As small-caps face one of their toughest periods in decades, fund manager Nish Patel is positioning the Columbia Threadneedle Global Smaller Companies Trust to capitalise on the anticipated global recovery of the unloved asset class.

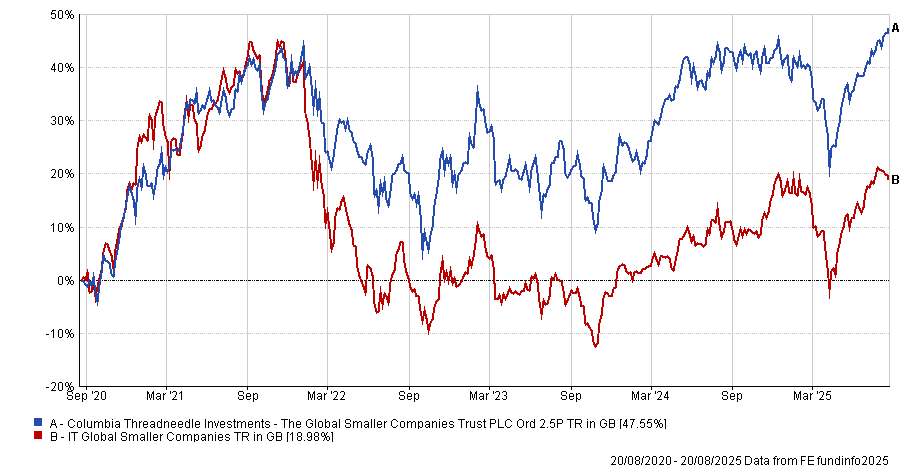

Despite ongoing headwinds for small-caps, the trust has delivered a top-quartile return compared to peers over three and five years (21.4% and 47.6% total return respectively).

Performance of fund vs sector over 5yrs

Source: FE Analytics

Below, he explains how the trust maintains a truly global focus and reflects on performance over the past year.

What is the philosophy of the trust and what has changed since you became lead manager?

I have been involved in the trust since 2007 and took over as lead manager in April 2024.

The trust aims to be a one-stop shop for investing in the best-performing smaller companies across both developed markets and faster growing emerging markets.

We take a long-term approach to buying quality growing businesses, looking for companies that are temporarily out of favour and available at an attractive valuation.

Since I became lead manager, we have cut the number of holdings, ramped up buybacks from 5% to 10% on an annualised basis and narrowed the discount from around 17% to 10%.

How do you manage a global focus?

There are nine people involved in the management of the trust, as it is split into siloes. I head the North America portfolio alongside two other managers, then we have managers for the UK, Europe and Japan.

We then define small-caps according to their region – so a small-cap in North America is typically much bigger than one in the UK, for example.

You can automatically rule out a large chunk of the small-cap universe because companies are not profitable or they are too risky for us to invest in, so we will just focus on the stocks that are likely to make it – but this still leaves us with more than 8,000 viable companies we can invest in.

Emerging markets are the riskier part of the world when it comes to small-caps and we don’t have that internal capability. However, because we want the trust to be truly global it does need to include emerging markets, so we hold four funds that can offer that exposure – around 15% of the overall trust.

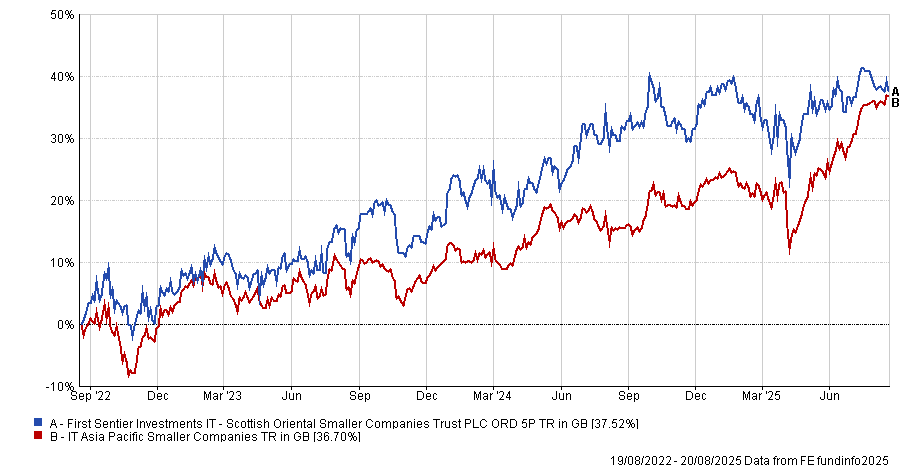

One of them is the Scottish Oriental Smaller Companies Trust, which invests in mostly Asia ex Japan high-quality small-caps – for example, Colgate-Palmolive. Colgate is a high-quality company in developed markets but is also proving to be a fast-growing company in emerging markets as the middle class spends more on oral care.

Performance of fund vs sector over 3yrs

Source: FE Analytics

Which portfolios within the trust have struggled and why?

We had a difficult 12-month period overall for the UK portfolio. We had about 21% of that portfolio invested in AIM-listed companies and one of the main ongoing concerns is the reduction of inheritance tax benefits.

Our Europe portfolio also had a difficult year because Germany decided to spend more money on infrastructure and defence and we were not positioned for that, so we had to correct it. Our European portfolio also has a lot of China exposure as a lot of European businesses sell into China.

What have been some of your best calls over the past year?

Given I more closely oversee the North American portfolio, we can focus there.

Safe-haven types of investment have outperformed. For example, gold has done well, so our position in Wheaton Precious Metals has been beneficial, as it has risen with the gold price and the underlying performance of the royalty streams it owns.

We purchased the company in February 2019 and it is up 222% since then. Over the year ending April 2025, it contributed 2% to the North American portfolio.

Insurance has also been a safe-haven-type asset. Brown & Brown is a major US insurance broker that has done well because of this flight to quality.

We bought it in March 2015 and it is now up 525% and has contributed 1.1% to the North American portfolio over the 12 months to April. Earnings, cashflows and the share price have grown with higher insurance rates, market share gains and acquisitions of smaller competitors.

Which holdings disappointed?

On the negative side, we did suffer from a lower oil price – this didn’t help Kosmos, which has assets in the Gulf of Mexico and offshore west Africa.

Kosmos was initiated into the North American portfolio in August 2022 and its share price has since fallen by 78%, detracting 1.2% over the 12-month period to 30 April.

The lower oil price, paired with delays in the start-up of a liquefied natural gas project and lower than expected production from the company’s main assets, led to the share price decline.

The trust also bought WEX in April 2014 and the share price is up 37% since then. However, the past 12 months have been more difficult because of lower fuel volumes and price and the migration by a large travel-related customer to a new contract.

Why should investors keep the faith in small-caps?

We are at a somewhat pivotal moment for the asset class. It is very out of favour. When I look back over financial history, there are some analogous periods to where we are today, most notably the early 1970s and the late 1990s.

During those periods, large-caps were a big part of broader markets and the relative valuations of small-caps were very low. But small-caps came back into favour each time. We think this will happen again.

What do you do in your spare time?

I love travelling, so I often take my family abroad to enjoy experiences that often include trying food. Otherwise, I exercise and am a regular practitioner of meditation to keep the stress levels down.