Funds investing in precious metals and healthcare stocks were the biggest winners in November, FE fundinfo data shows, while those focused on artificial intelligence (AI) and cryptocurrencies tanked.

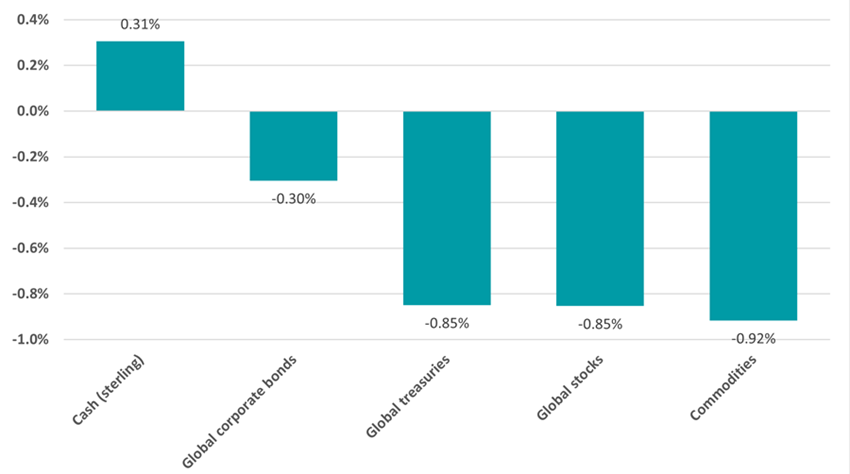

Investors were in a relatively nervous mood last month, with the MSCI AC World index slipping 0.85% (in sterling terms) on the back of heavy falls among growth and tech stocks. Bonds and commodities also fell.

Summing up the month, Fairview Investing director Ben Yearsley said: “AI always seem to get a mention, but another wobble in November saw about $1trn wiped off the value of leading AI stocks – as a comparison the UK’s six largest listed companies (AstraZeneca, HSBC, Shell, Unilever, BP and Diageo) have a combined market cap of just over this level. Concerns about debt funding huge capex caused the latest wobble.”

