Despite turbulent markets and sharp currency moves, there has been no pause in takeover activity this year. We’ve seen a flurry of takeover announcements in the UK, including a number of companies within the fund.

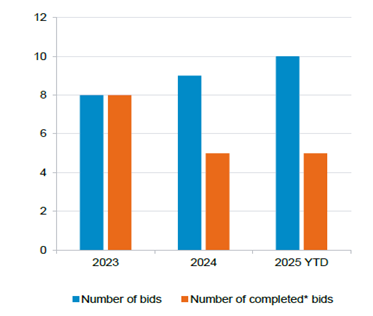

Several holdings have agreed to terms that are expected to deliver an average share price premium of 48.7%, subject to regulatory and shareholder approvals. Despite only being just over eight months into the year, the number of company bids within the portfolio has already exceeded last year’s total of nine and matched the five offers accepted.

The wave of mergers and acquisitions (M&A) activity has been broad-based including domestic consolidation (Greencore’s acquisition of fresh prepared food manufacturer Bakkavor), overseas acquirers (US-based FirstCash buying UK gold pawnbroker H&T Group) and private equity approaches (Blackstone and WareHouse REIT). The activity reflects a trend of UK company takeouts and demonstrates one of the benefits of investing in an undervalued market.

Fund bid activity

Source: Fidelity International, Refinitiv, 31 July 2025. Completed deals refers to acquisitions as at 31 July 2025, including completed deals such as H&T Group, as well as announcements that have received board recommendations or are subject to regulatory approvals, Just Group, Alpha Group, Bakkavor and Warehouse REIT*. Note multiple bids by the same company will only count for one each per year. There may be multiple bids for a holding if more than one company engaged in a bid.

Benefits of an undervalued market

M&A has largely accelerated in the UK compared to the rest of the world. Since 2023, the value of deals has surged 120% year-on-year in the UK to the end of 2024, outpacing the European average growth of 16%. But the increase in activity for the UK market began in 2021 and has maintained its pace since.

Investing in an undervalued market presents opportunities. Given their vantage point, the domestic market often doesn’t appreciate the hidden value, while other participants can, helping to close the valuation gap. Company executives, other corporates and private equity can capitalise on these low valuations through share buybacks, asset purchases or outright takeovers, taking a longer-term investment view.

The UK remains a preferred destination for US investors, given the highly international nature of UK companies. This year, 14.7% of takeover activity was from US acquirers, the highest level in three years. Many domestic companies trade at substantial valuation discounts compared with their US and global peers. This valuation gap has not gone unnoticed as overseas investors recognise the attractive prices on offer and the synergies available. Takeover activity can anchor on US valuations, particularly from private equity companies, offering a significant premium.

Is this level of activity sustainable?

Takeover activity and shareholder activism have long been important features of the UK equity market, acting as a corporate governance tool that helps unlock shareholder value in companies. However, rising company bids, a slowdown in UK IPOs and companies opting for US listings have raised fears among some market participants of a shrinking UK equity market.

We feel these concerns are overdone. It wasn’t long ago that the UK enjoyed a strong wave of IPOs in 2020 and 2021. While some high-profile companies have switched exchanges, they are relatively few. We would have to experience several consecutive years of high takeover activity with very few new listings to raise legitimate concerns. And these issues are not unique to the UK. Equity markets outside of the US face similar challenges, largely because US stocks trade at substantial premiums compared to the rest of the world.

While the investment thesis is not predicated around a takeover, it can be a secondary effect from our investment approach.

For us, the UK offers an attractive and deep investable universe. There are over a thousand listed companies with market capitalisations above £100m – offering plenty of choice and investment opportunities.

Alex Wright is portfolio manager of the Fidelity Special Situations fund and Fidelity Special Values trust. The views expressed above should not be taken as investment advice.