UK fund managers are doubling down on smaller homegrown companies, betting on their resilience and strong earnings potential despite ongoing economic headwinds.

The UK economy has been battered by sluggish growth, stubborn inflation, a cost-of-living crisis and rising unemployment (not to mention the aftershocks felt following Covid, the war in Ukraine and Liz Truss’ disastrous mini-Budget).

Yet the market – led by large-caps – has been largely resilient, with the FTSE 100 climbing to new highs in recent months.

Julian Cane, lead manager of the Columbia Threadneedle UK Capital and Income investment trust, said: “It’s too early to write the obituary for the UK market – there are still a lot of very good companies producing good results.

“When things are unpopular, ignored and the valuation is attractive, that provides opportunity for investors.”

Yet valuations have so far failed to entice enough investors beyond UK large-caps to small- and mid-caps or the AIM market.

George Ensor, manager of the RGI UK Listed Smaller Companies fund, said: “If you look at the earnings of the FTSE 250 over the past five years versus the FTSE 100, they have performed in line, so the set-up is there for outperformance of smaller companies in the UK versus large-caps.”

Trustnet asked both fund managers to share their stock picks for UK mid-caps.

Ensor’s first pick was UK online greetings card retailer Moonpig. The business benefitted from rapid growth during Covid, where it was able to very cheaply acquire new customers that it has since managed to retain, according to Ensor.

With a market capitalisation of around £600m, Moonpig is listed on the FTSE 250 and is about 16 times larger than the next biggest online card retailer on the market, Funky Pigeon.

“It has also really successfully grown profits over the past five or six years, at around 27% per annum – excluding any kind of uplift and reduction through Covid,” Ensor noted.

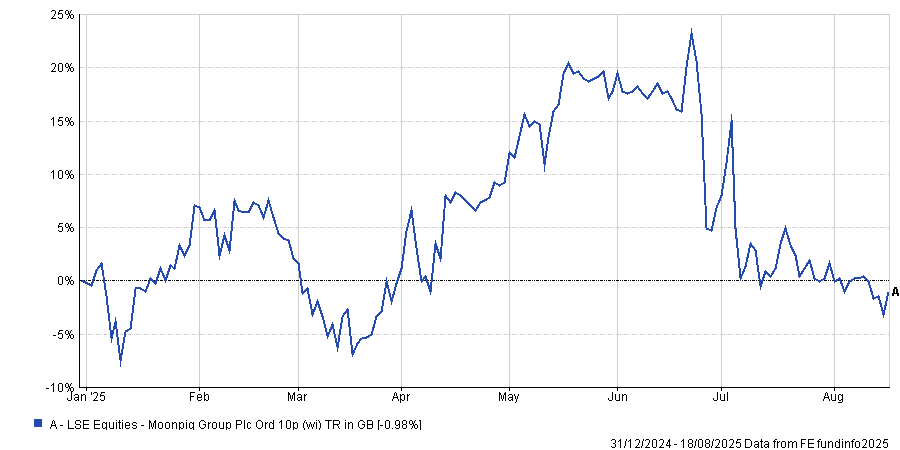

RGI UK Listed Smaller Companies invested in Moonpig at its IPO in 2021 at 350p per share. Moonpig now offers a dividend yield of 1.4% and a price-to-earnings (P/E) ratio of around 14x. The share price is down just under 1% year-to-date.

“As growth slows, we can see the business transitioning from a high growth business to a high-quality, high return on capital business,” said Ensor.

Stock price performance YTD

Source: FE Analytics

Public restaurant owners Mitchells & Butlers, meanwhile, is a top 10 holding of Ensor’s RGI UK Listed Smaller Companies fund, managing around 16,000 sites across 15 brands. The company is also listed on the FTSE 250, with a market cap of £1.6bn.

“We bought shares in 2023 and were looking at the discount to book,” Ensor explained. “We bought on a 50% discount, which we felt was a high margin of safety versus the book value of the bricks and mortar businesses and debt of the company.”

Since then, the book value of Mitchells & Butlers has grown at around 9% per year and the discount has closed to 40%, meaning the fund has made an “attractive return”.

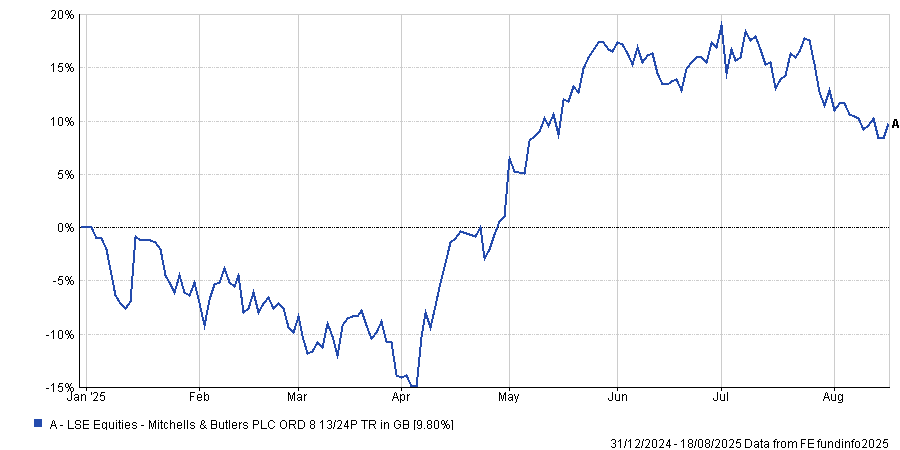

The company currently offers a P/E ratio of 10x, and its share price is up 8.8% year-to-date.

