Renewable energy has pulled ahead of oil in 2025 for the first time in four years, reclaiming investor attention.

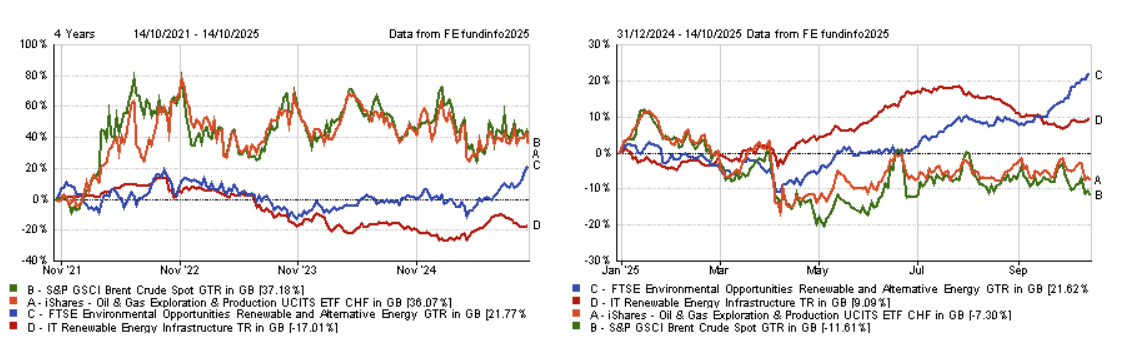

The IT Renewable Energy Infrastructure and the FTSE Environmental Opportunities Renewable and Alternative Energy index, for example, surpassed Brent Crude and oil and gas investments this year, closing a gap that at times was wider than 50 basis points, as the charts below show.

Performance of indices and sectors over 4yrs and YTD

Source: FE Analytics

Sentiment has therefore been picking up in the area, underpinned by artificial intelligence (AI) energy needs, global electrification demand and the re-shoring trend, all of which have been among the reasons why Mark Hume, co-manager of the $200m BlackRock Energy and Resources Income Trust (BERI), has been tilting the trust towards renewables.

The portfolio is a mix of mining, ‘conventional’ energy like oil and gas and energy transition, with a neutral allocation of 40%, 30% and 30%, respectively; as of May 2025, however, exposure to the energy transition trend had been increased to 33.5%, conventional energy dipped to 29.5% and the remaining 37.1% remained in mining.

A small shift, but one that reflects the direction of the market and that Hume was able to make thanks to the flexibility of his investment process – crucial for investing in the area, he argued.

“There is a desire to decarbonise, electrify and completely replumb the world’s energy and power systems, but the necessary changes are going to take years and so we need to be very flexible in a constantly changing landscape,” he said.

“In the context of the trust, $200m is not going to change the direction of travel of the global energy transition, which will require trillions of dollars and different types of energy over the next 30 years. It is important that we can change the sector lens and stocks we pick accordingly.”

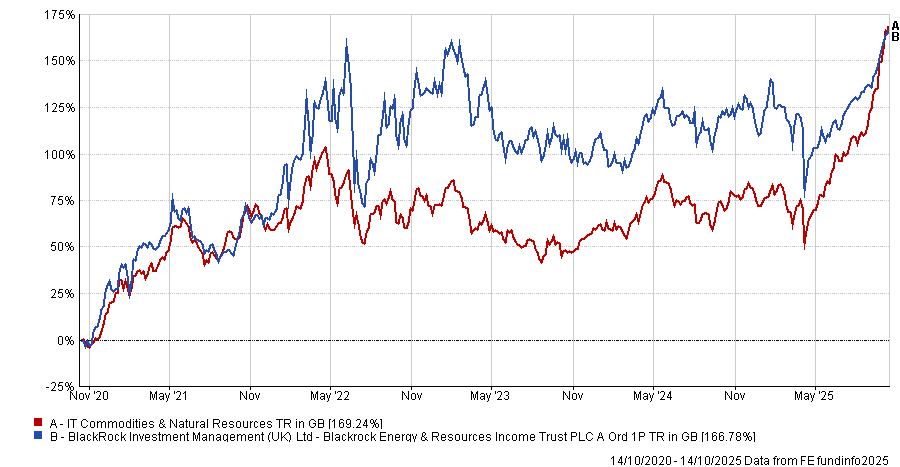

Performance of the fund vs sector over 5yrs

Source: FE Analytics

BERI is not constrained by exclusionary ESG-related screens whereby it can only own certain types of company or try to solve for a specific carbon-emissions target within the portfolio.

While keeping an eye on valuations, Hume noted that “there are plenty of renewables companies that are not currently generating free cashflow – if you tried to measure that on a fresh cash or yield basis, it would be negative. But, as we look years ahead, we also look beyond current multiples”.

Therefore, although renewables are “massively de-rated”, Hume expects “the pendulum to swing back and there will be better returns available”.

However, the trust has the flexibility to swing back to a heavier weighting to fossil fuels should this be the better option for investors in the trust, he maintained.

In addition, while energy pragmatism remains an important component of managing the investment trust, Hume said that “energy fragmentation is not being talked about enough”.

“Policymakers need to tie their energy policies with their industrial policies, otherwise they are going to struggle,” he said, pointing to Europe as an example.

“On the one hand, [the bloc] has understandably looked to [detach from] Russia [since 2022], which artificially increased the cost of energy into Europe. On the other, Europe is trying to decarbonise faster than any other nation state or continent and has therefore dropped a lot of the traditional supply sources. Again, this has pushed up the cost of energy.”

The higher that cost, the less competitive European energy companies can be from an industrial perspective, he said, although he noted they are seeing “pockets of improvement” across the region.

Other trends the trust is exposed to

Hume cited growing opportunities in meeting the energy demand of data centres which are needed to power AI.

The trust does not invest in technology companies directly but is increasingly exploring opportunities in conventional energy and energy-transition companies which are deemed essential to powering these data centres.

He pointed to Japan’s well-positioned semiconductor industry and electrical equipment manufacturers, the US and Germany’s decision to back nuclear – and the subsequent demand for uranium – as well as the use of gas-fired power alongside renewables.

This leads on to a higher-level issue, and opportunity, which is grid capacity.

“It is easy, theoretically, to build a power plant but you also need to connect it back to the grid and grids have not been updated in a long time,” said Hume.

“Look at the blackouts that happened in Spain. This has nearly happened in the UK several times in the past year because the grid is struggling to cope with the extra demand.”

The trust has invested 1.3% in the UK’s National Grid as of May 2025.

Copper will also be a crucial material when updating grids around the world.

Hume said the trust is “positively disposed” to the industrial metal.

“It takes years to bring a new copper mine online, yet we need copper now,” he said. “When you think about the tightness of the value chain, it is clear to see why we have seen some copper consolidation coming through in the copper market. Assets are likely to become more scarce and more valuable over time.”

The trust also targets aluminium, with Hume explaining that aluminium prices tend to track copper prices as the former can serve as a substitute for use in high voltage cables, “so it is good to have a spread between the two”.

As the energy evolution unfolds, Hume believes it is not about predicting the future – whether fossil fuels or clean energy will win – but being ready to move with it.