Investors who were overly exposed to the US, and in particular large-cap American stocks, have made superb returns for more than a decade, but “diversification is finally hitting headlines and investors are starting to take note,” according to Daniel Lockyer, senior fund manager at Hawksmoor.

While it has been a brilliant long-term strategy, a high US allocation started to backfire in 2025 as the S&P 500 has trailed other developed markets, causing investors to reconsider the benefits of portfolio diversification.

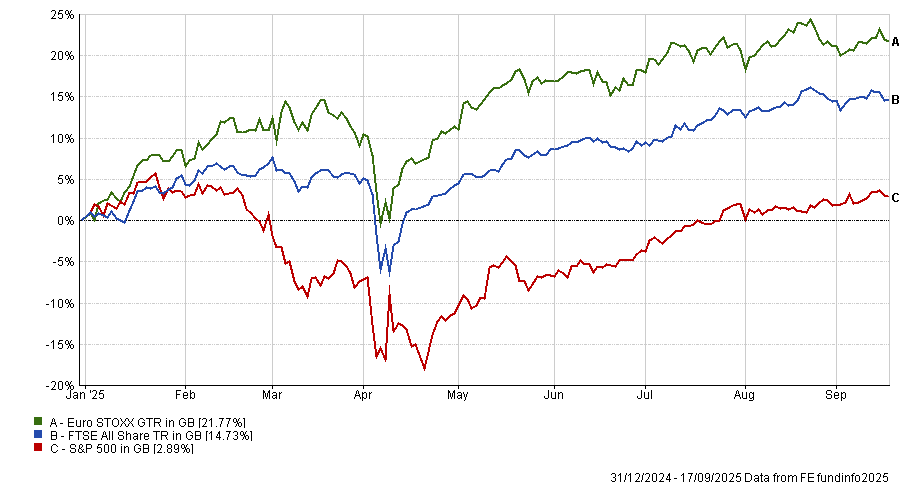

Performance of indices YTD

Source: FE Analytics

Below, experts highlight funds that can diversify away from US mega-cap tech stocks, while also working in tandem alongside one another.

Hawksmoor: Artemis UK Select and International Public Partnerships

Lockyer said the Artemis UK Select fund, led by FE fundinfo Alpha Manager Ed Legget and Ambrose Faulks, is the “obvious choice”.

For a domestic investor, having some sterling assets “makes a lot of sense” to diversify currency exposure away from the dollar, which has already weakened this year but could fall further, he noted.

On top of this, UK equities remain “relatively undervalued” despite only underperforming the S&P 500 by 10 percentage points over the past five years, the Hawksmoor manager said.

There are several talented active managers in the UK but Legget and Faulks stood out due to their willingness to “take some very high conviction positions in sectors and stocks”, for example, their high allocation towards banks.

This has worked out very well, with the fund posting “fantastic performance” over the past one, three and five years.

“You’re diversifying in terms of currency, style, sector and companies,” Lockyer concluded.

To complement it, he liked International Public Partnerships Trust, which invests in government-backed assets such as schools, banks and toll roads. This gives it some protection from inflation, which it pairs with an “attractive yield” of around 7% all on a “appealing discount” of 20%.

As a FTSE 250-listed company “there is some level of correlation [to the Artemis fund] you can’t avoid”. However, due to the different underlying assets, the trust “should trade like property over the long term ”, providing some protection.

Additionally, the high yield is a safety net, giving a solid income in an investor's “back pocket” for years when the two are correlated.

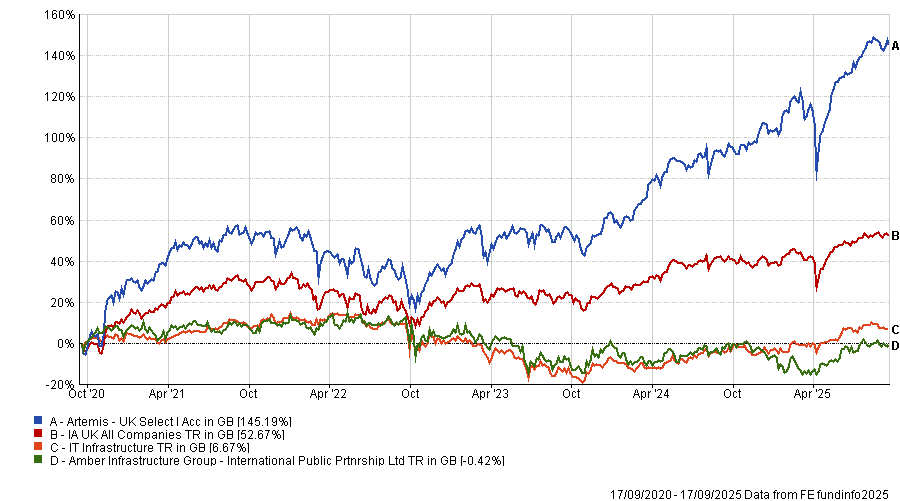

Performance of the fund and trust vs sectors over past 5yrs

Source: FE Analytics

Forvis Mazars: Baillie Gifford Pacific and M&G Japan

Meanwhile, James Rowlinson, associate investment governance director at Forvis Mazars, said Asian funds are a good choice for diversification.

He favoured the Baillie Gifford Pacific fund, which has an “unabashed growth focus” that has led to the best returns in the IA Asia Pacific Excluding Japan sector over the past 10 years.

