Spencer Adair will retire from Baillie Gifford in March 2026 after 26 years at the firm, prompting fresh scrutiny of the Monks Investment Trust he has co-managed for the past decade.

The firm confirmed that Adair will remain in his current role until his retirement, “continuing to work closely with Malcolm MacColl and Helen Xiong to ensure a smooth transition and handover of responsibilities”.

A spokesperson added: “The partnership structure at Baillie Gifford (59 people own and run the firm) plus regular rotations and collaborations across investment teams allows for smooth transitions and long-term succession planning.”

Michael Taylor, a recently appointed partner of Baillie Gifford who has been at the firm since 2009, will join Monks’ investment team from 1 April 2026.

With Adair’s departure now in sight, Trustnet asked analysts to revisit their views from June’s ‘buy, hold or fold’ feature on Monks. All three agreed the trust should continue to hold its place in investors’ portfolios, despite Adair’s retirement leaving a mark on sentiment.

Continuity of approach

Matthew Read, senior analyst at QuotedData, acknowledged the importance of Adair’s role but emphasised Baillie Gifford’s long history of managing changes.

“It’s unsurprising [Adair] has become synonymous with this success and the trust itself. However, Baillie Gifford has run Monks for 95 years now, successfully dealing with similar transitions and numerous challenging periods before,” he said.

“Baillie Gifford has a very strong emphasis on taking a team approach and Adair’s co-managers are not only deeply ingrained with the investment process but both very credible managers in their own rights.”

Read added that the group’s bottom-up approach and long-term mindset should shield the trust from disruption. “Monks does not chase fads and this should insulate it from difficulties that a more short-term portfolio might suffer from with a similar change of guard.”

Read therefore still considered Monks to be a core long-term holding for investors who want some growth in the portfolio, particularly for those that would like “a more diversified and less volatile portfolio” than its stablemate, Scottish Mortgage.

Potential for further re-rating

Emma Bird, head of investment trust research at Winterflood, agreed.

Monks’ “broad stock base, diversified growth exposure and valuation discipline” should help it continue to perform more defensively than peers when growth is out of favour.

“We continue to view Monks as an attractive vehicle for exposure to a diversified portfolio of high-growth global equities,” she said.

However, she noted that, while the fund is still growth focused, there is “an acknowledgement by the managers that growth comes in different forms and they are more cognisant of valuations than some others at Baillie Gifford”.

On current trading levels, Bird highlighted scope for the discount to narrow further.

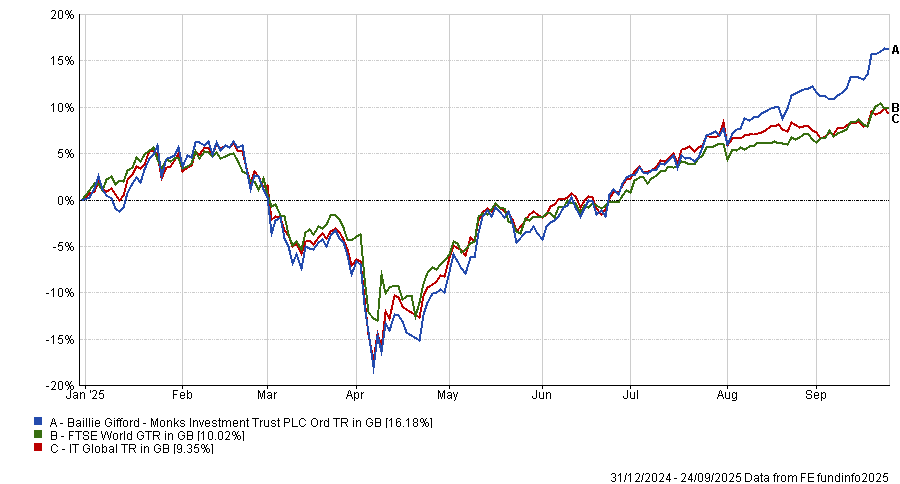

Following a period of re-rating over the last two months, the trust’s shares are currently trading at a discount of c.6%, which is tighter than the one-year average discount 10% and the current IT Global peer group weighted average discount of 8%.

This re-rating has followed a sustained period of strong performance, with Monks being the joint-strongest performer in the 10-strong global investment trust peer group over the last six months in total return terms.

Performance of fund against index and sector over the year to date

Source: FE Analytics

Bird said: “While the current entry point is not as compelling as a few months ago, we think that there is potential for further re-rating if the recent run of strong relative performance can be sustained”.

A weaker team, but still worth holding

Jonathan Moyes, head of investment research at Wealth Club, took a more cautious line, warning that “Monks will be weakened by the retirement of Spencer”.

“Adair, MacColl and [former manager] Charles Plowden did an excellent job turning around the trust when they took it over back in 2010. With Plowden stepping back in 2021, and now Adair, there will be some investors who might reassess the team,” Moyes said.

However, he added: “I am sure they are leaving the mandate in capable hands.

“This is a team-based sport at Baillie Gifford and there is a clear philosophy running through the Monks team that will endure long after Spencer’s retirement. For this reason, any knee jerk reaction to sell the trust on the news of this retirement feels overly reactive.”

While Wealth Club does not hold Monks in its portfolios, Moyes said this reflected allocation limits rather than doubts over the strategy.

“We have a strict limit on our total investment trust exposure and we are unable to fit Monks into this bucket. We pair Scottish Mortgage with a more quality (less growth) focused mandate,” he concluded.