In a market gripped by tech-driven exuberance, for Bertrand Cliquet, co-manager of Lazard Global Listed Infrastructure Equity, the real opportunity lies in Europe’s infrastructure sector, where long-term stability and inflation-proof cashflows are drawing renewed investor interest.

“Since the political turmoil across Eastern Europe, and Ukraine in particular, we have seen increased alignment between energy transition policies and energy independence policies which is ultimately accelerating investment into energy networks,” Cliquet said.

In particular, with governments prioritising the need to ensure energy independence from Russia following its 2022 invasion of Ukraine, this has bolstered growth across the European infrastructure asset class.

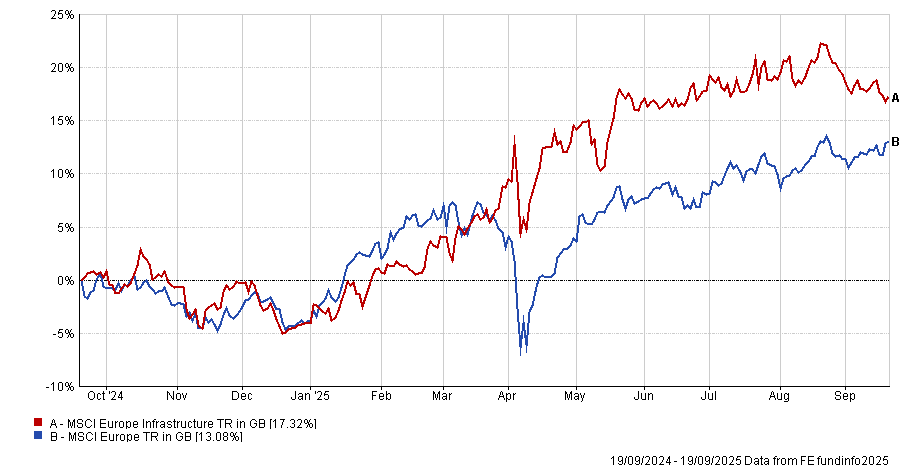

Although the MSCI Europe Infrastructure index has been beaten by MSCI Europe over three, five and 10 years – managing a 93.1% gain over the decade – the index has performed more strongly over one year, gaining 16.8% compared to MSCI Europe’s 13.1%.

MSCI Europe Infrastructure vs MSCI Europe over 1yr

Source: FE Analytics

“In a world that is very driven by and attracted to technological innovations, prompting euphoric markets, the last thing most investors will be thinking about is a European regulated utility because it is – for lack of a better word – comparatively boring,” Cliquet said.

But this is where Cliquet said there are opportunities that have been “cast aside by many during the tech renaissance in the US”.

As such, Lazard Global Listed Infrastructure Equity has a large European weighting.

Within Europe, Cliquet said Italy is especially attractive and currently makes up 20% of the portfolio.

“We find the utility set-up in the country is probably one of the best around the world in terms of consistency and transparency,” he explained.

“The regulatory authority is independent from politicians, and it also has a very long-term view of the sector in terms of investment requirements and how those companies will help meet the energy policy goals of the country. Our [portfolio] companies are therefore benefitting from the key role they have played to keep the energy flowing in the country through the European gas prices.”

As an example of a recent outperformer, he pointed to Italgas, a gas distribution business in Italy. The fund has a 4.6% position.

Cliquet admitted that the stock was previously “frustrating” as it “was not doing very much” but the company’s recent announcement that it would be acquiring competitor 2i Rete Gas for around €5bn has unlocked Italgas’s potential, with its share price up 63.3% year-to-date.

“It is fully regulated and has a monopoly. Now a valuation gap is emerging and we have maximised our position there.”

Stock price performance YTD

Source: Google Finance

As was the case for many European countries, Italy was previously very dependent on Russian gas and so there was a potential scenario back in 2022 when the Italian energy industry would not have been able to function.

However, Cliquet said investing in domestic utilities has allowed Lazard Global Listed Infrastructure Equity to benefit from efforts made by companies to shore up supply and diminish dependence on Russia.

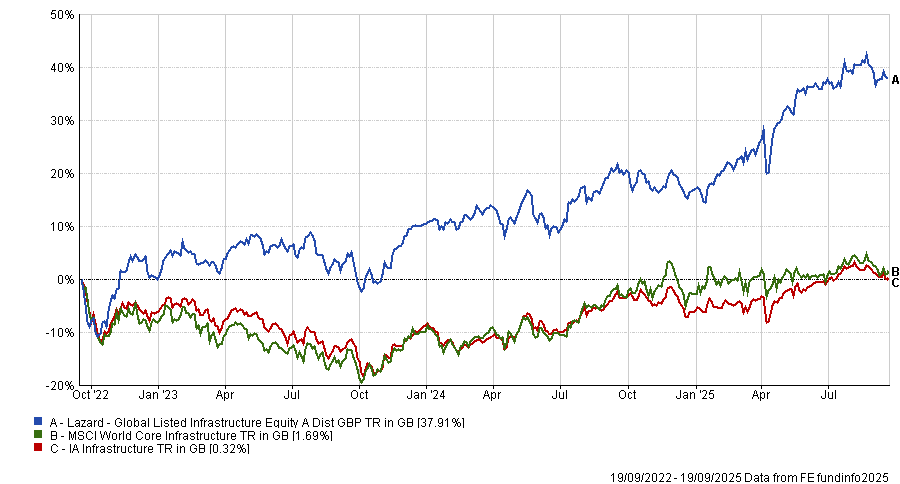

Performance of the fund vs sector and benchmark over 3yrs

Source: FE Analytics

Cliquet pointed to Snam, the transmission grid of gas in the country (and in which the Lazard fund has invested 5.9%), as an example.

“Snam was able to secure a floating liquefied natural gas (LNG) import vessel very early on in the energy crisis and, through that, made sure that the country continued to receive gas,” he said.

“By pumping more gas from Norway and Algeria, they really managed to ensure continuity of service.”

Stock price performance YTD

Source: Google Finance

The continued drive to ensure energy independence in Europe has multi-decade growth potential, Cliquet insisted.

“Stocks that have performed well in the past 12 months were starting from a very low point,” he said.

Indeed, he added that the continent’s overall drive to facilitate the energy transition – the move away from carbon-intensive energy supply to clean and renewable sources such as solar and wind power – “will also keep going for at least the next 15 years”.

“When you look at the growth of the National Grid in the UK, for example, at least 10% of asset-based growth per year until the early 2030s is linked to the energy transition,” he said.

National Grid is Lazard Global Listed Infrastructure Equity’s top holding at 7.9%.

In comparison, Cliquet argued that valuations of US utilities are “stretched” – in part because of their exposure to the push for artificial intelligence (AI) via the development of data centres.

However, he did note that there were “compelling” investment opportunities in the US transport market – specifically, railway companies such as CSX Corporation and Norfolk Southern.