“When looking at why the rest of the world underperformed US equities for such a long time, it can get lost in the noise that the US was the only region with meaningful earnings growth following the global financial crisis,” he said.

This is finally starting to reverse, with companies in China and India both expected to post double-digit earnings growth this year. This could lead to great returns for Baillie Gifford's high-conviction approach, which will have very different drivers to US equities, Rowlinson said.

He suggested pairing this fund with something like M&G Japan, run by Alpha Manager Carl Vine. While it is more focused on steady outperformance than a specific style, the manager does have a value tilt, serving as a balance to Baillie Gifford, he explained.

It provides “general exposure to Japanese equities”, which Rowlinson said looked ready for a resurgence due to a growing emphasis on shareholder returns. It has also emerged “relatively unscathed” from US president Donald Trump’s tariffs.

“With an OCF [ongoing charges figure] of 0.47%, you are paying relatively little for consistent alpha, as well as a fund which has outperformed in both rising and falling markets,” he said.

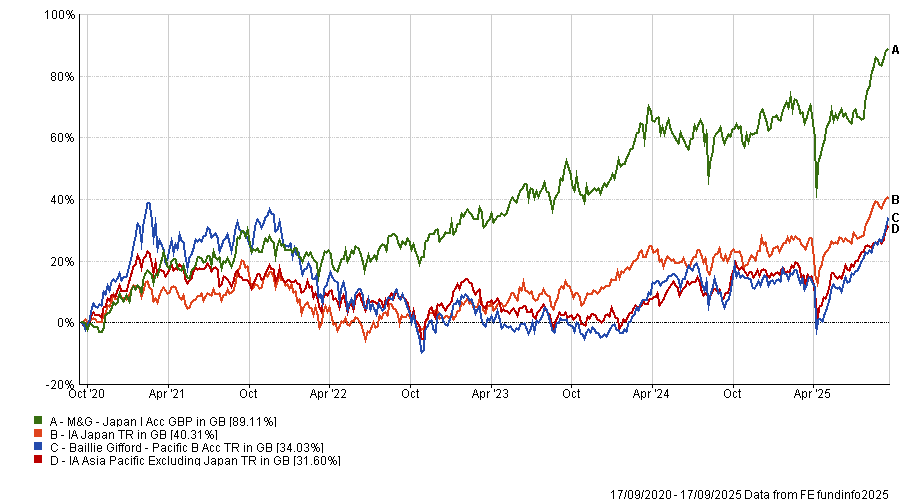

Performance of funds vs sectors over past 5yrs

Source: FE Analytics.

“Combined, they provide comprehensive coverage of Asia, a region of exciting opportunities after years of moribund earnings growth,” he concluded.

Columbia Threadneedle: Latitude Global and CT Global Focus

Finally, Paul Green, portfolio manager of the multi-manager range at Columbia Threadneedle, opted for a pair of global funds.

Firstly, he pointed to the Latitude Global Fund, which has a “quality-value” approach with an extremely high conviction process.

It avoids most of the large stocks in the US index, instead favouring cheap international companies such as supermarket chain Tesco.

While it does hold some US stocks, these include businesses such as car retailer Autozone, rather than mega-cap tech companies, which provides solid diversification from the standard US exposure, he explained.

To complement it, Green pointed to the in-house CT Global Focus fund run by Alpha Manager David Dudding and Alex Lee.

This is a lower-conviction strategy with emphasis on the US and holds more mega-cap tech stocks. However, it balances this with allocations to companies lower down the market-cap spectrum, such as engine maker Howmet Aerospace, as well as international companies like credit expert Experian.

“Although they both share a 'quality' framework, the value approach of Latitude and growth style of CT Global means that they’re often fishing in different ponds,” Green explained.

Over the past year, their performance has also proven complementary, with Latitude outperforming during the 'Liberation Day' volatility, while CT Global Focus has benefited from recent market recoveries

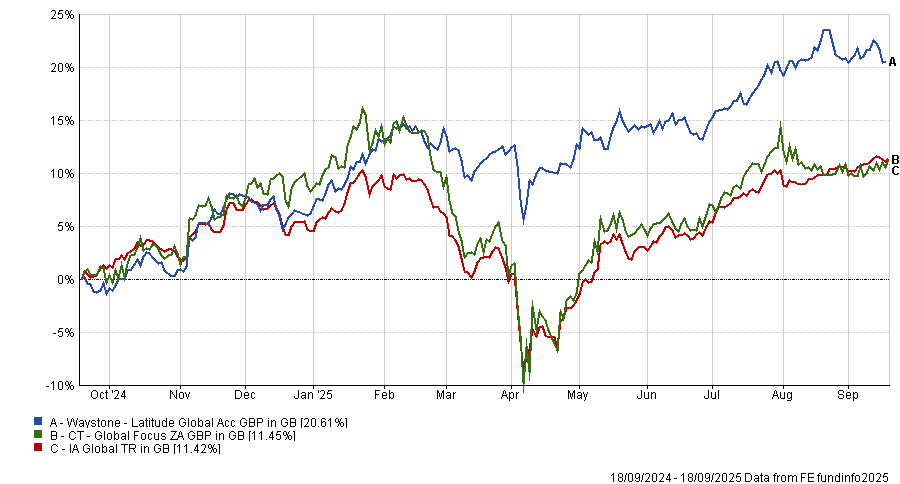

Performance of funds vs sectors over past year

Source: FE Analytics.