Performance of asset class in Nov 2025

Source: FinXL

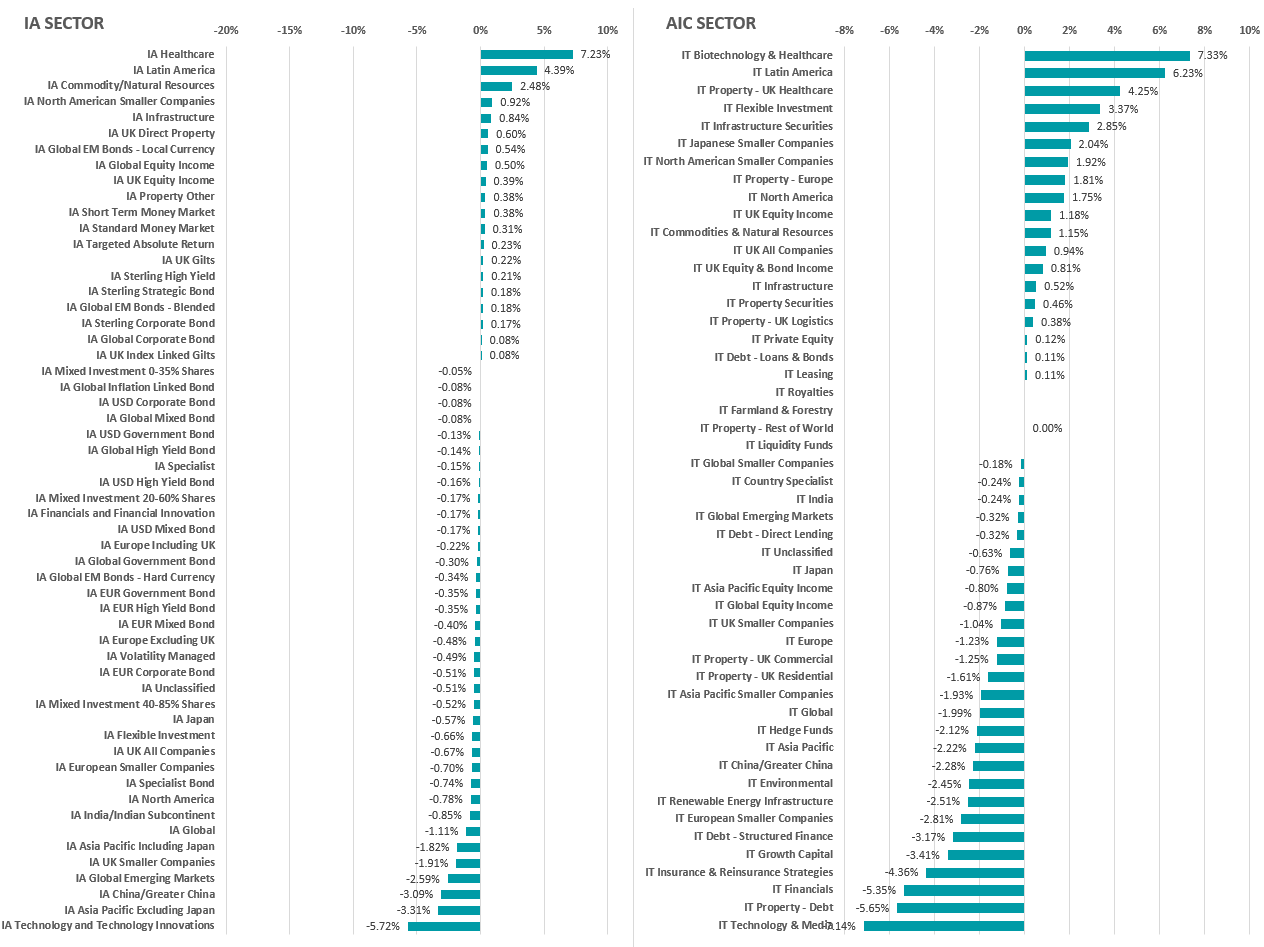

However, some parts of the market handed investors ample gains in November, with healthcare standing out. The average fund in the IA Healthcare sector was up 7.2% over the month while the average IT Biotechnology & Healthcare trust gained 7.3%.

Healthcare funds have been strong during recent months, thanks to easing policy and drug‑pricing uncertainty, positive sentiment around weight loss and diabetes drugs such as Wegovy and Zepbound, and continued merger and acquisition (M&A) activity in the biotech space.

Ailsa Craig, portfolio manager of International Biotechnology Trust, said: “With the looming patent expiries facing pharmaceutical companies in the next few years, we expect M&A activity in the biotech sector to continue for the foreseeable future.

“Last year, biotech companies were responsible for more than 70% of new drugs approved – a significant shift from just a decade ago when most new drugs originated in pharmaceutical R&D departments. This means that acquiring biotech companies is increasingly the most effective way for pharmaceutical companies to add innovative treatments to their pipelines and protect their long-term revenues.”

Performance of fund and trust sectors in Nov 2025

Source: FinXL

Latin American equity funds and trusts had another strong month, with Brazil's Ibovespa index reaching new record highs. This was supported by positive returns from the likes of Chile and Mexico.

Strategies investing in US smaller companies, infrastructure and property were also up last month, although these were far below the gains made by healthcare and Latin American funds.

The worst average returns came from funds in the IA Technology and Technology Innovations sector and trusts in the IT Technology and Media sector.

Investors dropped tech stocks in November amid worries that AI stocks were in bubble territory, after several years of meteoric returns.

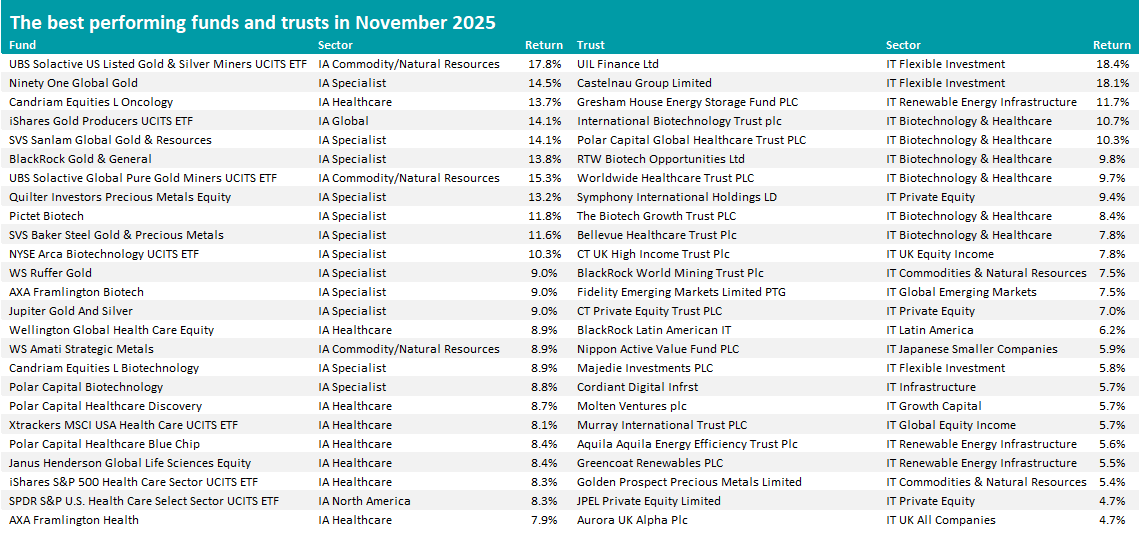

Source: FinXL

Funds investing in precious metals and their miners topped the overall performance ranking in November, with UBS Solactive US Listed Gold & Silver Miners UCITS ETF making a 17.8% total return.

