Investors who only buy infrastructure for the income potential are “frustrating” Richard Sem, manager of Pantheon Infrastructure, who said people have an “incessant” need to conflate the two.

Instead, he wants to be judged by whether or not his trust (and its underlying assets) are delivering growth for investors.

Infrastructure has long been viewed as an income play, with Hawksmoor’s Ben Conway recently noting that the asset class could be a useful alternative to bonds in the coming years.

Typically, infrastructure assets are long-term projects that produce a lot of repeatable cash, which they in turn pass on to shareholders. This makes them a strong option for income enthusiasts.

But Sem said he is “more interested in companies that reinvest it [excess cash] for growth”, rather than returning it all to shareholders.

This makes his trust unusual in the sector. While it pays a yield, the 4% it offers is below the average in the IT Infrastructure peer group.

He argued that by focusing on companies that grow, it widens the options available in geographies and sub-sectors that others may avoid.

As a result, this gives him more scope and lowers the chances that his trust is impacted by challenges that can hit the sector, such as policy changes and government intervention, he said.

Sem prefers companies with lower debt and therefore more “fiscal headroom”, noting that some assets demand “massive amounts of investment” to grow successfully and sustainably, which can be a deterrent to returns.

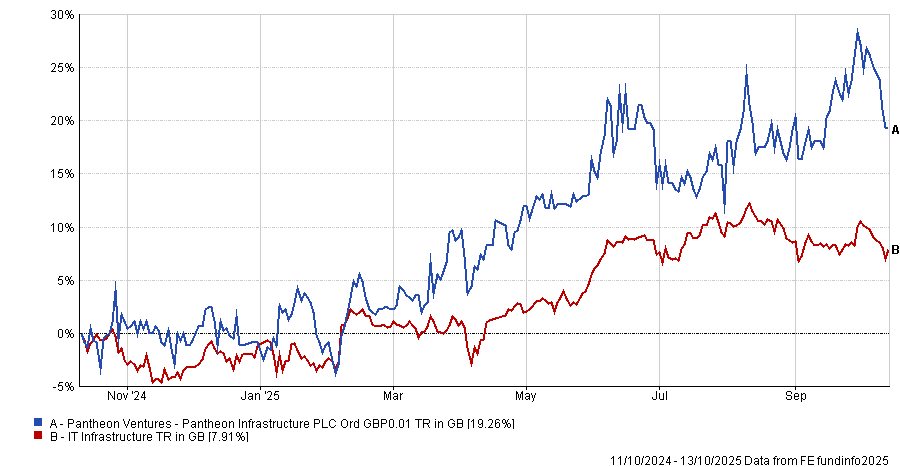

This approach has paid off for Pantheon Infrastructure. Over the past year, it is up 19.3%, the best performance in the IT infrastructure sector. Since its launch four years ago it has nearly tripled investors' money.

Performance of trust vs sector over past 12 months

Source: FE Analytics

Jean Hugues de Lamaze, manager of the Ecofin Global Utilities & Infrastructure Trust, also takes a more growth-focused approach and noted that, although the sector might not have the “growth profile of tech”, it is still full of “high-growth stocks”.

He pointed to Europe as an interesting space for infrastructure investors, finding assets with solid fundamentals in countries such as Spain and Italy. Assets here also tend to have returns that are very resistant to changes in inflation, he explained, which enables them to perform across a variety of market conditions.

“We’re trying to find the highest growth profiles in the space, while also focusing on those assets with the best inflation pass-throughs,” he said.

High-growth companies can grow their earnings per share by an average of 5%-7% per year, he explained, which can lead to a double-digit total returns depending on the size of the dividend.

Additionally, infrastructure has plenty of room left to run, as interest rates look set to “plateau or even reduce” from here. Higher rates from 2021 onwards have been a major headwind to the sector, he explained, which should reverse and pique the interest of investors who recognise the strong fundamentals of infrastructure stocks and want to buy now they are on “historic low” valuations.

