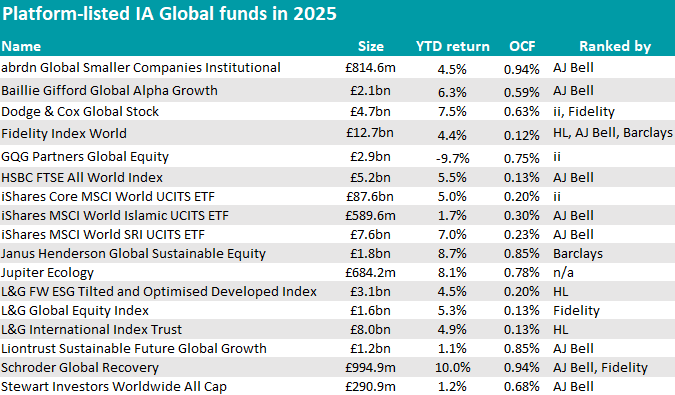

AJ Bell and Fidelity had the highest number of top-performing global-equity funds in their best-buy lists this year, with two first-quartile picks each.

Picking funds here is notoriously difficult as in recent years, the market has been dominated by a handful of large stocks, making it harder for active managers to outperform low-cost index trackers. Investing styles also come in and out of fashion, impacting returns.

In this series, Trustnet is looking at the half-year performance of the funds currently backed by the main investment platforms in the UK and today, we are looking at the IA Global sector.

Best-buy lists are built with portfolio construction in mind, so not all funds are meant to outperform in any given year and at the same time. However, strong showings can highlight where platforms’ fund-picking teams have successfully identified managers able to navigate the sector’s most recent challenges.

AJ Bell: Two standouts from a long list

AJ Bell’s selection featured more global equity funds than any other platform, with two delivering first-quartile returns over the year to date: Schroder Global Recovery and the iShares MSCI World SRI UCITS ETF (exchange-traded fund).

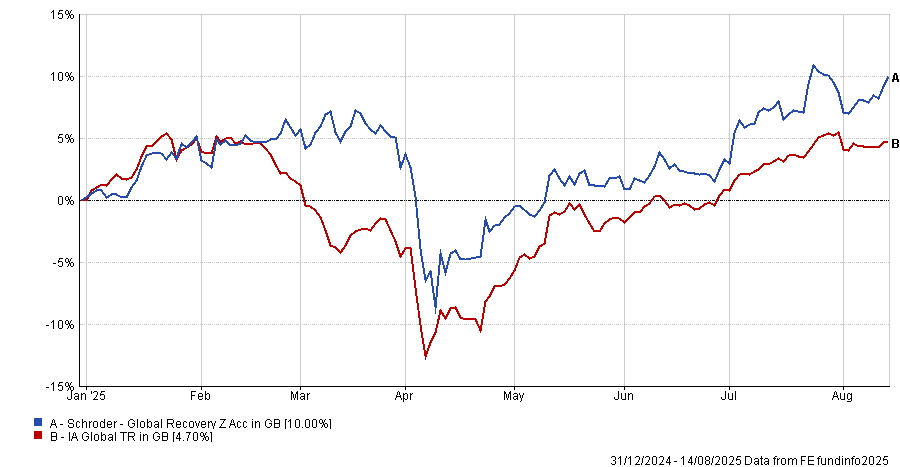

Schroder Global Recovery gained 10% against the MSCI World’s 5% and the 4.7% of the average peer, placing in the top quartile of its sector. The fund invests in companies that have suffered a setback but retain strong long-term prospects.

AJ Bell highlighted the team’s disciplined process and collaborative research culture, noting its willingness to hold positions far removed from the benchmark.

Performance of fund against sector over the year to date

Source: FE Analytics

The other top performer, iShares MSCI World SRI UCITS ETF, returned 7% over the period. This tracker screens out companies deemed to have poor environmental, social or governance (ESG) records and overweights those with stronger sustainability scores. AJ Bell positions it as a core option for investors wanting a low-cost, environmental, social and governance (ESG) tilted route to global equity exposure.

Several other AJ Bell picks delivered respectable, but not first-quartile, returns, for example Baillie Gifford Global Alpha Growth, which rose 6.3%. Others lagged more noticeably, such as Liontrust Sustainable Future Global Growth (1.1%) and Stewart Investors Worldwide All Cap (1.23%).

