US stocks have surged in recent months on the back of a strong earnings season and general investor optimism, but experts are split on whether now is a good time to be cautious or if the market deserves confidence.

Current American equity market valuations are not far from the height of the dot-com bubble, according to Wolf von Rotberg, equity strategist at J. Safra Sarasin Sustainable Asset Management, after making a “stellar comeback” since April.

“Led by the ‘Magnificent 7,’ the Nasdaq has surged 50% from its early April lows, boosting its year-to-date gains to 19%,” he said, adding that the rally has been fuelled by the US administration’s shift on tariffs and surging capital expenditure announcements.

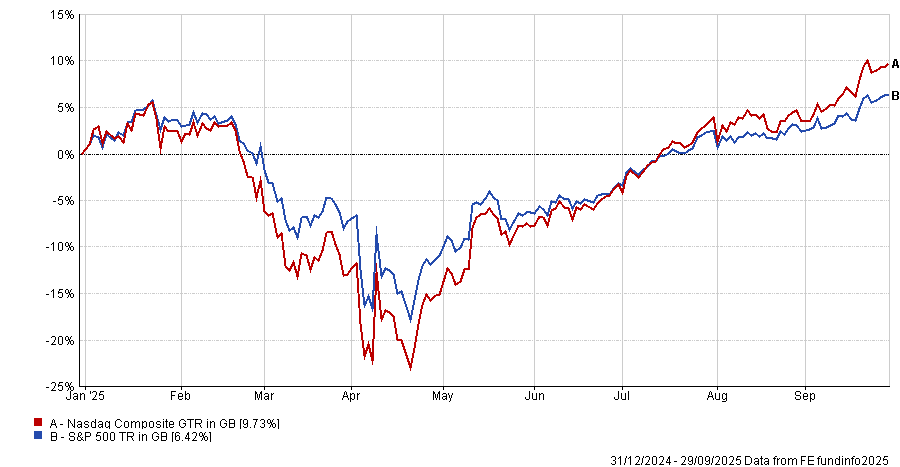

Performance of S&P500 and Nasdaq YTD

Source: FE Analytics

While the Nasdaq Composite’s price-to-earnings (P/E) ratio remains far below the record levels of the dot-com era, when it soared above 70x, the wider S&P500 is remarkably close.

“The S&P 500’s P/E ratio, based on 12-month forward earnings, stands at 23x – matching its 2021 cycle high and approaching the 25x peak seen during the dot-com boom. This suggests current valuations may be in dangerous territory, potentially ripe for correction,” he warned.

Meanwhile, the equity risk premium (ERP) – calculated as the 12-month forward earnings yield minus the 10-year treasury yield – fell to zero for the first time since the early 2000s.

He said these figures suggest “the market is moving into bubble territory”, but noted that this “does not necessarily mean that it will pop immediately”. It took several years for the dot-com boom to come to an end, for example.

Shannon Saccocia, chief investment officer of private wealth at Neuberger, said other factors could also give investors “reasons to be cautious”.

“In recent weeks US and global equities have routinely hit record highs, credit spreads continue to trade at historic tights, and the VIX index of volatility is near its lows for the year so far,” she said, suggesting investor apathy towards high valuations.

This comes at a time when there has been a “clear deterioration” in US employment and inflation data, with the Federal Reserve restarting its rate-cutting cycle as a result.

“To add to the mix, geopolitical risk remains at historic highs, with fresh spikes this month from Russia violating Polish, Estonian and Romanian airspace, and Israel carrying out a strike in Qatar against Hamas’ leadership,” she added.

Despite this, markets have “ripped higher” on the back of US economic resilience, which has led some to believe that, with supportive monetary policy, the economy remains in “decent shape”.

“This optimistic view appears, for now, to override any developing concerns around the independence of the Fed and the US’ fiscal challenges,” she said.

Additionally, a stronger-than-expected earnings season for both the ‘Magnificent Seven’ stocks (Alphabet, Amazon, Apple, Nvidia, Microsoft, Tesla and Meta) and the broader market has helped to bring renewed optimism.

Belief that central banks have more room to react to an economic downturn given higher interest rates, and a lack of concern over geopolitical risk (which could spike but is currently viewed as a non-factor), are also giving investors confidence.

However, this optimism could be misguided. Von Rotberg said that, at current valuations, US equities will “struggle to generate better than mid-single-digit returns per year over the coming decade”, a far cry from the gains made since the financial crisis of 2008.

Stuart Clark, Helen Bradshaw and Bethan Dixon, managers of Quilter’s WealthSelect Managed Portfolio Service, have taken a pessimistic view themselves, noting they have a “cautious stance” when it comes to asset allocation.

Dixon said: “We continue to maintain a steady, long-term approach to investing, with our clients’ goals guiding our decisions, particularly given the noise of late in both the US and Europe. In the current environment, resilience and adaptability are vital. Given the market backdrop, we retain our cautious stance.”

The team has taken profit from equities and recycled this money into fixed income, alternatives and cash, adding particularly to the Quilter Investors Diversified Bond fund managed by Premier Miton.

“Recognising that corporate credit spreads are at all time tights and that interest rate uncertainty and increasing political risk are priced into government bond markets, we have directed the top-up in fixed income towards the Quilter Investors Diversified Bond fund. The fund is dynamic in terms of its duration and credit positioning, and we believe its approach will continue to add value in the current environment,” said Dixon.

The team has also added Aegon Global Sustainable Government Bond to the Responsible Active and Sustainable Active portfolios.

Saccocia said investors “should rightly be cautious about where to go from here”, but said that despite “economic weaknesses and the risks” she has an “optimistic” outlook for growth and risk assets over the medium term.

“In equities, in particular, optimism is clearly being priced in. But we do not believe there is an irrational exuberance and overextension in allocations, not least because absolute yields in fixed income remain attractive,” she said.

“What is important, especially now, is that investors ensure portfolios are as diversified as they can be across multiple asset classes, providing a balance of exposures across public and private markets that blend attractive sources of risk-adjusted returns with sufficient downside protection.”