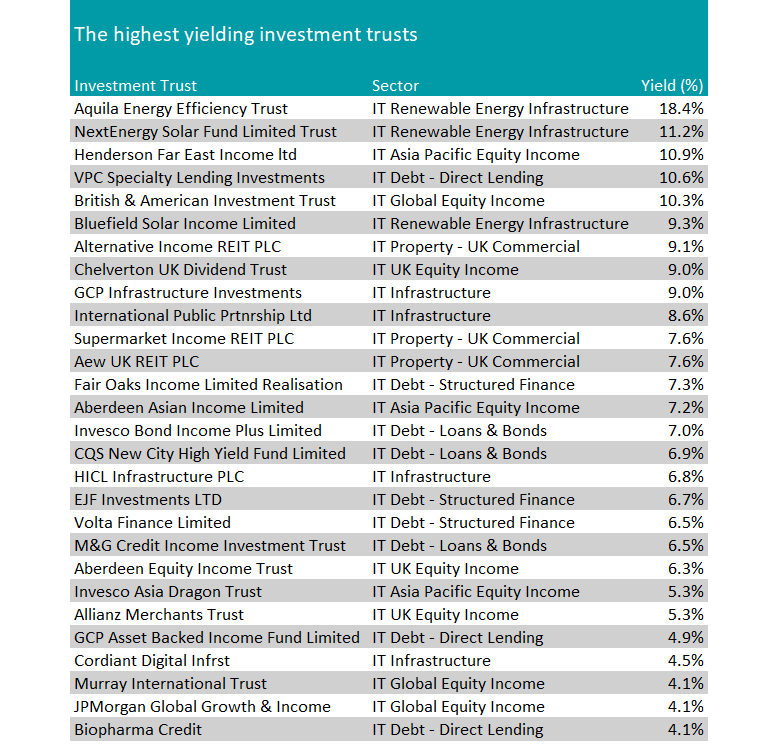

Some 88 investment trusts are paying interest-rate busting dividends, according to research by Trustnet, potentially offering a haven for income-needy savers who are unsure where to put their cash.

Last week the Bank of England cut rates from 4.25% to 4%, a move unlikely to be well received by savers, as it should bring bank and building society savings rates down with it.

This may encourage more people to look to invest their cash, with some investment trusts offering significantly higher yields than the current base rate.

These could be ideal for more adventurous savers during this period of lower rates and higher inflation, and can offer more consistent income than funds thanks to their ability to retain up to 15% of income generated each year in reserve.

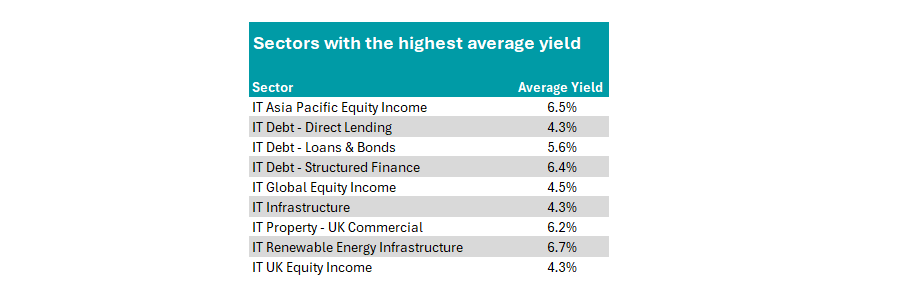

Investment trusts in the IT Renewable Energy Infrastructure sector have the highest average yield at 6.7%, closely followed by IT Asia Pacific Equity Income and IT Debt – Structured Finance.

Source: FE Analytics

But which investment trusts across these sectors offer the highest yield? Below we look at the top-yielding trusts from the highest-paying sectors.

