Yields on UK government bonds have crept upwards on worries about the nation’s financial health but there is currently little risk of 2022’s swift and dramatic gilt sell-off being repeated, investment strategists argue.

The 30-year gilt yield reached 5.72% at the start of September, its highest in 27 years, after the Bank of England (BoE) kept interest rates on hold at 4% and expressed caution around future rate cuts.

It has since fallen down to around 5.5%. However, with the next Budget due in November, there are concerns that yields could climb again if chancellor Rachel Reeves fails to reassure the market.

These concerns are down to two main factors, according to Richard Carter, head of fixed interest research at Quilter Cheviot.

“Firstly, inflation remains persistently higher than the 2% target, currently sitting at 3.8%, and is expected to climb higher this year, due to increases to national insurance and the minimum wage as well as higher energy and food costs,” he explained.

“Meanwhile, economic growth remains anaemic and borrowing is increasingly having to be relied upon for day-to-day spending by the government. This and the seeming inability to make substantial spending cuts (U-turn on the winter fuel allowance and welfare reform) has damaged fiscal credibility and raised expectations of further significant tax rises in the forthcoming Budget, and thus dragging further on growth.”

30-year gilt yields

Source: Bloomberg, Quilter Cheviot

Gilt yields also spiked three years ago, following the ‘mini Budget’ in September 2022 by Liz Truss’ short-lived government. Then-chancellor Kwasi Kwarteng unveiled a series of tax cuts that would be paid for by increasing the national debt, spooking the markets.

Carter said the risk of another gilt market meltdown similar to one that followed the 2022 mini Budget is low as “we are not yet at a point where investor confidence has been well and truly lost”. In 2022, unexpected and fairly radical policy announcements caught investors off guard, which is unlikely to be the case today.

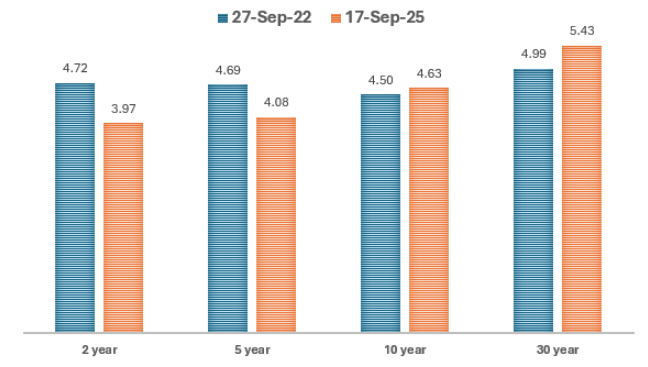

However, yields on 10-year and 30-year gilts are currently higher than they were in the days after the mini Budget. Laith Khalaf, head of investment analysis at AJ Bell, asked: “Why is there not the same level of panic?”

Gilt yields in Sep 2022 vs Sep 2025

Source: LSEG Refinitiv, AJ Bell

Khalaf thinks there are five reasons why the level of concern around elevated gilt yields isn’t the same as in September 2022.

The first is the slower pace of yield increases compared with 2022. Between 22 and 27 September 2022, the 30-year gilt yield rose by 1.2% in three trading days; in 2025, the 30-year gilt yield has risen by 1.2% over the course of a year.

“This has allowed investors to absorb and adjust to the rise in yields, which are also offset by income payments from the bonds,” he explained. “A more orderly market, even a declining one, also allows leveraged investors (such as LDI funds in 2022) to post collateral to maintain their positions.”

The recent rise in gilt yields has also occurred alongside similar moves in global bond markets, helping to normalise the UK’s experience. Khalaf noted: “Long-term bond yields are higher not just in the UK, but in the US and Europe too.”

The current bond sell-off has largely been focused on longer-dated gilts, meaning it has had less impact on mortgage markets. This is in contrast to 2022, when short-dated yields spiked and filtered directly through to household borrowing costs.

Inflation remains elevated but is far below the levels seen at the time of the mini-Budget, when expectations were spiralling. “Inflation is the nemesis of conventional bonds,” Khalaf said, because it undermines their real value and triggers rate hikes that put further pressure on prices.

Finally, fiscal policy has returned to a more orthodox footing, restoring some of the credibility lost in 2022. Khalaf pointed out that “one thing we know about Rachel Reeves is she will live or die by her fiscal rules” and this discipline has helped reassure the gilt market.

Quilter Cheviot’s Carter said this last point is something investors will be paying close attention to during the looming Budget.

“One potential catalyst to watch would be Rachel Reeves relaxing her fiscal rules, downgrading their importance by suggesting less fiscal prudence or being replaced by a more ‘left-wing’ chancellor – when speculation mounted that Reeves may be leaving the role earlier this year there was a swift drop in gilt markets, pushing yields higher,” he explained.

“While gilt markets have calmed in recent weeks, as we approach the budget in November, tensions will begin to rise once again. It is a delicate act that Reeves needs to produce, and markets may just start pressuring for results sooner rather than later.”

Kate Marshall, lead investment analyst at Hargreaves Lansdown, agreed that the Budget could put upward pressure on gilt issuance as the government faces calls to boost spending, particularly in areas like energy and infrastructure.

At the same time, weak economic growth and above-target inflation complicate the policy outlook, making it harder for the government or the Bank of England to act decisively without trade-offs.

“This uncertainty could create market volatility around the Budget, but also opportunities for investors,” she added.

Marshall noted that gilts are offering attractive yields that may appeal to income-focused investors, especially given that the FTSE All Share yield’s 3.35% (as of 31 August 2025). This makes them a competitive option for those seeking a reliable income without taking on equity market risk.

“Looking at the long term, future yields will likely be lower than where they are today. That means investing now offers the potential for capital gains as well as income,” she said.

For investors considering fixed income, Marshall highlighted three funds: Legal & General All Stocks Gilt Index Trust, Invesco Tactical Bond and Royal London Corporate Bond.

Legal & General All Stocks Gilt Index Trust is a passive fund that tracks the broad movement in prices of all gilts currently in issue, making it a low-cost and easy way to invest in lots of different gilts. “However, funds that invest in only one type of investment can increase concentration risk. So, they should only form a small part of a well-diversified portfolio,” Marshall said.

Stuart Edwards and Julien Eberhardt invest flexibly in all types of bonds, including government and corporate bonds, in their Invesco Tactical Bond fund. The managers have a focus on keeping losses during periods of market stress to a minimum.

“The fund is highly diversified, and we think this is a great option to invest in a fund with experienced managers who can take advantage of the opportunities that come from market volatility,” the analyst explained.

Finally, Shalin Shah and Matthew Franklin’s Royal London Corporate Bond fund can offer further diversification for portfolios that already hold government bonds or stocks.

“The managers’ edge comes from deep analysis of individual bonds, looking for those that offer higher returns. This means there’s also some high-yield bonds in the fund which can carry greater risks,” Marshall finished.