More multi-asset funds on Hargreaves Lansdown’s recommended list have made top‑quartile returns so far this year than those on rival best‑buy lists, data from FE Analytics shows.

In this study, Trustnet examined how many funds backed by the biggest platforms in the industry made first-quartile returns in their Investment Association and Association of Investment Companies peer groups between January and July 2025.

When it comes to the mixed asset sectors, Hargreaves Lansdown (HL) had the highest number of top-quartile funds, while Fidelity recommends only two but both were top performers, meaning the platform got it right 100% of the time.

Hargreaves Lansdown: Four top-quartile picks but not all names delivered

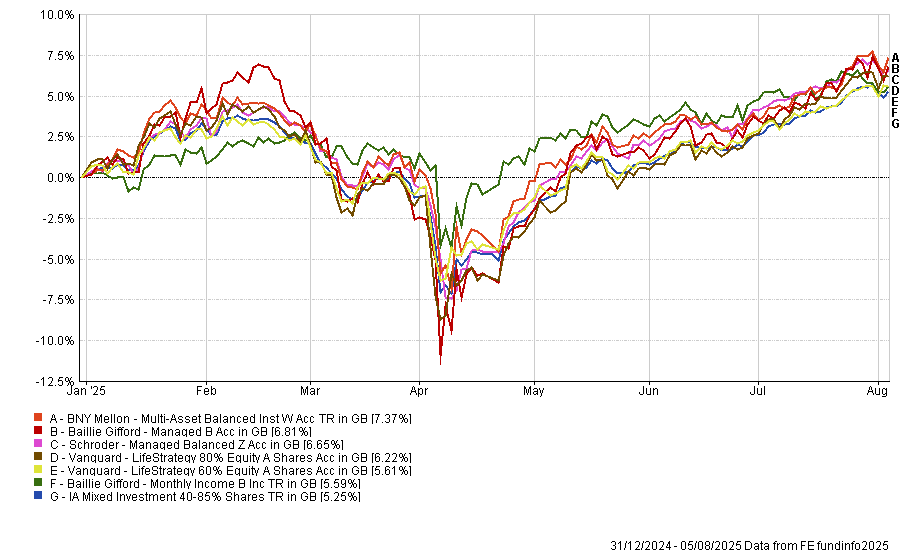

Hargreaves Lansdown’s list included four mixed-asset funds that have outperformed their sectors so far this year, each delivering first-quartile returns.

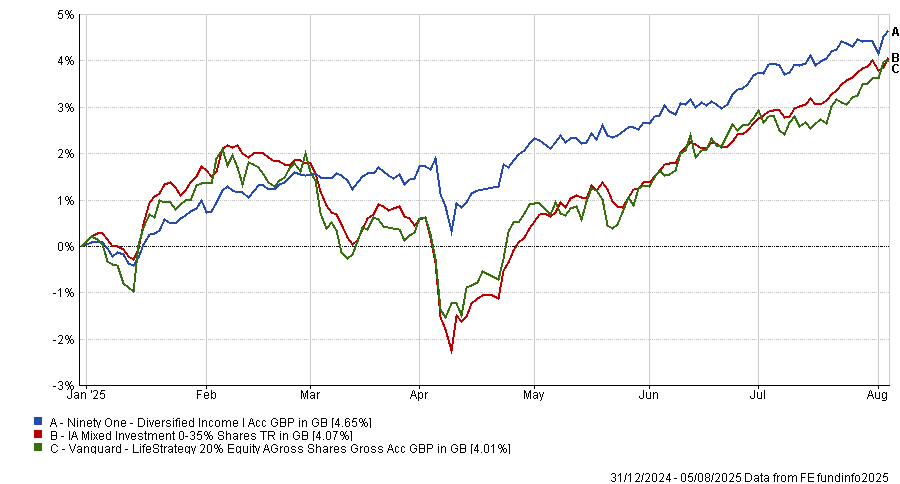

Ninety One Diversified Income was among the strongest IA Mixed Investment 0-35% Shares performers, returning 4.6% over the year to date against the sector’s 4.1%. HL analysts praised its consistent income focus and defensive profile, saying the fund “could provide some stability to an investment portfolio focused on growth or a portfolio focused on company shares”.

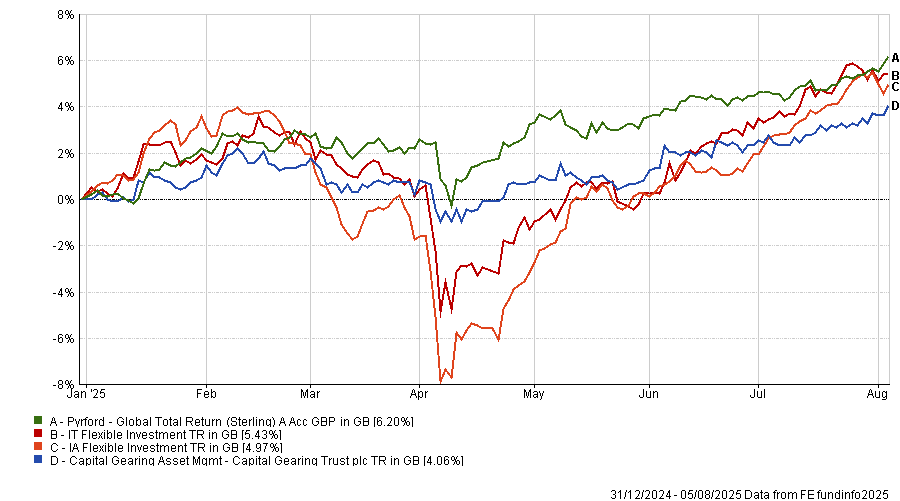

Another risk-conscious strategy, albeit being in the IA Flexible Investment peer group, Pyrford Global Total Return gained 6.2% compared to the sector average of 5%. The fund is designed to limit volatility and HL highlighted its long record of sheltering capital during downturns: “They’ve only lost money in two calendar years since 1994.”

