High yield bonds are full of risks for investors. A higher propensity for defaults, coupled with tight spreads and unappealing valuations, makes it a difficult sell at present.

And with an investible universe of nearly 1,500 issuers that managers need to distil down to a manageable portfolio, the potential to make mistakes is high.

Consistent outperformance in this sort of market can be a challenge, but Michael Scott, FE fundinfo Alpha Manager of the Man High Yield Opportunities fund, has made it happen.

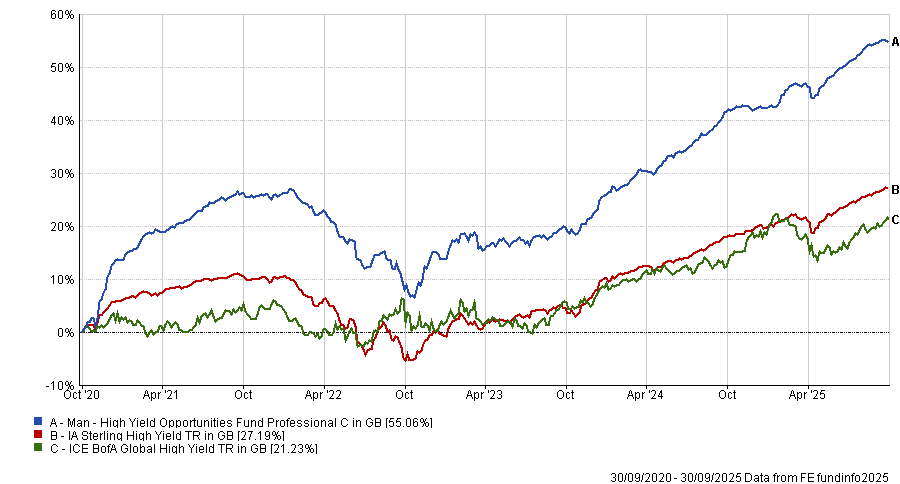

Since its inception in 2019, his fund has outperformed across multiple time periods. In the past five years, it has been the best performer in the IA Sterling High Yield Sector, with further top-quartile returns over the past one and three years.

Performance of fund vs sector and benchmark over past 5yrs

Source: FE Analytics. Return in sterling

It is the top fund in the peer group in four of the past six calendar years, only failing to beat the sector average once (in 2023).

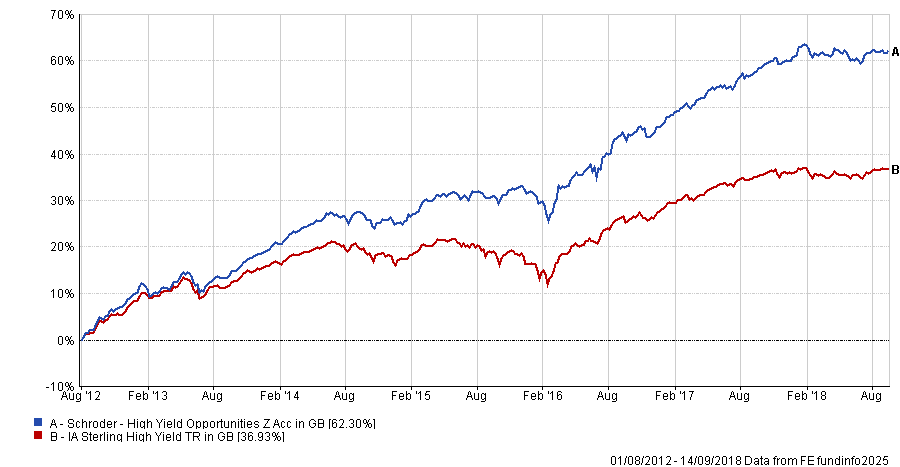

This is not the first time that Scott has proven his ability to navigate the choppy waters of the high yield market, however. Before joining Man Group, he led the Schroder High Yield Opportunities fund, which posted a best-in-class 62.3% total return under his tenure.

Performance of fund vs sector and benchmark during manager tenure

Source: FE Analytics. Manager tenure is measured from 1 Aug 2012 to 16 Sep 2018

Scott explained that part of his consistency is due to his willingness to be highly active.

“You need to have as much flexibility as possible if you want to manage the risks of high yield and optimise the return relative to the risks you're taking. That means being as active as possible,” he said.

At least once a year the portfolio is completely turned over, with new opportunities added while older issuers are removed. This is necessary because the opportunity set in the high yield market is constantly changing, meaning investors who try to hold the same thing for too long can get left behind, he said.

“The world changes every day and you need to stay abreast of it as much as you can if you want to make money,” he noted.

Many investors often misunderstand this and remain allocated to legacy opportunities rather than being more proactive, the Alpha Manager explained.

The biggest example of this is investors' tendency to buy the biggest names in the benchmark, unaware that these are riskier than they look.

Fixed income benchmarks are debt-weighted, meaning the most prominent issuers in the benchmark are the most indebted. The top 50 issuers represent more than 20% of the total benchmark, yet credit investors should avoid these names, he explained.

Trying to replicate the benchmark means that investors have ended up over exposed to areas such as US credit, which is “one of the most cyclical, levered and yet most expensive parts of the credit market”.

“It’s a huge luxury for us to have this approach, because I don’t have to buy a name because it’s a large part of the benchmark like someone else might,” he said.

The biggest opportunity set in high yield is in the 1,400 other issuers outside the top 100, which investors can only access by being more proactive, the Man Group manager explained.

Another factor in his long-term success is his emphasis on value. “If you want to make good money in this asset class, you have to come in with a value investor's mindset,” he said.

Throughout his career Scott has focused on companies where the enterprise value (EV) far outstripped the value of the bond on the market. By taking this approach, he argued, investors can make money even from businesses on the edge of default.

“In this asset class, getting paid back is not necessarily the only way to make money. You’d prefer it, of course, but you can make quite a lot from businesses that need some form of restructuring,” he continued.

For example, Scott said he has been interested in companies approaching the ‘maturity wall’ (the point at which a significant amount of corporate debt will reach maturity at the same time).

These are businesses that investors generally avoid touching, but managers can extract a lot of extra value from them as they will need to refinance, allowing investors to put a “lot of pressure on these companies to give us good terms and roll over that debt”.

In some cases, these companies in need of refinancing can be “very asset heavy”, which gives him the confidence that “even if the market closes tomorrow, those assets will still be there”. This makes the enterprise value more compelling than it may initially appear, he explained.

This has led to Scott finding opportunities in areas such as retail, real estate, telecoms and even health care, he explained.