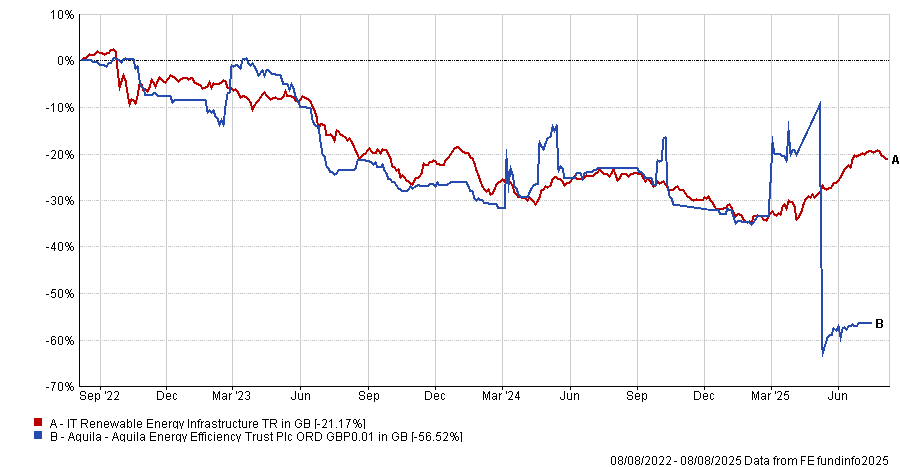

Coming in top of the table is Aquila Energy Efficiency Trust, which offers an 18.4% yield.

The £26.6m trust was launched in 2021 and aims to generate returns – principally in the form of income distributions – by investing in a diversified portfolio of energy efficiency investments.

While the dividend may be enticing, investors should note that a higher yield can signify higher risk. For example, this trust has disappointed against its sector from a total return basis, languishing in the fourth quartile across three months, six months, one year and three years.

The trust’s shares trade at a 37.6% discount to the net asset value (NAV).

Performance of the trust vs the sector over 3yrs

Source: FE Analytics

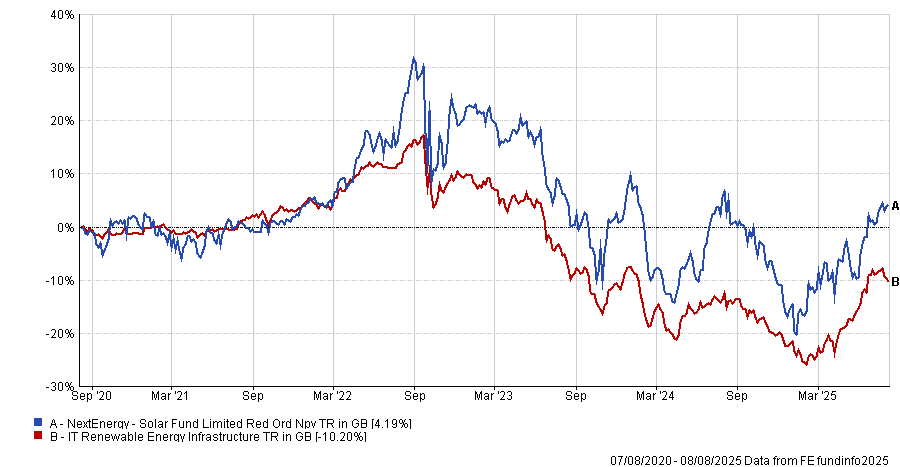

In second place is another renewable energy specialist, NextEnergy Solar Fund Limited Trust, with the £435m trust’s dividends representing an 11.2% yield.

Also trading at a discount (28.8% to NAV), the growth-focused trust was launched in 2014 and has an over 80% weighting in the UK, 12.4% in Europe ex UK and 3.5% in international.

It has managed a top-quartile performance over three-, five- and 10-years, delivering a 46.5% total return over a decade. However, it has struggled in the past year, managing a 1.4% return compared to its sector average of 5.9%.

Performance of the trust vs the sector over 5yrs

Source: FE Analytics

Turning to equities, Henderson Far East Income in the IT Asia Pacific Equity Income sector has the highest payout, with a 10.9% yield.

Managed by Sat Duhra since 2019, the £417m trust is heavily weighted to financials but has some 15% in technology names – unusual for an income portfolio.

While there are concerns hanging over the region, such as global trade relations souring between the US and China, there are bright spots, according to the manager.

“The outlook for dividends in the region remains robust as positive free cashflow generation alongside the strength of balance sheets – with record cash being held by corporates – provides a strong backdrop across a number of sectors and markets across the region,” he said in the trust’s latest factsheet.

Despite the manager’s optimism, the trust has failed to perform in recent years, languishing as the worst trust in the sector over one-, three-, five- and 10-years.