Both funds were also recommended by Fidelity (as covered below), making them the two strongest cross-platform picks.

BNY Mellon Multi-Asset Balanced, up 7.4%, benefited from a more equity-leaning approach within the IA Mixed Investment 40-85% Shares sector. Its manager Simon Nichols was noted by HL as a “naturally conservative investor” who has historically reduced losses in falling markets without giving up upside when markets recover.

Performance of funds against sector over the year to date

Source: FE Analytics

The fourth HL-listed fund to outperform was Baillie Gifford Managed, returning 6.8% over the same period. Analysts at HL described it as an “adventurous option” due to its relatively high equity allocation, adding that its broad global exposure and internal research capabilities made it “a great option for diversified exposure to stock and bond markets”.

However, not all picks landed in the top quartile.

Schroder Managed Balanced, while well-regarded by HL for its long-term record and diversification, placed in the second quartile with a 6.6% return. The fund remains a core holding candidate for cautious investors, but its performance trailed slightly behind its peers.

Meanwhile, Baillie Gifford Monthly Income returned just 5.6%, a fourth-quartile result in its sector. Despite the weak start to the year, HL continues to back its long-term income strategy and emphasis on sustainability, positioning it as “a useful addition to a portfolio focused on providing an income”.

Fidelity: Small selection, strong outcomes

Fidelity’s recommendations were fewer but highly effective. Both Ninety One Diversified Income and Pyrford Global Total Return were among its featured funds and both landed in the top quartile.

Fidelity analysts said the Ninety One fund “has displayed skill in limiting losses and providing a steady yet growing income,” while Pyrford’s contrarian approach appealed to investors seeking conservative, manager-driven asset allocation. The combination of income stability and tactical flexibility helped these funds stand out in a challenging first half of the year.

interactive investor: Vanguard LifeStrategy disappoints

At interactive investor, the buy list also featured two first-quartile performers but the rest of its list underwhelmed.

The standout was Capital Gearing Trust, which returned 4.1% in the IT Flexible Investment sector. The trust is known for its long-standing capital preservation mandate under Peter Spiller, who has managed it since 1982.

Analysts said the trust’s defensive mix of bonds, equities and alternatives, as well as its long record of protecting capital in downturns, made it “a strong proposition for risk-averse investors”.

Performance of vehicles against sectors over the year to date

Source: FE Analytics

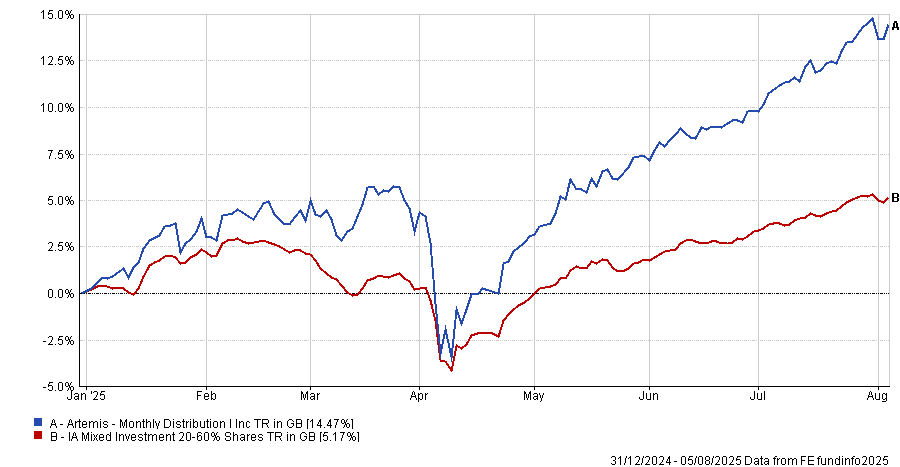

Another success was Artemis Monthly Distribution, which gained 14.5% against the IA Mixed Investment average of 5.2%. Its balanced allocation of equities and bonds, alongside an income-driven strategy, allowed it to lead its peer group.

Analysts at interactive investor noted that its high-yield bias may result in drawdowns during weak markets, but that “performance remains impressive even when adjusted for higher-than-average risk”.

Performance of fund against sector over the year to date

Source: FE Analytics

The rest of ii’s selections did not fare as well, with three Vanguard LifeStrategy funds – 80% Equity, 60% Equity and 20% Equity – ranking in the third or fourth quartile. The 80% and 60% funds returned 6.2% and 5.6% respectively, while the more defensive 20% strategy returned 4%.

The platform continues to support the LifeStrategy approach as a transparent, low-cost solution with global diversification. However, analysts acknowledged that recent market dynamics, including rising rates and weak bond performance, have become headwinds for fixed-allocation portfolios.

Performance of funds against sector over the year to date

Source: FE Analytics