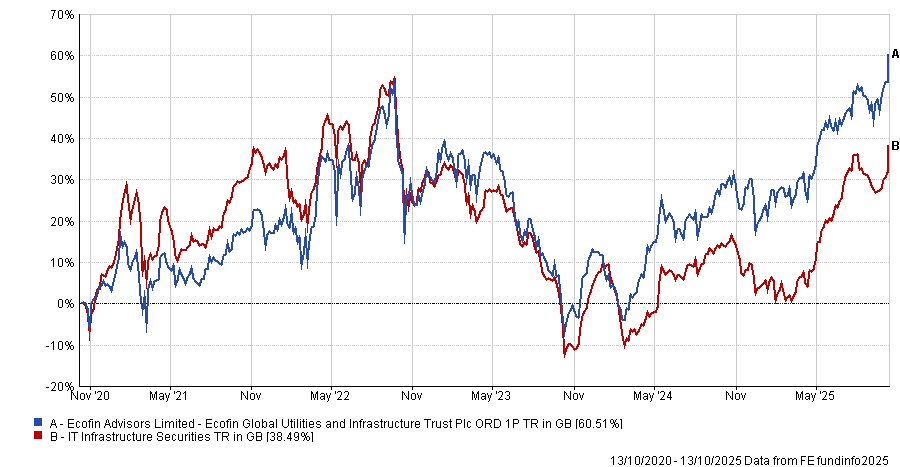

This growth-focused approach has led to a 60.5% total return for the portfolio over the past five years.

Performance of trust vs sector over past 5yrs

Source: FE Analytics

However, for some experts, income remains the key tenet of infrastructure. This is the case for Philip Kent, manager of the 9.5% yielding GCP Infrastructure Investments trust.

Many investors are underestimating and “under-pricing” the value of an enhanced income stream, he said.

While he thinks there will eventually be a catalyst for prices to rise, even without one, a strong yield means investors “can get paid to wait”, all while accessing the asset class at low valuations. The average IT Infrastructure trust currently sits on a share price discount to net asset value (NAV) of 17%.

“If you bought the portfolio at the share price and nothing happened, you’d always get that 10% yield. I find that hard to reconcile with the discount infrastructure trusts are trading at,” Kent explained.

If inflation proves stickier, GCP and other income strategies in the sectors are a solid inflation hedge that investors should take more advantage of, he argued.

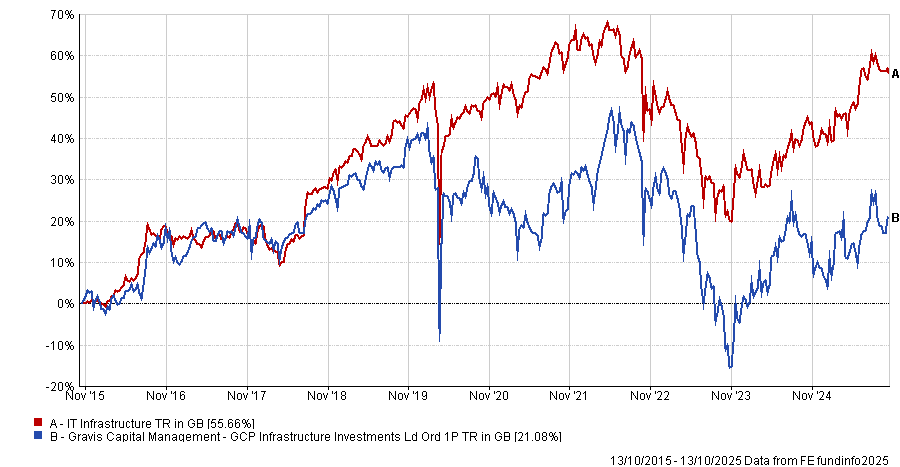

GCP has returned 21.1% over the past decade, around 34 percentage points behind the sector average.

Performance of trust vs sector over the past 10yrs

Source: FE Analytics