Income is back in fashion, as lowering interest rates and higher volatility around the world are pushing investors towards larger and more established companies that pay a dividend.

Fears of companies becoming overvalued and concentration in growth-focused areas of the market have also made investors more interested in other, not-so-crowded trades, with value investing and its key byproduct, income generation, being an obvious place to look.

Equity income Investment Association (IA) sectors have pushed slightly ahead of their broader equity counterparts this year, so below, experts highlight their favourite income funds in the UK and globally.

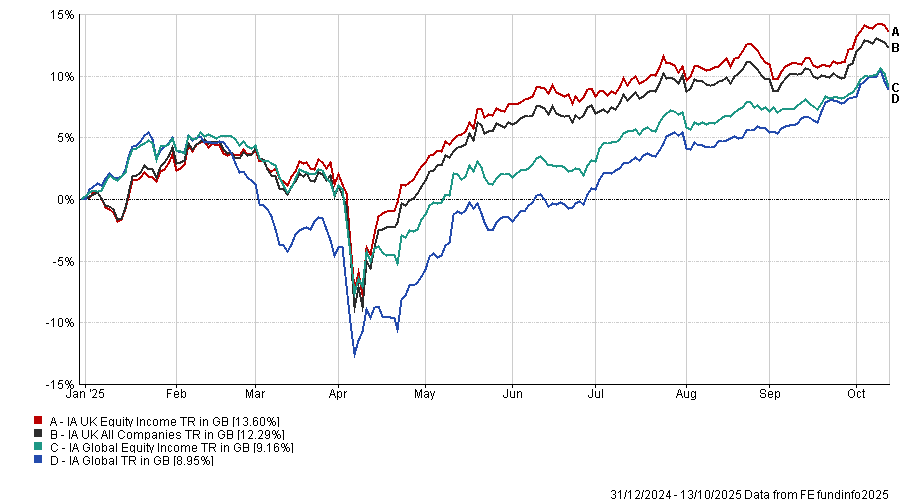

Performance of sectors over the year to date

Source: FE Analytics

UK equity income

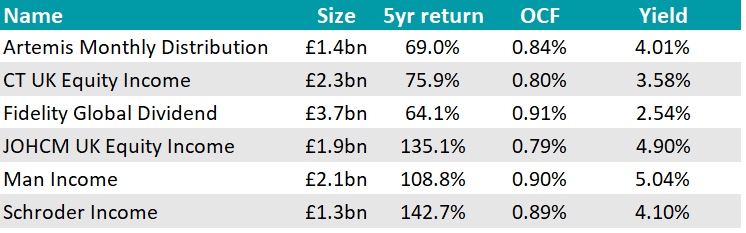

We begin with the UK, where FundCalibre managing director Darius McDermott chose CT UK Equity Income.

“With interest rates no longer anchored at zero, we’re likely to see periods where value outperforms, just as it has done in previous rate-tightening cycles,” he said. “A key by-product of value investing is income generation and CT UK Equity Income is a great example of that”.

Managed by the “highly experienced” Jeremy Smith, the fund takes a contrarian, unconstrained approach, seeking out overlooked UK companies with resilient balance sheets and the capacity to deliver sustainable dividend growth.

It focuses on long-term capital preservation and real income generation, underpinned by bottom-up research.

“With the UK equity market still trading at a discount to global peers, CT UK Equity Income is well positioned to capitalise on the re-rating potential of high-quality, undervalued businesses,” McDermott continued.

“For income-seeking investors, it’s a compelling value option in today’s market.”

Other options exist however, with Dzmitry Lipski, head of funds research at interactive investor picking Man Income. Managed by Henry Dixon and co-manager Jack Barrat, it seeks superior capital returns to the FTSE All-Share along with a higher level of yield, which is currently 5.0% compared with about 3.5% for its benchmark.

“The fund has an excellent record of delivering on its objectives,” noted Lipski.

In addition to strong recent performance, over the mid and long-term the fund has outpaced peers and benchmark convincingly. Over both five and 10 years, for example, the fund has outperformed the benchmark and has almost doubled the average return of its equity income peer group over the decade.

Meanwhile, Dennehy Wealth discretionary investment manager Joe Richardson selected two further alternatives: Schroder Income and JOHCM UK Equity Income.

The former he described as “the grandaddy of UK value income funds”, highlighting its “solid, consistent” strategy with “a great record of growing payouts” year after year.

JOHCM UK Equity Income was praised for its strong yield, its value tilt and its “very strong” growth in payouts. He also appreciated its allocation to mid- and small-caps to give investor more breadth than the usual big-dividend names.

“Being UK income funds, both fit with the broader value story: the UK market in general looks incredibly cheap, not just versus history, but also compared to other regions,” said Richardson.

