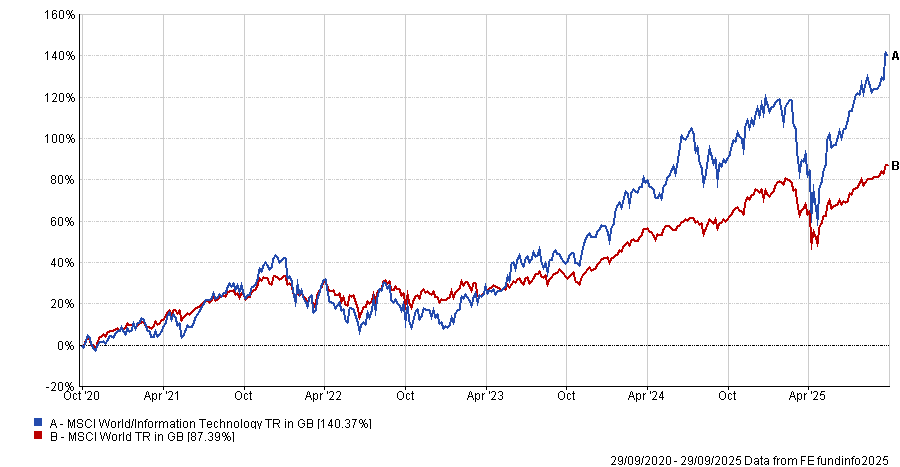

Technology stocks have delivered exceptional returns for years, with the MSCI World Information Technology index up 140.4% in the past half a decade, versus a 87.4% return from the MSCI World index.

The dominant force in the world of tech is the Magnificent Seven (Nvidia, Apple, Microsoft, Meta, Alphabet, Amazon, Tesla), with Nvidia posting a total return of more than 1,000% in sterling terms over the past five years.

Performance of indices over past 5yrs

Source: FE Analytics. Return in sterling

However, as valuations of these mega-cap tech companies and their dominance in the market (as a percentage of market capitalisation) has neared all-time highs, some experts are worried that technology and artificial intelligence (AI) are nearing bubble territory.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said: “These valuations rely on eye-watering sums to continue to be poured into the sector at a rapid click, far into the horizon. So, it’s not surprising fears are growing that an AI bubble has formed, which risks popping down the line.”

This may leave a first-time investor wondering if they have missed the chance to invest in tech, but experts argue the opportunity set is still compelling.

Greg Eckel, portfolio manager of the Canadian General Investments trust, said: “It’s never really ‘too late’ to invest in technology; the sector has been the backbone of market growth for decades.”

However, new investors need to be aware that in tech, “winners can quickly become losers”. Companies such as IBM and BlackBerry, which used to dominate the tech market, have become “shadows of their former selves”.

The most compelling options in the sector, then, are the ones that have proven they can stay ahead of the curve over the long term. Eckel pointed to Microsoft and Apple as examples. Microsoft has been a fixture in the S&P 500’s top 10 largest companies for almost 25 years, making it one of the most durable stocks on the market.

Meanwhile, his team has held Apple since 2008, when it “redefined the consumer market” by producing the iPhone. Ever since, it has been one of the most dominant tech companies in the world and still has compelling long-term growth potential.

David Harrison, manager of the Rathbone Greenbank Global Sustainability fund, agreed there are opportunities for new investors in some of the ‘Magnificent Seven’.

He said: “Fundamentally, many of the leading technology businesses have durable ‘moats’ that are becoming increasingly difficult to penetrate.”

Examples include Microsoft and Nvidia, both of which Harrison owns in the top 10 of his Greenbank fund. “They remain in a strong position to benefit from structurally rising spend and have the scale to deploy capital better than most,” he said.

Both stocks also have strong long-term propositions, Harrison added. Microsoft is “embedded in most applications” and is very difficult for most businesses and workplaces to replace, giving it one of the most durable offerings in the sector.

This allows it to withstand the volatility that investors should expect from a fast-moving market such as tech, he explained.

Meanwhile, although Nvidia’s price-to-earnings (P/E) ratio is “high on a static one-year view”, when looking long-term, it is more appealing. On a five-year view, its dominant position in the market and ability to compound earnings make it an excellent choice for a first-time investor, Harrison said.

For other experts, the best opportunities in tech are outside of the Magnificent Seven.

Orbis’ head of multi-asset, Alec Cutler, said: “The burning hot centre of AI, with Microsoft, Meta, Google, Amazon and so on, is the highest risk place to be.”

Technology is a “winner takes most” industry where there may be plenty of competitors, but only one is likely to emerge on top, he explained. With the mega-caps all competing for market share, the best opportunities in tech are elsewhere in the infrastructure businesses that have enabled this wave of AI investment, Cutler said.

One of his preferred stocks for tech exposure is Taiwan Semiconductor, which produces the chips for companies such as Nvidia.

He said that, as one of the main producers of chips, it maintains a “huge barrier to entry” that makes it very difficult for other companies to take market share. It is also “compelling value” at just a 17x P/E ratio versus Nvidia, which is trading above 30x, despite both companies being tied to the AI megatrend, Cutler added.

Nisha Thakrar, investment specialist on the Nedgroup Contrarian Value Equity fund, agreed that the rally in mega-cap tech names has led to “sky-high expectations and elevated valuations”.

However, outside of these mega-caps, first-time investors can find several opportunities that are not being “priced to perfection”.

In her portfolio, Thakrar highlighted health tech businesses such as ICON and Thermo Fisher, which provide the tools and infrastructure for medical development. “They’re essential to the ecosystem yet often overlooked in favour of more prominent tech names,” she said.

“For new investors, this moment isn’t just about gaining exposure to tech as it might have been over the past two years. It’s about building a portfolio of businesses that can deliver long-term value, even when the market narrative is focused elsewhere.”