Sean Peche, manager of the $1.9bn Ranmore Global Equity fund, is steering clear of overpriced US tech and backing underappreciated names, arguing that real cashflow and sensible management matters more than market trends.

“We want to own decent businesses instead of overvalued US tech stocks,” he said. “When we assess companies, we therefore look at the three ways you can get a return: dividends, earnings or re-rating.”

Peche also said he doesn’t believe in holding stocks forever.

“We are attuned to the fact that the world changes, so we will hold stocks for as long as our thesis is intact – we want 80% of the juice of the lemon.”

This philosophy has led him to a portfolio that is underweight the US and more tilted toward Asia and select emerging markets. Below he outlines four key holdings that he prefers to the dominant US tech titans.

Mattel

The American toy manufacturer is a top 10 holding at 2.1%. Despite being a well-known global brand, its market capitalisation of $6bn makes it small compared to the tech giants, meaning it is “overlooked by large managers”, said Peche. It is also comparatively cheaper than the Magnificent Seven, trading at 13x times price-to-earnings (P/E).

The company recently issued $598m in bonds to raise cash – due November 2030 – ensuring liquidity and flexibility, while easing immediate refinancing pressures and supporting operations.

“It’s also on a 10% free cashflow, which is very attractive, and has a sensible management team that is paying the debt,” Peche added.

Despite Peche’s scepticism of companies making big bets on artificial intelligence (AI) like the Magnificent Seven, he said companies utilising AI within their business operations and innovations remain attractive.

Earlier this year, Mattel announced a new partnership with OpenAI to develop AI-powered toys and experiences, including video games.

Shares are up 5.6% year-to-date.

Stock price performance YTD

Source: Google Finance

Petrobras

The Brazilian multinational oil and gas company also features in Peche’s top 10 holdings at around 2% and serves as one of his emerging market plays.

The manager said that the Ranmore Global Equity fund bought the stock when sentiment around energy prices was negative, yet the company’s fundamentals were strong. For example, he cited the company’s attractive 9.3% dividend yield.

Although Petrobras reported a 7.1% decline in sales revenues from January to September 2025 compared to the same period last year, the company upped its net income attributable to shareholders by 62.3%.

For the third quarter of 2025, oil made up the biggest chunk of sales at 80.2%, with natural gas accounting for 18.9%. Overall sales increased 8% between the second to third quarter of this year.

However, Petrobras’s total debt increased to $70.7bn at the end of the third quarter – up 3.9% on the second quarter.

The share price is down 13.7% year-to-date but has risen 43.8% over five years.

Stock price performance YTD

Source: Google Finance

TV Asahi

The Japanese broadcaster was a top 10 position in the Ranmore Global Equity fund as of September 2025, with Peche noting that inflation has had a positive impact on the company, with competitors having to increase their advertising spend to justify price increases. As a result, “TV Asahi’s operational leverage exploded,” he added.

The Tokyo Stock Exchange-listed company reported a strong performance for the first half of the fiscal year ending 31 March 2026, enjoying significant growth driven by high viewer ratings and increased digital advertising revenue.

Net sales increased by 7.6% and operating profit surged by 140.9% compared to the same period in 2024. The stock remains cheap with a P/E ratio of 10x, despite its share price climbing 45.3% year-to-date.

Stock price performance YTD

Source: Google Finance

Diageo

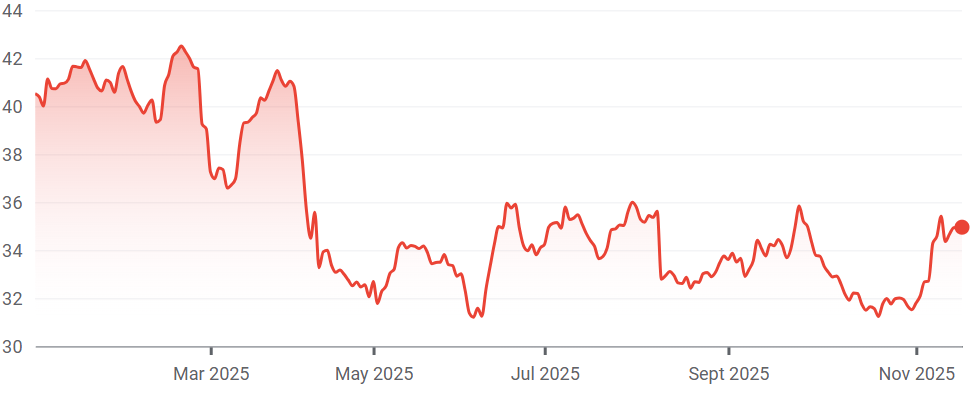

“We have been buying Diageo recently because it is deeply out of favour,” said Peche. Indeed, the global beverage powerhouse has had a rough year, with its share price down 32% year-to-date.

The company’s latest quarter results, published on 6 November, reported that sales were up 5% in Europe, with Guinness driving the increase in revenues, but sales were down 10% in Asia Pacific – largely due to the weak performance of white spirits in China. Sales were also down 4% in North America.

Stock price performance YTD

Source: Google Finance

However, Peche said he sees promise in the company’s fundamentals and brand strength. In addition, a recent leadership change – with ex-Tesco chief executive Dave Lewis entering the fold from 1 January 2026 – may trigger a recovery.

“People may be drinking less [alcohol] but they are increasingly drinking 0% products, which are proving quite profitable for Diageo,” said Peche. “Guinness Zero is about 18% of its revenue and growing like crazy.”