The idea of building a diversified portfolio from scratch is likely to be overwhelming for beginner investors, who have thousands of funds to choose from – each with different strategies, risk levels and costs.

As such, fund of funds – vehicles which invest in a portfolio of other funds – could be a straightforward option.

The all-in-one vehicles offer diversification, with the added benefits of automatic rebalancing and a focus on risk-adjusted returns.

Trustnet asked fund pickers to name their top choices for beginners who want simplicity, diversification and long-term potential returns, without the hassle of building a portfolio themselves.

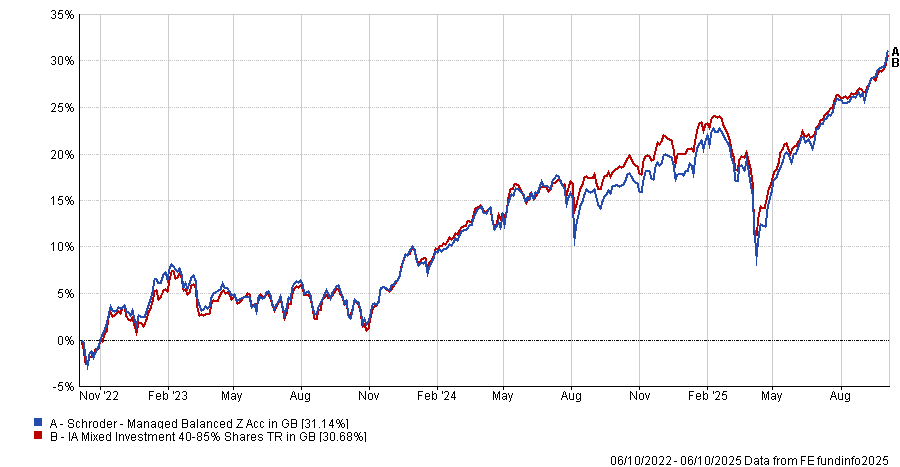

Kate Marshall, lead investment analyst at Hargreaves Lansdown, went with Schroder Managed Balanced. The £1.9bn vehicle mainly invests in other Schroders-managed funds, with Marshall noting the fund “could form the core of a broader portfolio aiming to deliver long-term growth”.

The fund of funds is currently managed by Remi Olu-Pitan and Nick Pearson and has an ongoing charges figure (OCF) of 0.93%.

“The managers aim to deliver performance that is better than, but does not stray too far from, the broader IA Mixed Investment 40-85% Shares sector,” she said, noting that “this is one of the reasons we believe it could provide a useful core to an investment portfolio”.

The fund has languished in the third quartile in the IA Mixed Investment 40-85% Shares sector over the long run – gaining 91.7% over a decade – but is in the first quartile over one year, gaining 12.5%.

Performance of the fund of funds vs sector over 3yrs

Source: FE Analytics

Around a third of the portfolio is invested in Schroder ISF Global Equity, Schroder ISF QEP Global Core and Schroder ISF US Large Cap. These all provide exposure to dominant US-based tech names, including Nvidia, Alphabet, Meta and Broadcom.

“The equities part of the fund is likely to be the most volatile but also provide the greatest potential for long-term growth,” said Marshall.

