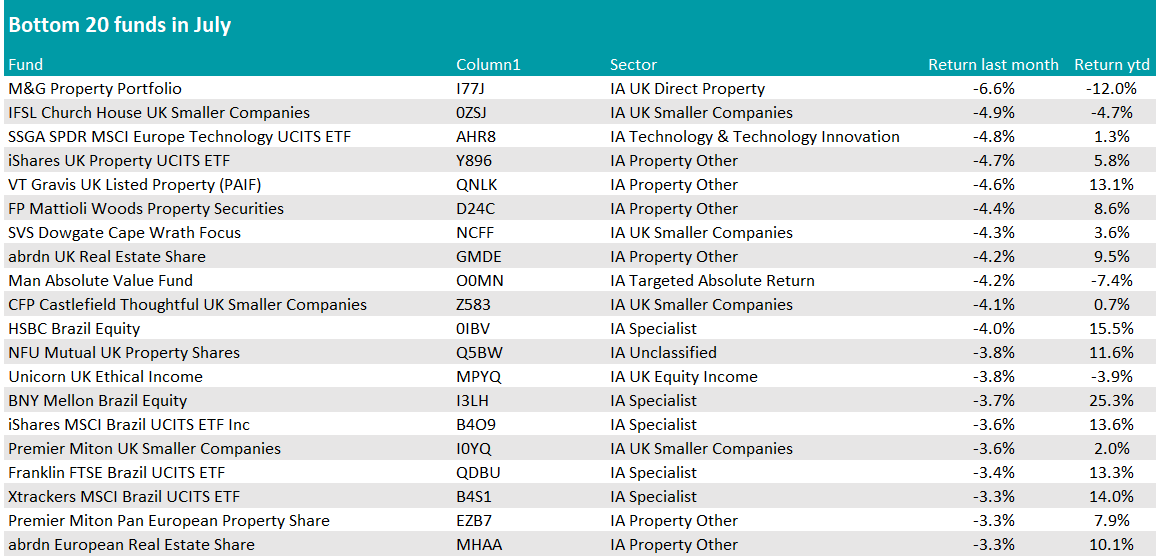

At the foot of the table, property funds were among the key losers.

The M&G Property Portfolio propped up the table with a 6.6% loss, but other names were equally challenged, including iShares UK Property UCITS ETF, VT Gravis UK Listed Property and FP Mattioli Woods Property Securities.

Source: FE Analytics

UK smaller companies were also disappointing. The sector has been volatile this year, dropping 15% by early April but recovering more than 20% since. “A pause for air is unsurprising”, according to Yearsley.

The biggest fall was that of IFSL Church House UK Smaller Companies, which was down 4.9% in July. SVS Dowgate Cape Wrath Focus and CFP Castlefield Thoughtful UK Smaller Companies also featured towards the bottom.

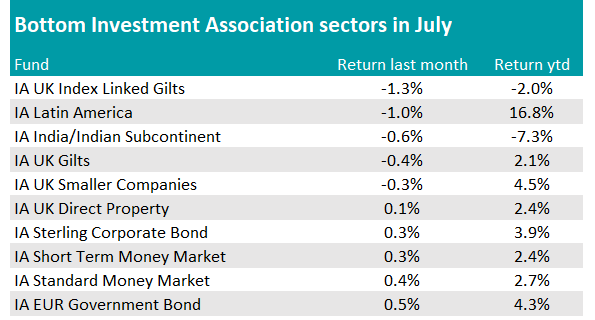

Latin America, Brazil and India funds were also near the bottom last month, as the chart below shows.

Source: FE Analytics

It was no surprise to Yearsley, as “the likes of Mexico and Brazil are yet to come to a deal with [US president Donald] Trump over tariffs and India looks like it will be hit with a rate of 25%”.

However, the IA UK Index Linked Gilts was the worst sector, with a fall of 1.3% in July.

It was also a bad month for IA Targeted Absolute Return funds, with market volatility giving absolute return managers a hard time. The sector made 0.5% in the period analysed, only marginally better than money market funds.

The worst performance came from the Man Absolute Value fund.

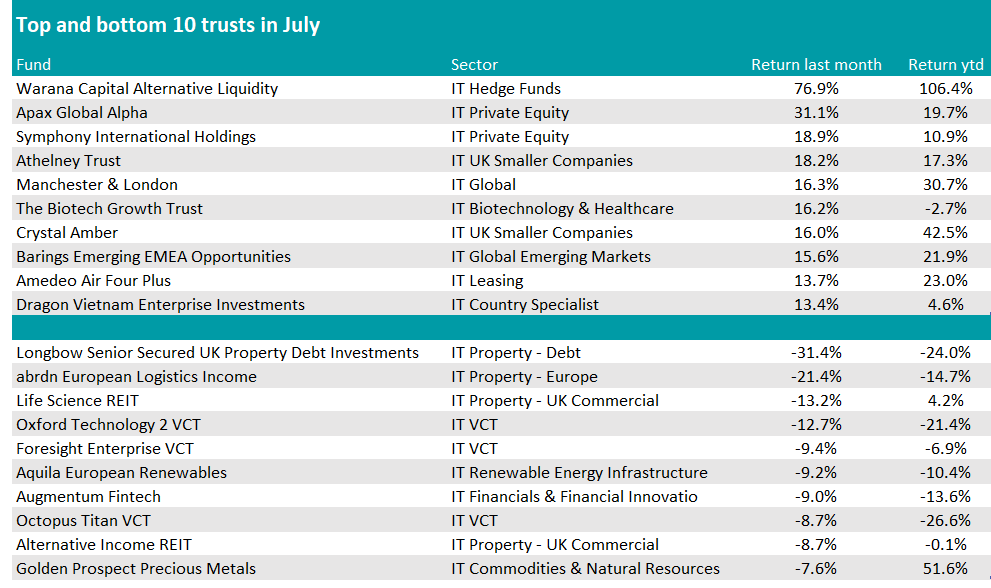

Turning to trusts, some of the trends above, for example China’s strength, sifted through, while others didn’t.

Source: FE Analytics. Excluding IT Unclassified.

Biotech had a good run in the closed-ended space, led by the Biotech Growth trust, which gained 16.2% over the month.

A handful of UK small-cap trusts defied gravity, however, including Athelney (18.2%), Crystal Amber (C8T2) and Oryx International Growth (10.0%).

In China, Fidelity China Special Situations was just outside of the table with a return of 13.2% - the best performer in the peer group.

Elsewhere, Manchester & London gained an “impressive” 16.3%, said Yearsley, thanks to its 60% weighting in just two stocks: Nvidia ad Microsoft.

Ignoring hedge funds, the top spot went to Apax Global, which rose 31.1%.

More specialist sectors such as IT Leasing and IT Infrastructure Securities also made some of the top spots. Property dominated the list of worst performers.