“However, if we get a widespread recession, dividends can be cut. That’s why we always stress the importance of a defensive layer, ideally with a few years of income set aside, so you don’t have to sell at the wrong time or rely on payouts that may be under pressure”.

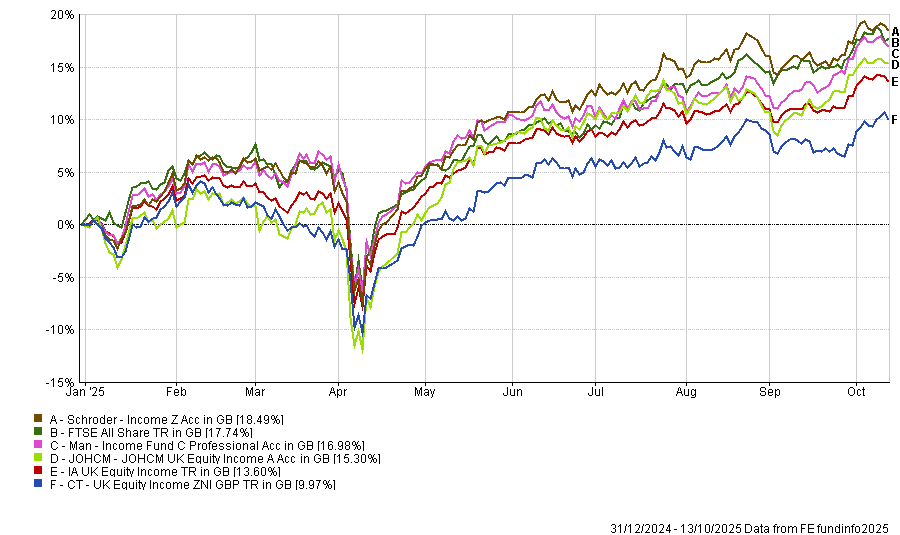

Performance of funds against index and sector over the year to date

Source: FE Analytics

Global equity income

For global income seekers, Lipski opted for Fidelity Global Dividend. Since its inception in 2012, the fund has been led by Dan Roberts, who brings more than 20 years of experience to the table and is supported by the research team and resources at Fidelity.

It aims to achieve a mix of growth and income with low volatility versus the MSCI All Country World index. The yield aim is 25% more than the income produced by the companies included in the index.

“From an income perspective, the fund's yield fell as low as 2.2% in the aftermath of the Covid pandemic, but has since been rising steadily to a level of 2.5% today,” said Lipski.

Finally, the head of fund research pointed out that not all income-paying funds are necessarily found in equity income sectors.

Artemis Monthly Distribution, for example, combines bonds and global equities, with the objective of providing a regular monthly income along with capital growth over a five-year period.

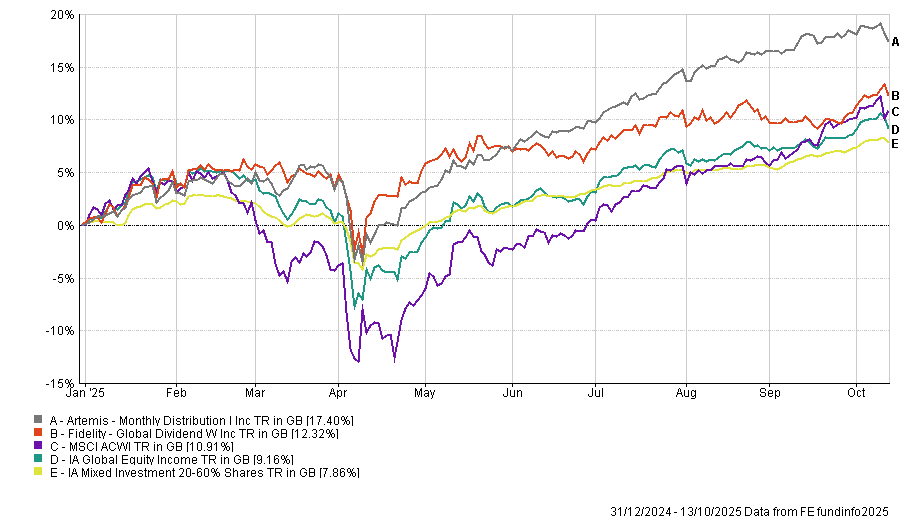

Performance of funds against index and sectors over the year to date

Source: FE Analytics

Managed by four experienced specialists, Jacob de Tusch-Lec and James Davidson are responsible for managing the equity sleeve of the portfolio with Jack Holmes and David Ennett in charge of the fixed-income allocations.

“The strategy has a strong track record, ranking in the top quartile of the IA Mixed Investment 20-60% Shares peer group since inception,” Lipski noted.

“Income has also been consistent over time, with a yield of at least 4% since inception to 2020, where it understandably dropped but has since re-established at pre-2020 levels, currently 4.0%.”

Source: FE Analytics