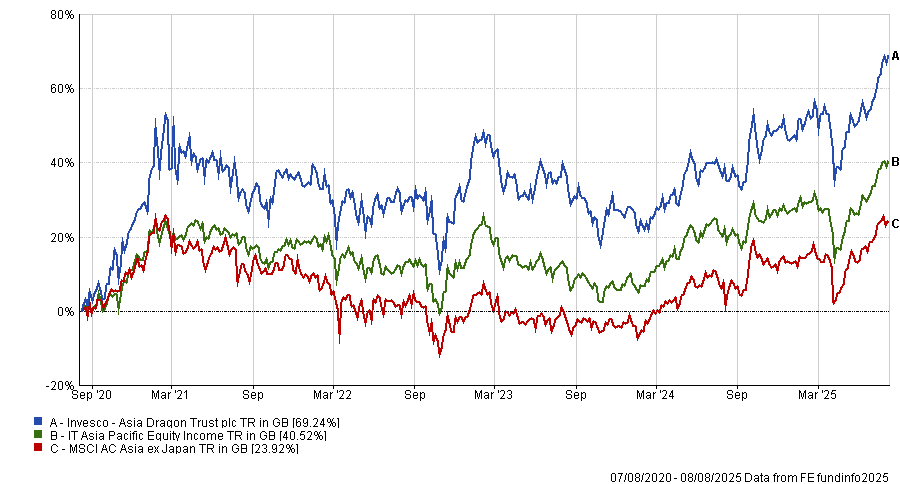

By contrast, the £772.4m Invesco Asia Dragon Trust has outperformed its sector across one-, three-, five- and 10-years – delivering 188.2% total return over the decade. It offers a slightly lower yield of 5.3% but still beats the Bank’s base rate.

Managed by Ian Hargreaves since 2011 and Fiona Yang since 2022, it aims to grow its NAV in excess of its benchmark index, the MSCI AC Asia ex Japan index. The trust is at a 6.1% discount to NAV.

Performance of the trust vs the sector and benchmark over 5yrs

Source: FE Analytics

There were three UK trusts on the list, with Merchants Trust the pick of the trio, sitting in the top quartile of the IA UK Equity Income sector over five and 10 years. It has struggled more recently, however, sat in the bottom quartile over more recent timeframes.

It offers investors a 5.3% dividend yield.

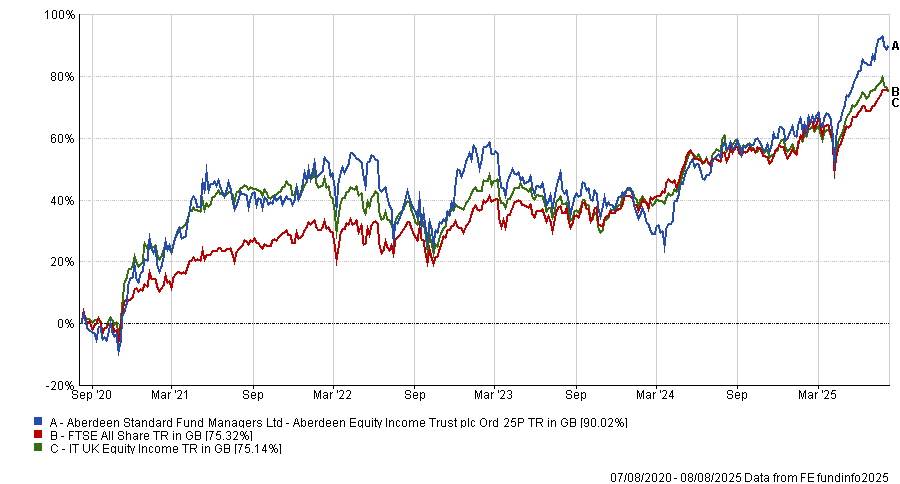

By contrast, the £176.8m Aberdeen Equity Income Trust, which is offering a 6.3% yield, has been on a strong run over the past one-, three- and five-years, but struggled over the decade.

Managed by Thomas Moore, it aims to provide shareholders with an above average income from their equity investment while providing real growth in capital and income. Top holdings include British American Tobacco, HSBC and BP.

Performance of the trust vs the sector and benchmark over 5yrs

Source: FE Analytics

Chelverton UK Dividend Trust is the highest-yielding of the trio at 9% but has failed to beat its average peer over one, three, five and 10 years, as well as over shorter time periods.

For a more comprehensive list, below we included the top three high-yielding investment trusts across each of the selected sectors.

Source: FE Analytics