Japan has been rallying this year with the Nikkei 225 approaching the 50,000 mark, but the market is still full of “low-hanging fruit begging to be picked and plucked”, according to Dan Hurley, global equity specialist at T. Rowe Price.

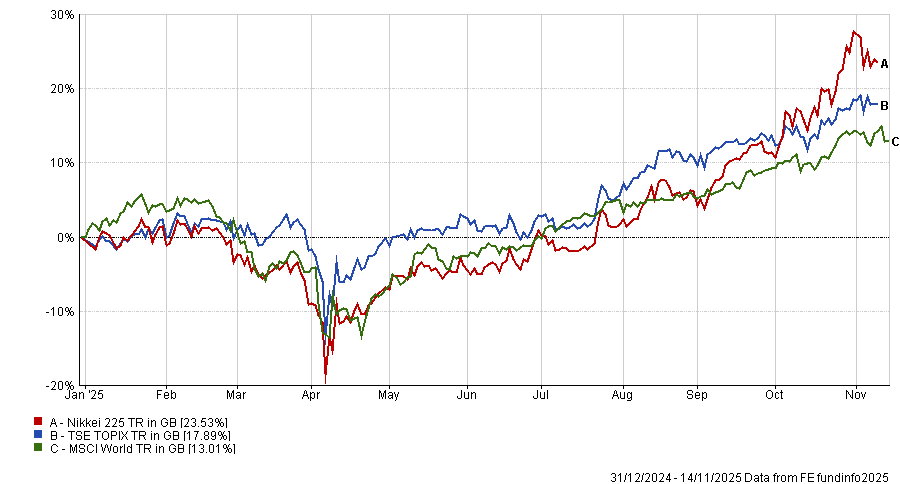

Since the start of 2025, the TOPIX is up 17.9% and the Nikkei 225 has surged 23.5% outperforming the MSCI World, yet Hurley argued Japanese equities are still being underestimated by investors.

The Japanese market represents just 5.5% of the MSCI World, making it small enough that global equity managers have been able to “ignore” it for years with few consequences, the T. Rowe Price specialist said.

But there is a lot to like about this oft-forgotten hunting ground.

Performance of markets YTD

Source: FE Analytics.

Corporate governance reform

The corporate governance reform story is a large part of the easy opportunities available in Japan, Hurley said. Companies' efforts to become more shareholder-friendly have yet to be reflected in valuations, with 45% of the market trading at less than 1x price-to-book value. Even companies that seem expensive are streamlining and becoming better businesses than investors think, he said.

For example, electronics company Sony is a much stronger business due to corporate reform. It used to be “one of the true Japanese conglomerates”, with branches in areas such as financial services and med tech.

Sony sold off parts of its business that “do not make sense anymore”, which has led to the share price surging by 61% over the past year.

Share price of Sony over past 12 months

Source: Google Finance

Other companies benefiting from corporate reform include games company Nintendo and sportswear producer Asics, which have become more fundamentally solid businesses that can deliver over the long term, Hurley said.

“This corporate governance reform story is going to continue to play out and there’s still a lot of returns to be made from it.”

Joe Bauernfreund, manager of the AVI Global Trust, agreed that corporate governance reform means the Japanese market is full of “cheap, cash-rich companies” with potential that investors have only just started to notice.

Changes to the Corporate Governance Code are allowing companies to streamline their once “bloated balance sheets” and focus on paying out shareholders. As a result, dividend payments have hit “record highs”, with Japanese companies reporting 13% core dividend growth in the third quarter of this year.

However, “this is still the early stage of a much deeper transformation”, he said, which has so far been limited to larger companies. Over time smaller businesses will start to benefit, which should lead to continued outperformance from Japanese equities, Bauernfreund said.

“Both regulators and investors are only beginning to see the rewards of Japan’s corporate governance reforms – and we believe there is far more to come.”

Reduced headwinds

By contrast, investors who entered this year bearish on Japanese assets overestimated the headwinds facing the market and missed out on these easy opportunities, according to T. Rowe Price’s Hurley.

“Investors’ bear cases did not really play out at all and the market has re-rated very sharply,” he said. For example, many investors entered this year concerned about the impact of US president Donald Trump’s tariffs, which came in above initial expectations.

“We thought common sense would win out and Trump would be unable to go through with these tariffs at this level,” said Hurley. Investors' negativity meant that when tariffs were negotiated down, many missed out on the resulting rally.

Pessimistic investors were also incorrect about the monetary policy situation.

“People thought the Bank of Japan was going to have to hike interest rates and cause huge issues for an economy that has been reliant on low rates for some time”, but the central bank has been “slowly but surely” normalising monetary policy without causing much issue and could even hike rates further without causing much impact, he said.

For AVI’s Bauernfreund, “such strength, in the face of these challenges, suggests that something deeper is at play beneath the surface – a more fundamental and lasting shift in Japan’s market dynamics.”

As a result, he has remained very constructive on Japanese equities this year, with a 16% exposure to the region – the second highest regional exposure within the AVI Global Trust.