Investors have been split on whether to take a more bullish or cautious stance on North American companies, but James Thomson, manager of the Rathbones Global Opportunities fund, has a clear view: “US exceptionalism will remain in place for the foreseeable future”.

On this conviction, he has raised the US weighting within his portfolio to almost 75%, an “all-time high” for his portfolio, while remaining unconvinced about the prospects of European companies, which instead have been in fashion among investors.

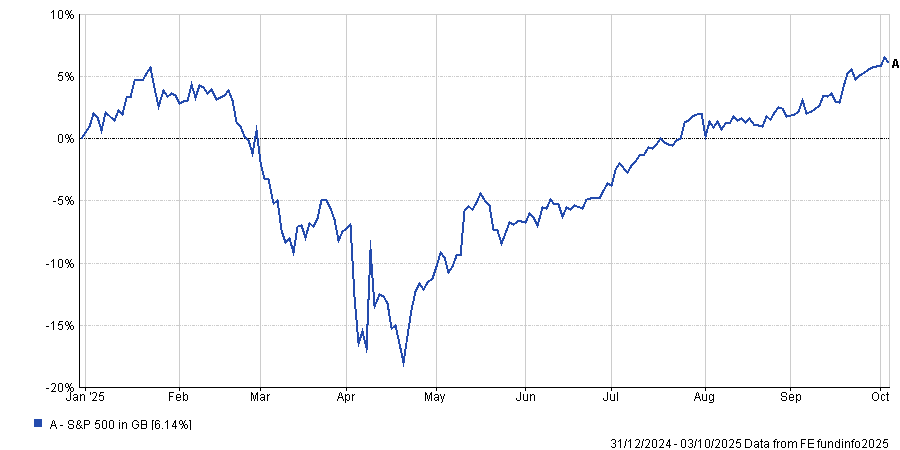

Performance of the market YTD

Source: FE Analytics

American companies have rallied strongly this year, with the S&P 500 up 6% in sterling terms – a recovery from its 18% on the announcement of ‘Liberation Day’ tariffs.

This is because they have many of the ingredients they need to adapt and thrive irrespective on who is in the White House, the FE fundinfo Alpha Manager said.

“Hallmarks of success” such as lower tax rates and higher research, development and venture-capital spending are all key features of the US economy, which creates a “useful foundation” for continued outperformance.

He added that the US is full of “mission-critical companies that have pricing power and limited effective alternatives”, for example Microsoft, which is embedded in most businesses and cannot be easily replaced, and Amazon, which some people use almost daily.

This gives them the ability to increase their prices without driving away too many customers because “there are simply no viable substitutes”.

These sorts of companies “don’t exist anywhere else in the world”, which “provides the backbone of the US exceptionalism story.”

But “mission-critical businesses” can be found in more than just mega-cap tech, for example the manager pointed to defensive businesses such as pest control and waste disposal companies, where he holds a few names.

The sticky and hot climate in North America means the country has “endemic pest problems” that companies need to solve, because it is not a responsibility of the government, the Rathbone manager explained.

As a result, they are always in demand and can perform well even in the face of a more “aggressive administration” and unpredictable market dislocations.

“When the US is booming, people don’t want to own US pest control businesses, so they reduce our upside during bull markets. But when sudden downturns or recessions come, that’s exactly the kind of company we want in the US,” Thomson said.