Ninety One Global Gold, iShares Gold Producers UCITS ETF, SVS Sanlam Global Gold & Resources, BlackRock Gold & General, UBS Solactive Global Pure Gold Miners UCITS ETF, Quilter Investors Precious Metals Equity and SVS Baker Steel Gold & Precious Metals also fit into this theme and made more than 10% last month.

Gold has been rallying hard over 2025 but sold off in October. Yearsley said: “Gold has regained some of the shine lost in October. An ounce of gold started the month at $3,996 and finished at $4,254. Silver appears to be the metal to watch with it rising from just below $48 to finish at $56.5 – a five-year high."

The remaining funds in the list of the Investment Association’s top performers last month reside in the IA Healthcare sector or focused on biotechnology or health stocks but sat in other peer groups.

Likewise, many of November’s best trusts are from the IT Biotechnology & Healthcare sector, although the two with the highest returns – more than 18% - are UIL Finance and Castelnau Group, both from the IT Flexible Investment peer group.

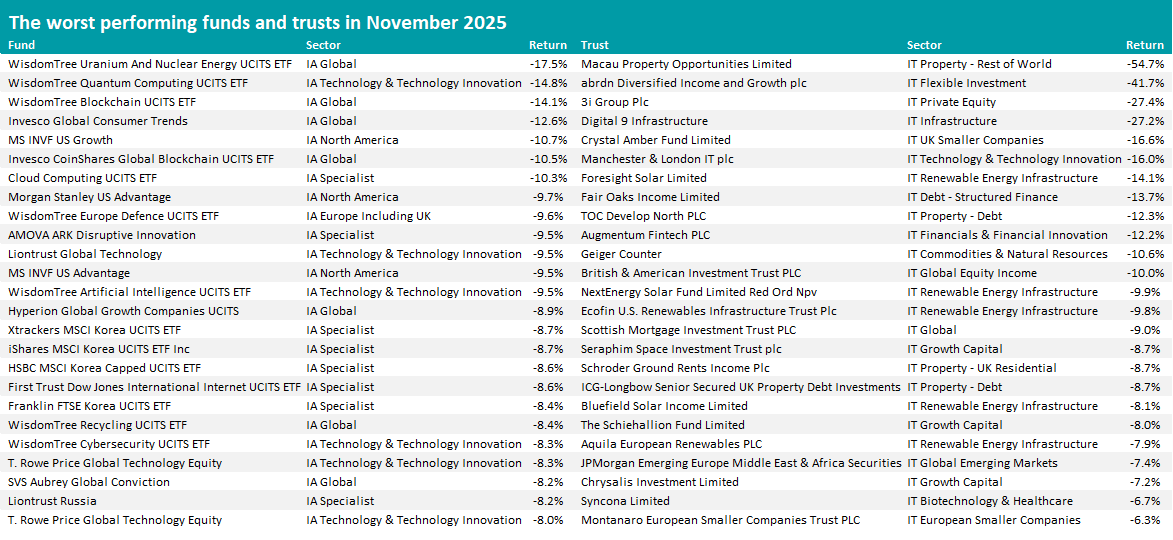

Source: FinXL

The bottom of the performance table is populated by funds linked to the tech boom, such as WisdomTree Quantum Computing UCITS ETF, Cloud Computing UCITS ETF, AMOVA ARK Disruptive Innovation, Liontrust Global Technology and WisdomTree Artificial Intelligence UCITS ETF.

As noted above, tech stocks sold off in November on concerns around valuations, the huge amount of investment going into the AI data centre buildout and circular financing deals from some of the major players in the space.

WisdomTree Uranium And Nuclear Energy UCITS ETF also fits into this theme, as its companies are tied into expectations of greater energy demand to power AI’s data centres.

The falls for WisdomTree Blockchain UCITS ETF and Invesco CoinShares Global Blockchain UCITS ETF reflect a plunge in the value of Bitcoin last month, as investors pulled risk off the table.