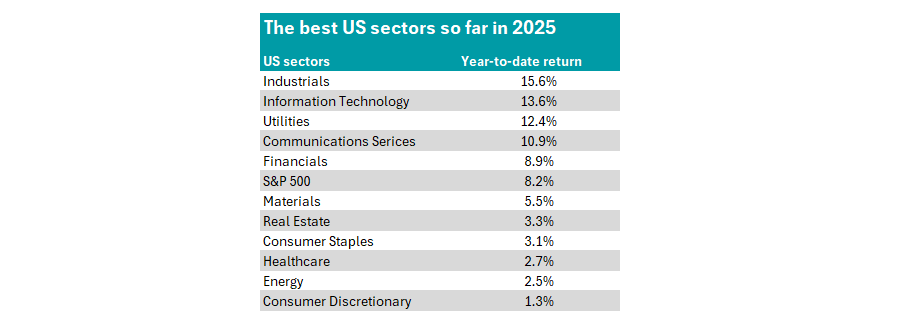

US industrials have overtaken technology stocks as the winners of 2025 so far, according to data from Standard & Poor’s, with the S&P 500 Industrials sector returning 15.6% year to date.

This is 2 percentage points ahead of the information technology sector and almost double the wider S&P 500, as the table below shows.

Source: S&P indices

Industrials have traditionally been viewed as a cyclical sector, rising and falling as government spending increases (or decreases) the demand for new projects.

However, Saurabh Sharma, fund manager of the Regnan Sustainable Water and Waste strategy, said several secular growth trends are now forcing investors to re-evaluate this idea, with the sector “fostering more consistent and sustainable long-term earnings growth”.

“A few such trends stand out for us. First, the need for new infrastructure [to replace ageing ones] is encouraging spending. Second, with geopolitics and tariff noise, more countries and companies are onshoring and increasing domestic investment,” he said.

“Third, government initiatives such as the Inflation Reduction Act, the Infrastructure Investment and Jobs Act, and the CHIPS Act are accelerating the shift, supporting long-term structural growth by encouraging the return of domestic production.”

Industrials is the second-largest weighting in the Canadian General Investments trust at 21.1%, significantly ahead of the benchmark index’s 12.8% weighting. Greg Eckel, the portfolio manager, said the sector has “greatly benefited” from increased spending in the US, driven by trends such as nearshoring, electrification, and decarbonisation.

“The $1.2trn Bipartisan Infrastructure Law alone is funding more than 66,000 projects”, he said, while the trends above “continue to propel demand”.

However, investors should note that, unlike some sectors, industrials is a broad term. Sharma said: “Industrials is one of the most diversified sectors in the standard GICS sectors classifications. It encompasses a broad spectrum of businesses from capital goods to commercial and professional services to manufacturing.”

As such, investors may need to be more targeted than just buying the entire sector, as the disparity in returns can be wide.

Eckel highlighted two companies in his portfolio. The first “standout” performer was Stantec, a global leader in sustainable design and engineering. So far this year, shares are up 39.6%.

“Stantec’s focus on operational efficiency and project execution has led to industry-leading margins, with strong growth prospects fuelled by public and private investments – particularly from US government initiatives like the Infrastructure Investment and Jobs Act,” he said.

Sharma noted the water and waste management segments “stand out” as “particularly compelling” in the industrials sector, highlighting US waste operator Republic Services (RSG).

It has “strong pricing power underpinned by resilient demand for essential waste and recycling services”, he said, with “strong free cashflow, disciplined capital allocation and a prudent dividend policy”.

As such, “the company balances shareholders’ returns with reinvestment in innovation and operational efficiency”, he added.

RSG share prices have done well this year, up 16.9%, driven by the company’s strong pricing and margin expansion, said Sharma, but there could be more to come.

“As broader economic activity – and thus volumes – recover, RSG is well placed to capitalise, offering both defensive characteristics and upside potential,” he said.

It is not just a US phenomenon, however, with some experts tipping industrials in other markets too. Eckel also praised satellite systems, robotics and geointelligence firm MDA Space, noting there is “strong upside” for “high-growth innovators”. Its shares are up 42.5% in 2025 so far.

"With a C$4.6bn backlog and 54% revenue growth in the latest quarter, MDA is capturing rising demand from governments and commercial clients alike,” the manager said.

“Based in Canada, the company benefits from both global export reach and insulation from US tariffs on Canadian goods, with most of its backlog tied to non-US customers and limited reliance on US suppliers. As the global space economy expands and defence budgets grow, these advantages reinforce MDA’s long-term investment case.”

Meanwhile, Francesco Viggiano, analyst at Arcus Investment, said one of his preferred choices is Japanese agricultural machinery manufacturer Kubota, known for making tractors and construction equipment such as mini excavators.

“Agriculture machinery is going through a prolonged inventory adjustment, due to higher interest rates in key markets but earnings are currently depressed due to industry-wide cyclical weakness in developed markets,” he said, which could rebound when this cycle reverses.

Additionally, there is a “long-term growth story” in developing markets, particularly Asia, where the firm “has built a strong market position”. Although share have been less spectacular versus US counterparts, Viggiano said “valuations are cheap on an absolute and relative basis”, adding the company has a “strong balance sheet versus industry peers”.