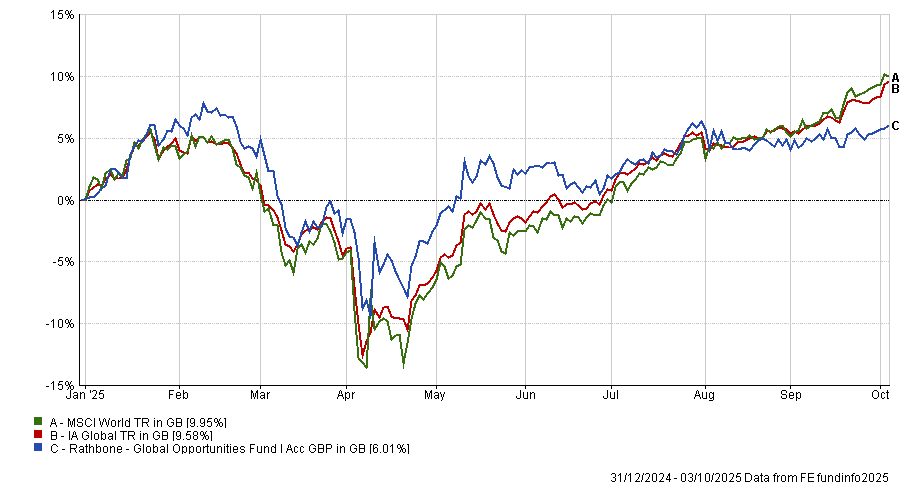

Indeed, while Thomson’s Rathbone Global Opportunities fund has fallen behind the average IA Global sector peer during the recent rally, it also slid less than the average competitor during the downturn this year.

Performance of the fund vs the sector and benchmark YTD

Source: FE Analytics

Thomson also took advantage of the US sell-off earlier this year to buy three new stocks, including online commerce platform Shopify.

Shopify has become “the enabler for small and medium-sized merchants who want to sell online,” the manager explained, and one of the most popular ways for small influencers in niche markets to promote products and encourage sales, leading to some steady recent gains. The stock has jumped more than 50% since it was added to the Rathbone portfolio.

The two other stocks he purchased were auto parts company O’Reilly (up more than 30%) and industrial company Parker Hannifin (up more than 21%).

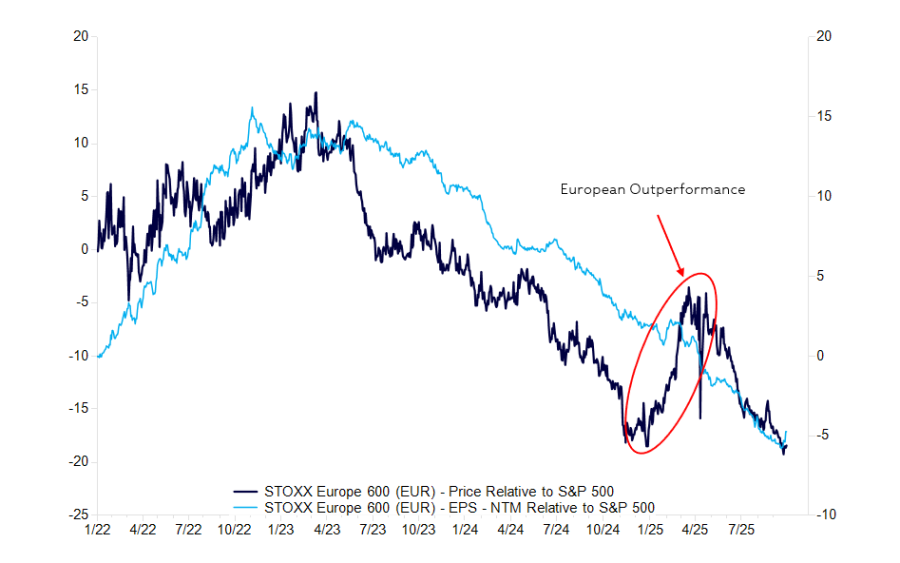

Given these premises, Thomson has not been swayed by European outperformance this year.

Europe is still “dominated by quite old economy businesses” such as industrial manufacturing companies with close ties to China. “They don’t have quite the same innovation you can find in US companies,” he said.

On top of this, structural reforms such as the €500bn stimulus package in Germany are “helpful, but not enough” to kickstart a sustained pivot out of the US, the Alpha Manager said.

This is because fundamentals have not improved sufficiently, he argued.

While European companies have outperformed their American counterparts this year, European earnings are still lower than those of US companies on a relative basis, he argued. As a result, he does not expect the current level of European outperformance to sustain itself over the long term.

US and European earnings over the past three years

Source: Rathbones Asset Management. Piper Sandler

“If you believe that share prices should follow fundamentals and growth, this should tell you that Europe is not providing enough for investors,” the Rathbone manager noted.

With no viable substitutes for the breadth and depth of US companies available anywhere else, large sovereign wealth funds and managers will continue to allocate tens of billions to the US, preventing a sustained rotation out of North American equities. “There are high hurdles to justify leaving the US,” he concluded.