St. James’s Place is going into the fourth quarter of 2025 with an underweight to US stocks and a preference of the UK, Europe and emerging markets, citing steady fundamentals and the need to remain adaptable in the face of a volatile macroeconomic landscape.

Justin Onuekwusi, chief investment officer at St. James’s Place (SJP), said: “As we enter the final quarter of the year, global markets remain shaped by persistent macroeconomic uncertainty, diverging central bank policies and ongoing geopolitical tensions.

"We continue to review the house view and asset allocation and have made no changes this quarter as current allocations continue to reflect our medium-term views. While global markets do appear expensive compared to history, this is largely driven by the US. Other regions look more reasonably valued and have been benefiting from positive momentum this year.”

Source: St James’s Place

Political uncertainty in the United States remains on SJP’s radar. The firm said the government shutdown is not expected to have a major economic impact if resolved quickly and markets have so far shown resilience.

But while US equities continue to dominate portfolios, the firm is maintaining an underweight position due to valuation concerns and concentration risks. “We are striking a deliberate balance – cautious on valuations, but mindful of the long-term importance of the US in global portfolios,” Onuekwusi said.

Despite the underweight call, the US remains the firm’s largest equity position. SJP noted that large-cap growth stocks have continued to lead, though broader earnings growth beyond the mega-cap tech sector is now emerging.

Valuations across global markets appear stretched, but the firm said this is mostly driven by the US. Other developed regions are seen as more reasonably priced and are benefiting from positive momentum heading into year-end.

SJP is therefore running overweights to European, UK, Japanese and emerging market equities.

In Europe, Russia’s ongoing military activity in Ukraine and alleged drone activity in EU states are contributing to elevated uncertainty, though the firm sees trade tensions easing compared to previous quarters.

"Market performance across continental Europe has also improved, with increased business optimism and a strengthening euro,” the chief investment officer said. “Resolution on trade tariffs and strong exports has also helped. However, there are still challenges ahead and our optimism is cautious.”

UK markets have shown signs of improvement. St. James’s Place pointed to balanced economic conditions, expectations of rate cuts and increasing corporate adoption of artificial intelligence as supportive factors.

“UK equities remain one of the most undervalued globally – second only to China – and continue to offer attractive shareholder yields. We see selective opportunities in UK small-cap, growth and value stocks,” Onuekwusi said.

Emerging markets are viewed more favourably, with equities showing cyclical improvement, particularly in China, where recovery is underway from a low base. The firm also holds a constructive view on smaller companies in developing regions.

St. James’s Place has growing confidence in international small-caps in general. “Global small-caps and particularly those in Japan are compelling from a valuation and earnings perspective,” said Onuekwusi.

Smaller companies, particularly outside the US, are showing stronger earnings potential and higher returns on capital than their large-cap counterparts, he said. The firm said international small-caps have notably outperformed US small-caps so far this year, especially those in Japan and Europe ex UK.

“International small-caps currently offer a return on earnings above historical averages and stronger earnings growth outlooks than their large-cap counterparts,” said Onuekwusi. “Given this, we believe there is a real opportunity for strong returns in the coming years.”

Within fixed income, the firm continues to favour corporate bonds, citing solid fundamentals and attractive yields. It also sees government bonds as fairly valued, although inflation and fiscal risks in the US and UK remain key concerns.

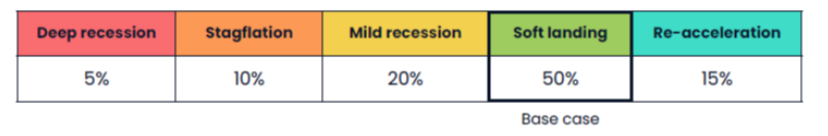

SJP’s economic views: 12 to 18 month outlook

Source: St James’s Place

St. James’s Place has held its recession probability at 35%, though chief economist Hetal Mehta said recent data suggests risks of a deeper downturn have moderated. The firm still expects a soft landing, where growth slows but avoids a formal recession.