“The business has been de-leveraging,” Ensor added. “So, if you start assuming the company buys back shares, then its net asset value (NAV) per share can grow rapidly going forward, picking up to the mid-teens.”

Stock price performance YTD

Source: FE Analytics

For Colombia Threadneedle’s Cane, OneSavings Bank (OSB) is a great mid-cap alternative to larger UK domestic banks. He noted that the largest established banks may be performing well but it is “hard to see how they can grow”.

“I would much rather have a higher weighting in a small challenger bank like OSB than some of these larger and established banks,” he noted.

OSB, which has a £2bn market cap, is cheaper than domestic banks like HSBC, trading on a 7x P/E ratio versus 13x for HSBC. The bank managed £308m in net income in the year ending 31 December 2024.

“OSB is a very focused lender, with clear expertise and specialisms in UK buy-to-let and specialised mortgages,” said Cane. “This expertise and cost efficiency has allowed it to generate returns significantly above most other banks.”

CT UK Capital and Income invested in OSB at its IPO in 2014 at a share price of 170p, which has since risen to around 560p currently, with each share paying cumulative dividends of 203.7p since the fund has owned it, said Cane.

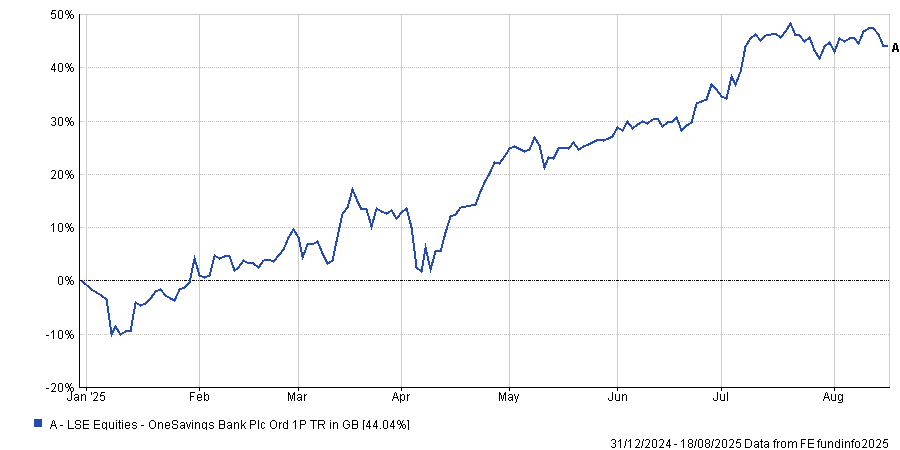

Today, the challenger bank offers a dividend yield of 6.1% and the FTSE 250-listed company’s share price is up 38.6% year-to-date.

Stock price performance YTD

Source: FE Analytics

Finally, Cane picked Burford Capital, which is the most expensive of the four mid-caps with a P/E ratio of 20x. The company offers specialist finance to those with corporate litigation, arbitration or other disputes.

It is dual listed on the Alternative Investment Market (AIM) of the London Stock Exchange and on the New York Stock Exchange.

“Burford is the global market leader in a fast-growing and developing industry, with the majority of its business in the US,” said Cane.

The finance it provides can be either from its own resources or from third-party funds.

“It is highly selective in its financing of new disputes, using proprietary data and experience to choose which case to back, which has led to very successful outcomes,” he said.

Of the cases Burford has invested in, 78% have been settled, 15% went to adjudication and won and only 7% went to adjudication and lost, Cane noted.

The company’s success rate has led to “impressive” financial returns, Cane said, noting it made an 83% return on invested capital and an internal rate of return of 26%.

The £2.2bn mid-cap has also been growing, with deployed capital increasing from to just over $1.6bn (£1.2bn) today, he said.

“It would certainly not be a stretch to say this alone would justify the valuation of the current business.”

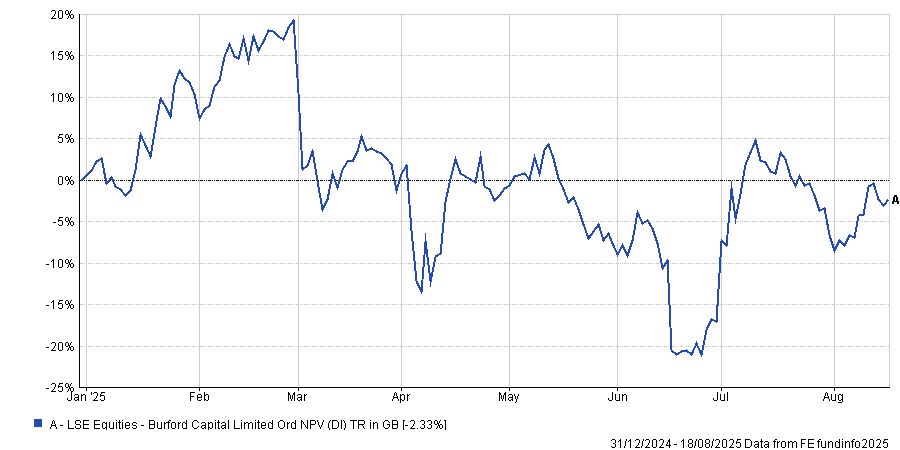

The share price has been volatile, however, peaking at over 2,000p in 2018 before reaching lows of 300p in 2020. The current share price is up 6.5% year-to-date and sits at around 1,000p.

Stock price performance YTD

Source: FE Analytics