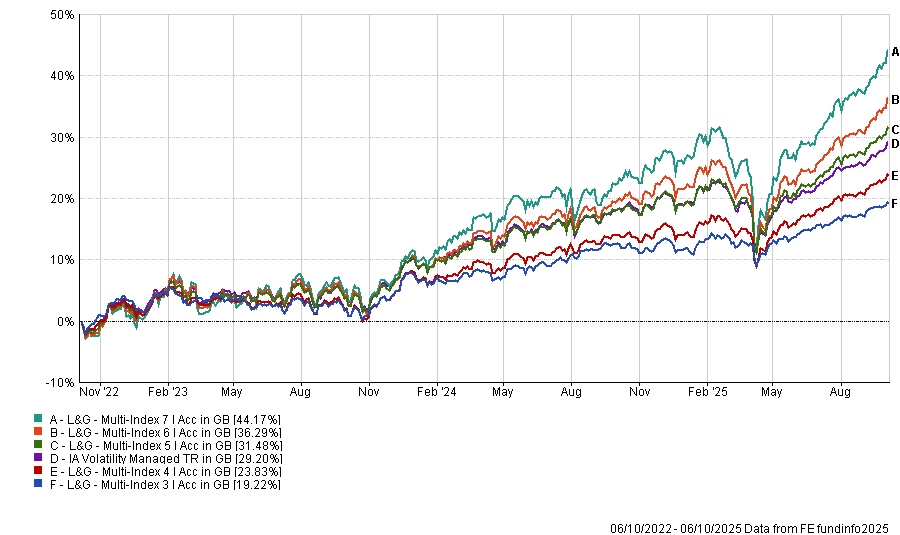

Meanwhile, Alex Farlow, associate director of multi-asset research at Titan Square Mile Investment Consulting and Research, pointed to the Legal & General Multi-Index range, which comprises five low-cost, actively managed portfolios.

He noted that lead manager Andrzej Pioch is experienced in managing risk-targeted and multi-asset products, with each of the five funds of funds mapped to a specific risk level.

The £334m L&G Multi-Index 3 is the least risky of the five, with a higher exposure to bond funds, investing 9% a piece in the L&G All Stocks Gilt Index Trust and L&G Global Inflation Linked Bond Index.

At the other end of the risk spectrum, L&G Multi-Index 7 has an almost 90% exposure to equities through funds such as L&G US Index Trust (20.5%), L&G UK Index Trust (12.5%) and L&G European Index Trust (11%).

“While we believe these strategies can be expected to achieve their stated objectives, and as such they hold a Titan Square Mile recommended rating, investors should remember that they predominantly invest in passive strategies, so their returns will be limited to those of the index they track,” said Farlow.

Performance of the range vs sector over 3yrs

Source: FE Analytics

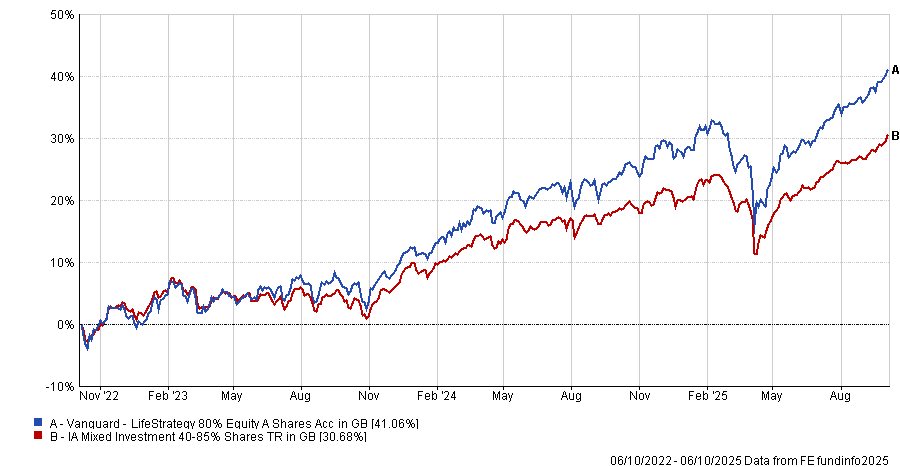

Dzmitry Lipski, head of funds research at interactive investor, said a good option for a beginner investor looking for a one-stop shop is the Vanguard LifeStrategy range.

Each fund is made up of Vanguard’s own passive funds, which keeps costs low. They are also automatically rebalanced daily to their target weights, rather than making tactical adjustments when volatility rises or falls.

“With this simple and unchanging approach to asset allocation, the strategy has delivered strong returns over time,” said Lipski.