Fidelity: High strike rate with fewer names

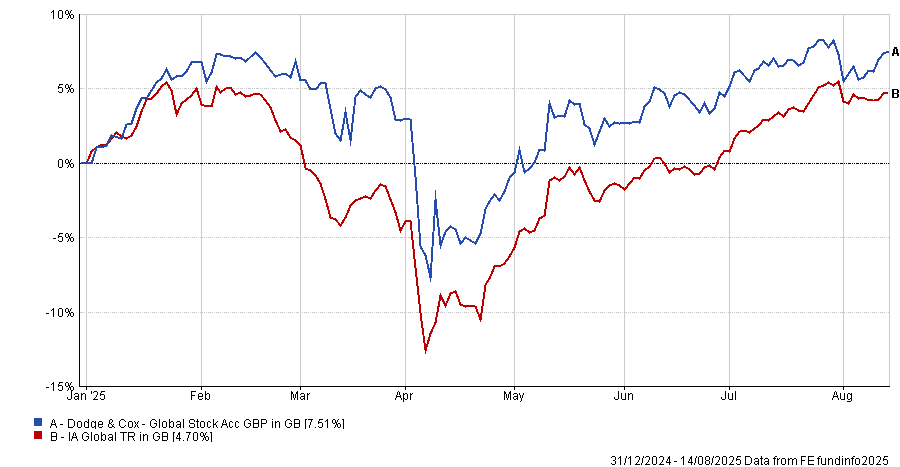

Fidelity’s more concentrated global equity list fared well, with two out of three funds making the top quartile of the IA Global sector. Dodge & Cox Global Stock was the strongest performer, up 7.5% over the first seven and a half months of 2025.

Performance of fund against sector over the year to date

Source: FE Analytics

Fidelity analysts described it as a “relatively concentrated” and contrarian value fund investing mainly in developed markets but with some emerging-market exposure.

The managers look for out-of-favour companies with good management and competitive advantages, aiming for recovery over the long term.

Also in the top quartile was Schroder Global Recovery, shared with AJ Bell’s list, while the third Fidelity pick – L&G Global Equity Index – returned 5.3% and landed in the second quartile.

The other first-quartile funds

Other platforms also had notable successes. Barclays would have tied with AJ Bell and Fidelity had it not removed Jupiter Ecology from its list in March. The sustainability-focused fund, managed by Jon Wallace, returned 8% (a first-quartile result) over the year to date.

This firm stated: “As part of our ongoing product monitoring, this fund is no longer part of our core fund selection and we’ve therefore removed this from our list. The removal doesn’t mean we have a negative view of the fund but it’s no longer one of our choices for new investment.”

Instead, Barclay’s fund list currently includes Janus Henderson Global Sustainable Equity, which has returned 8.7% so far in 2025, the only top-quartile pick.

Interactive investor also had one first-quartile global fund on its list: Dodge & Cox Global Stock, which it added in December 2024. It also highlights the high-conviction GQG Partners Global Equity but, with a 9.7% loss, it has been the year’s weakest performer among all best-buy list recommendations.

Some the reasons for backing it included its “flexible investment approach and quality bias, [which] have typically led to strong performance through the market cycle with good downside protection during periods of market weakness,” and the “proven and well-executed” investment process.

Hargreaves Lansdown, which led the mixed-asset rankings in the first instalment of this series, failed to achieve a single first-quartile pick in the global equity category. Its top performer, Fidelity Index World, gained 4.44% but ranked in the second quartile.

Source: Trustnet

Other funds of note

The abrdn Global Smaller Companies fund was removed from interactive investor’s Super 60 last week, despite a 4.5% gain so far this year.

It was originally placed under review on 13th June 2025, following the news of the departure of manager Anjli Shah and investment analyst Angus Johnson, both of whom worked with manager Kirsty Desson and “were largely responsible for covering US companies – a key element of the strategy’s investable universe”.

Analysts at interactive investor said: “While there is no planned change to the fund’s investment process, the fund no longer represents a highest conviction idea given the degree of change seen across the team and therefore will be removed from the Super 60.”

Hargreaves Lansdown removed the fund in July already, which now only remains ranked by AJ Bell.