Artificial intelligence (AI) may be the defining technology of this decade but Brunner investment trust manager Julian Bishop is worried about how much of the enthusiasm is justified and how much is only fuelling a hype train.

The question is particularly pressing in the US, where the tech giants are committing stellar sums to AI, hoping for a return on investment at some point in the future. But with US indices increasingly dominated by these companies, the wider market’s fortunes now hinge on their ability – and AI’s ability – to deliver on the promise.

“For US stock markets to continue to flourish at a headline level AI has to live up to the hype,” Bishop said.

This echoed Harvard economist Jason Furman’s post on X, where he calculated that without data centres the annual rate of GDP growth in the US for the first half of 2025 would have been 0.1% instead of its actual 4%.

The scale of the phenomenon particularly worries Bishop, with global spending on AI infrastructure expected to range between $450bn and $500bn a year, reaching $2trn to $3trn of total invested capital by the end of the decade.

“That is an extraordinary amount of money to be spending basically speculatively on a new technology where the use cases so far have proven to be reasonably limited,” the manager said, with such a level of investment requiring “massive profits” to justify it.

“If you aim at a 10% return on invested capital, that requires $300bn in profits; 20% requires $600bn,” Bishop continued. “The architect of all this is OpenAI and its revenue at the moment are about $13bn. Even allowing for rapid growth, that’s not even close.”

Microsoft reports this week, with about 40% of its quarterly growth year on year expected to come from its cloud computing business and be driven by OpenAI’s video generation tool Sora. Bishop, who invests in Microsoft, failed to see the appeal, describing it as “just very computing-intensive novelty nonsense”.

Yet the true speculative pockets, where valuations become completely disconnected from reality, are elsewhere, according to the manager.

“Tesla is a company whose value has just no foundation in reality,” he said. “Sales are going down, it makes virtually no money and yet it’s got a market cap of $1.5trn.”

Despite the warnings, the Brunner manager isn’t completely disenchanted by the sector. True AI pessimists would point at the unrestrained spending and recognise some similarities with the past technological bust of the early 2000s, but Bishop belongs to the cohort of fund managers who think the dynamics are very different this time around.

Crucially, as James Ashworth, senior portfolio manager of the trust, noted, the spending isn’t coming from loss-making companies trading at preposterous valuations on the stock market.

Instead, much of the current AI race is being funded by the big US technology platforms with real cashflows such as Google, Meta, Microsoft and Amazon – none of which need to borrow to spend.

“It may be a misallocation of capital and it may destroy value, but it's not being funded by debt,” Ashworth said.

Another positive note is that the speculative excesses are not in listed equities, with “a lot of the frothiness appearing to be in private markets”.

OpenAI is a good example of that, as the reported value has gone from $100bn to $500bn in the last year or so, the manager noted.

“These companies have no public shareholders, so that means that, to a degree, we won't really see when value is declining in the same way that we would with a public stock.”

While wary of risks, Bishop still sees opportunities within the AI supply chain and invests in Taiwan Semiconductors, the foundry that manufactures virtually every chip for Nvidia, AMD and Broadcom.

“Taiwan Semiconductors is a sort of agnostic play on whoever manufactures AI chips,” he said.

The team’s broader positioning reflects the same balance between innovation and valuation discipline that defines the trust. “We’re slightly underweight the US versus our benchmark,” Bishop said. “Whenever you look at globally comparable businesses, the US tends to be a fair amount more expensive.”

Beyond Taiwan Semiconductors, Brunner’s largest holdings include Microsoft, Visa, InterContinental Hotels Group, Auto Trader, Shell and GSK in the UK. It also holds DNB in Norway – “generally regarded as one of the safest banks in the world” – and Bank of Ireland. The portfolio spans developed markets across Australia, Japan, Korea, the US and Europe, reflecting what Bishop called “a natural source of diversification”.

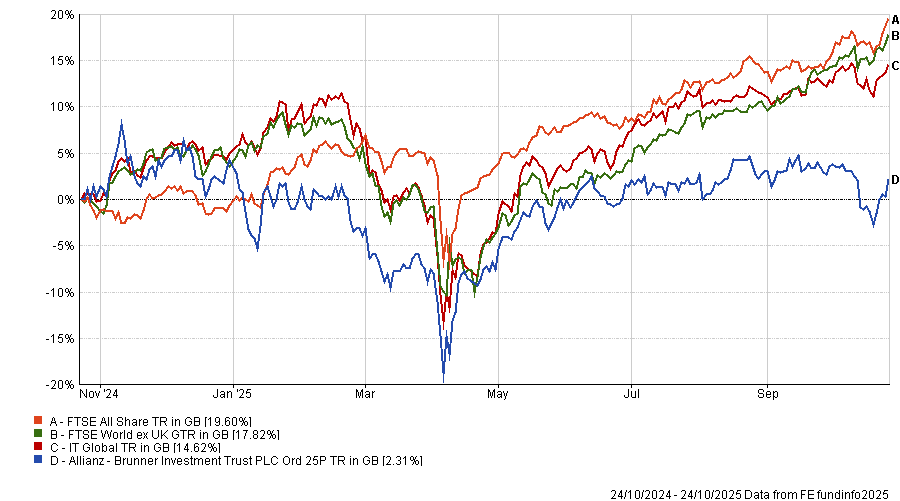

In the past 12 months, the trust struggled to keep up with its competitors, as the chart below shows, but performance is better over the longer term, with Brunner topping the IT Global sector over the past three and five years.

Performance of fund against index and sector over 1yr

Source: FE Analytics