The range was also selected by Rob Morgan, chief analyst at Charles Stanley, and Dan Coatsworth, investment analyst at AJ Bell.

Another benefit of the Vanguard LifeStrategy range is that investors are not heavily reliant on the technology sector to generate positive returns, said Coatsworth.

“While TMT [tech, media and telecoms] is the biggest sector weighting at 27.5%, financials, consumer products and industrials also do a lot of the heavy lifting and that diversification is important,” he said.

Both he and Morgan agreed that Vanguard LifeStrategy 80% Equity is the best option of the suite for most beginner investors.

“The primary benefit of the fund is exceptionally wide diversification covering major asset classes at a very low cost,” Morgan explained.

However, one criticism of the funds is that performance has been hampered by a “home bias” in recent years. “Although the share component of the funds is global, they are aimed at UK investors, so there is a bias towards domestic companies,” he said.

“It is about a quarter of the share component of each fund – considerably higher than the UK’s weight in major global share indices, which is around 4%.”

Although the top holding in LifeStrategy 80% Equity fund is Vanguard US Equity Index (at 19.5%), Vanguard FTSE U.K. All Share Index Trust (which tracks the entire UK market) is the joint second-largest position in the portfolio at 19.2%, alongside the Vanguard FTSE Developed World Ex-UK Equity Index.

In recent years, this high exposure to the UK has impeded performance as more US-centred funds have benefited from the rise in artificial intelligence.

However, Morgan said he “quite likes” the UK overweight, noting this offers improved diversification into a higher-yielding and more value-oriented market, as well as removing some currency risk.

“All in all, it is a good option for a simple and inexpensive ‘core’ in a portfolio around which other investments can be added to further diversify and personalise.”

Performance of the fund of funds vs sector over 3yrs

Source: FE Analytics

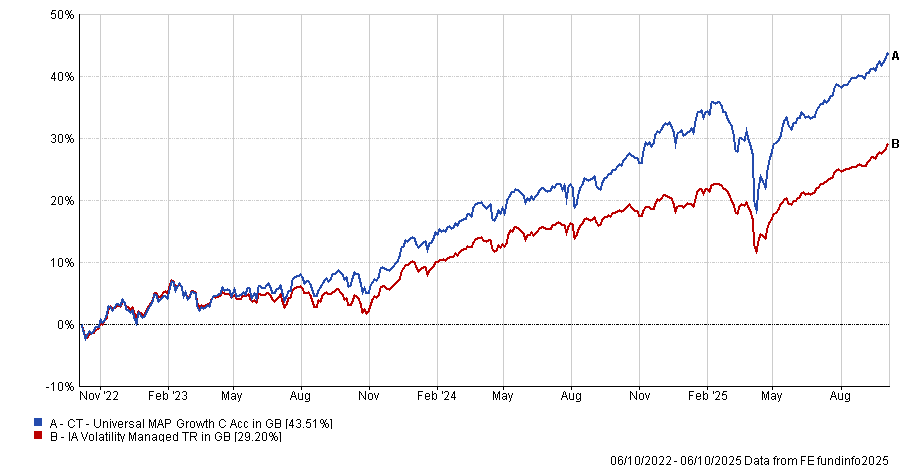

In contrast, Ben Yearsley, director at Fairview Investing, took a slightly different approach, noting that there are cheaper options out there than a fund of funds.

“The CT Universal MAP Growth fund is cheap as chips at 0.29% [OCF] yet it is largely actively managed and invested in equities, bonds and cash,” he said.

The wider range offers different risk ratings, with the growth-focused fund picked by Yearsley most suited to long-term and slightly higher risk investors.

The fund has gained 43.5% over three years, beating the IA Volatility Managed sector average of 29.2%.

Performance of the fund vs sector over 3yrs

Source: FE Analytics

We have also put together an article outlining the core holding the experts have suggested holding alongside these fund of funds.