Some 60% of UK wealth will be held and controlled by women by the end of this year, according to Charles Stanley research, yet they remain less likely to invest it than men – held back by lower earnings, career breaks and a preference for cash.

Financial advisers speaking to Trustnet urged women to focus on building long-term diversified investment portfolios through tax-efficient wrappers, such as stocks and shares ISAs, tailoring their risk profile to their individual goals.

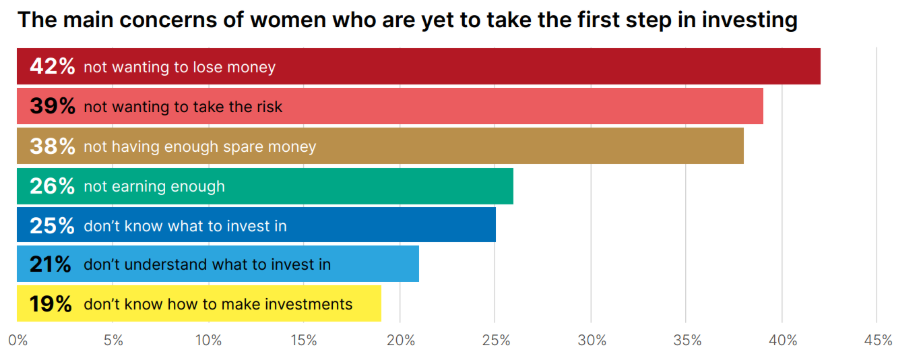

However, women remain far more risk-averse than men on average, which is proving to be a major barrier to closing the gender investing gap, according to Zoe Brett, financial planner at EQ Investors.

“Women tend to favour safety and security over aggressively seeking high performance. This can often be attributed to financial constraints owing to earning less money, taking career breaks to raise the family and traditional gender roles,” she said.

Source: Why Women Invest, Hargreaves Lansdown (January 2024)

Scottish Widows reported that, for women over 55, 40% invest outside of their pensions. For younger generations, this falls to 34%.

The Financial Conduct Authority found that 13% of women held a stocks and shares ISA in 2022, compared to 22% of men, while the average total investable assets women held that year – excluding pensions – was £34,000. In comparison, men held an average of £52,000 in investable assets.

In 2023, an HMRC study showed that 4.4 million women held their savings in cash ISAs compared to 3.1 million men.

The gender gap stretches across to pensions, too. In August, the Department for Work and Pensions found that the average woman in the UK is set to retire with far less in their pension pot than men.

Yet women choosing to invest are outperforming their male counterparts. Analysis by Fidelity Investments of 5 million customer investment accounts between 2009 to 2020 found that on average women’s holdings outperformed those selected by men by 0.4 percentage points annually.

Rewarded for risk

For women who have yet to explore investing, the first port of call is to invest in a stocks and shares ISA, according to Brett.

“This will keep more of their money in their own pocket rather than with HMRC,” she said, recommending that the focus should be kept on a handful of tracker funds looking at the likes of the FTSE 100, FTSE Global All Cap or the S&P 500.

“This will build in diversification at a low cost,” she said.

To more quickly and effectively bridge the savings gap between men and women, it would be prudent for women to take on more risk – as much as they feel comfortable with according to their individual situation and priorities, according to Chris Gray, financial planner at Forrester Boyd Wealth Management.

He said: “For any client – regardless of gender – who wants to grow their money and does not need access to a portion of it within the next five or so years, my recommendation is absolutely to invest over save.

“History shows us that, over the long term, the returns are higher through investing than they are in savings accounts.”

Those choosing to take on more risk have benefited from higher returns over the past 20 years than those erring on the side of caution, he said.

For a female investor with a risk profile of seven out of 10, Gray said he would invest around a third in UK equities, 20% in US equities, 23% in the Asia Pacific and emerging markets region and then smaller allocations across European equities, property and other asset classes.

“Over the past 20 years, that portfolio returned an average annual rate of return of around 8.6%,” he said.

Of course, the ride is far less smooth. “The best year would have been a 53% gain and the worst a 32% fall.”

Being more cautious still would have allowed for a better return than keeping cash in savings, Gray insisted.

For a woman with a risk profile of three out of 10, Gray would have invested around 20% in cash-like assets like money market funds, 50% in bonds and gilts, 12% in UK equities, 9% in US equities and the remainder “dotted around other assets”.

This approach managed a 5.7% average annual return over a 20-year period.

“Of course, I also say to clients that there is nothing stopping them from trying out a few different levels – for example, putting 10% of what they are prepared to invest in a slightly higher risk portfolio and seeing how they feel,” said Gray.