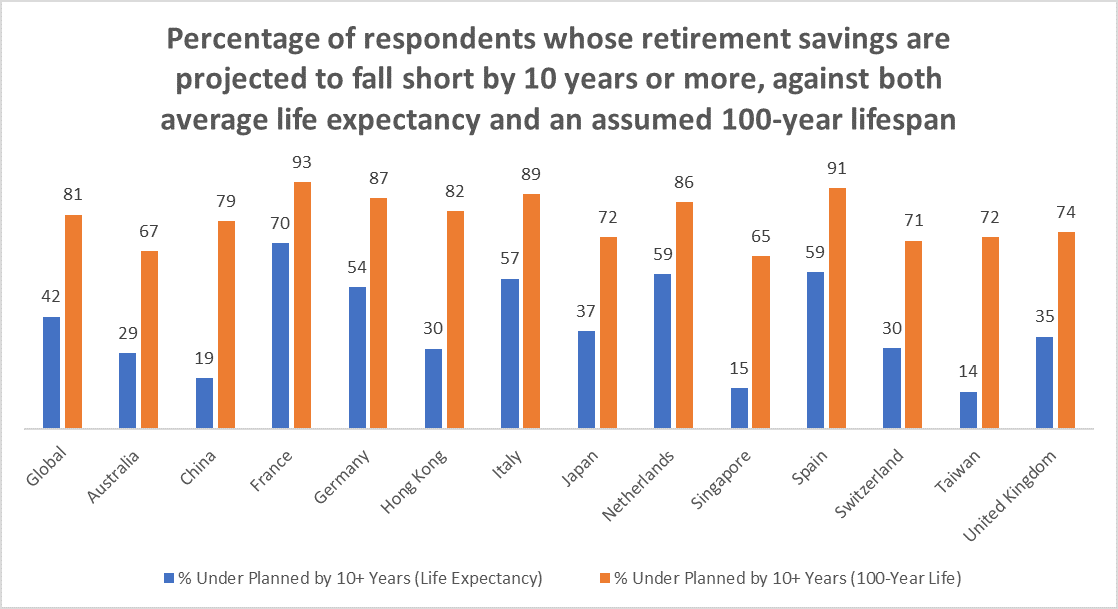

Four in 10 people globally are at least a decade short of their retirement goals, according to data from Fidelity International, with 35% of Britons chronically underestimating how far their pensions will stretch.

Most people plan their retirement pot around the average life expectancy, accounting 15 to 20 years in retirement, taking them to between 80 and 85 years old if they retire at 65.

However, many may need an income for much longer, particularly as life expectancies continue to increase.

“For married couples, the chances that at least one will live beyond the average life expectancy are even higher due to the added potential emotional, social and financial support that also can manifest in better physical health,” Fidelity International researchers found.

Average life expectancy is also on the rise, estimated to increase by 4.9 years in males and 4.2 years in females between 2022 and 2050, potentially widening the retirement savings gap further.

Additionally, by 2050, 3.67 million people are expected to reach the age of 100, an eightfold increase from about 451,000 in 2015, according to Pew Research Center, meaning many will live far beyond national averages.

When measured against a potential 100-year lifespan, the percentage of people who were underprepared for retirement by 10 years or more doubled to almost 80% of respondents. In the UK, seven in 10 (74%) are unprepared, as the below chart shows.

The research was conducted by surveying almost 12,000 people over the age of 50 who were either pre-retirement or had finished work.

Source: Fidelity International

Stuart Warner, global head of platform solutions at Fidelity International, said: “People are living longer than ever, but too many are preparing for retirements experienced by their parents and grandparents.

“This mismatch between life expectancy and savings horizons risks leaving many underprepared. With the right planning, longer lives can be a positive reality, but it requires a new mindset and earlier action.”

The single most powerful determinant of retirement wealth is time, specifically starting early and allowing cash to compound. The longer someone saves and the more they put away, the greater their options in retirement.

“Early contributions, even modest ones, create a foundation that grows exponentially, while delayed savings demand ever higher rates of return to meet a specific goal,” the report said.

This is especially important as people are worrying more about whether they will be able to rely on state support, with the stagnation or decline of public pension benefits (such as in the UK where the state pension triple-lock is under threat and tax thresholds remain stagnant), meaning more costs will have to be paid from private pensions.

“Globally, only 28% of people feel assured that their government will provide adequately for them in later life. In the UK, 60% are not confident,” the report found.

Katie Roberts, global head of client solutions at Fidelity, said there are two options to mitigate longevity risk without having to work for longer.

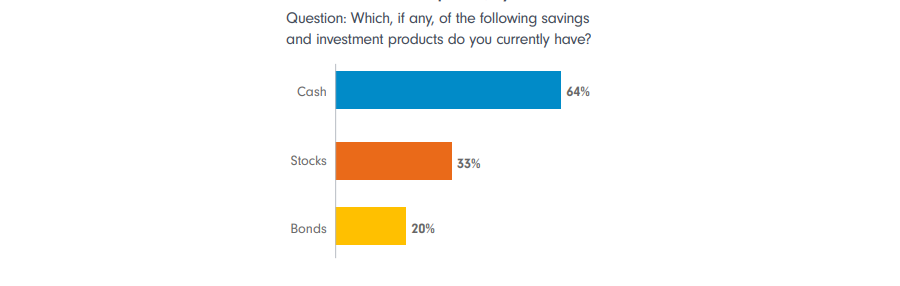

The first is to save more, while the second is to invest to optimise retirement assets. However, while respondents expected an annualised investment return of 4.9%, nearly two-thirds said they held their retirement pot in cash, with just a third of people invested in equities. A fifth had some exposure to bonds.

Source: Fidelity International

For those in the accumulation phase of their pension, she said a diversified portfolio that includes growth assets, such as stocks, property and higher-yielding bonds, is crucial.

People already drawing on their pension must contend with a different set of risks that are “not as well known”, such as making withdrawals during market downturns, which she described as “devastating” to pot sizes.

“Withdrawals do not need to be a fixed amount throughout retirement. Spending typically peaks early as travel and leisure dominate and may decline later in life,” said Roberts.

“The glide path to retirement cannot be based only on age. It must be linked to factors such as spending needs, health risks and family responsibilities. If paying off a mortgage is a priority, then retirement savings should include assets that can be liquidated flexibly. If legacy is a concern, then savings should include illiquid, longer-term assets that deliver capital growth.”

However, financial stability is only one portion of the equation when it comes to retirement, the report found, with physical health, emotional wellbeing and social connectivity all “vital elements” to enjoying later years.

Yet finances are a large part of the puzzle. As Warner noted: “When finances are secure, people can invest in their health, maintain social connections and approach retirement with confidence. When they’re not, the entire structure is weakened.”