Sat here in London, a stone’s throw from both 11 Downing Street and the Houses of Parliament, we await the chancellor’s upcoming Budget with the same feeling one might have before a trip to the dentist – we know it will be a painful and expensive experience.

Sadly, this feeling is all too familiar and has come round again all too quickly. It is unfortunately ‘that’ time again.

As the chancellor struggles to find ways to keep to her self-imposed fiscal rules without cutting spending significantly, consumers and corporates alike anxiously wait to hear how they will be asked to pay for both current spending and the rising cost of funding our previous spending.

We all know that the government’s balance sheet is not in a great place, and yields on 10-year UK government debt are now around 4.4%. Five years ago, they were around 0.4%.

Fortunately, we don’t invest in the UK government’s balance sheet. Not directly anyway.

The picture for consumers and corporates is very different and much healthier – despite a tax burden that is forecast to hit an 80-year high by the time of the next general election.

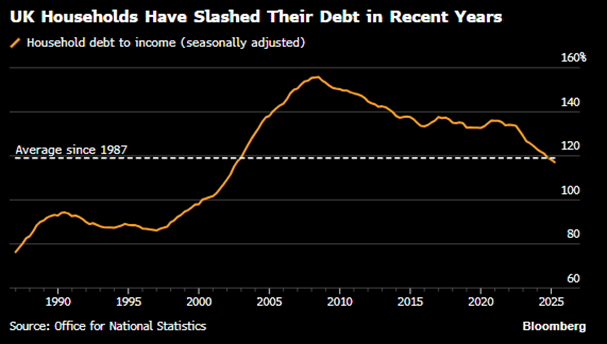

UK households have spent years strengthening their balance sheets, with debt relative to income falling both consistently and materially.

A large part of this improvement has come in the past few years as the inflation that was inspired by government responses to Covid has lifted nominal wages and led to a rapid rise in interest rates that have discouraged borrowing. Unlike the government, the UK consumer is not addicted to debt-funded spending.

Source: Tyndall Investment Management

UK corporate balance sheets have been in good shape for a relatively long period now. The 2008 banking crisis lives long in the memory with a subsequent list of crises that has included Brexit, Covid, tariff wars and actual wars, to serve as a reminder of the importance of prudent financial planning.

The net debt to earnings before interest, taxation, depreciation and amortisation (EBITDA) ratio of the UK stock market is currently around 1.4x, which is lower than most European stock markets.

While it is higher than the US, they have a small number of very large companies that have amassed cash piles that even our government would struggle to spend quickly.

Corporate profits can be volatile and the denominator can drop significantly in times of crisis, but it is unlikely that current profit forecasts have reached the top of the cycle yet after years of somewhat sluggish profit growth.

It is the weak government balance sheet that generates the headlines and creates such high levels of anxiety, but that is not the balance sheet we are investing in.

We are investing in corporates with strong balance sheets and businesses exposed to consumer spending, which is backed by strong household balance sheets.

Where we do have exposure to government spending, it is in areas such as construction, where spending levels are currently low due to, among other things, an overly burdensome regulatory regime, which could be improved as a relatively pain-free way to (try and) boost growth and help meet those fiscal rules.

The issue for consumers and corporates is that they don’t have the confidence to use these balance sheets because they fear what will happen in the upcoming Budget, the one after that and so on.

Consumer confidence has remained low despite the improving position of their finances. The long-running GfK consumer confidence survey shows that consumers feel more confident about their future finances and the climate for making major purchases than on average over the past 30 years and yet they are still choosing to save their money.

Savings rates are at or near long-run highs as they remain concerned about the economic situation – not entirely without reason. Likewise, corporates in the UK are hardly splashing the cash in a positive, pro-growth way.

Corporate cash generation is largely being used to pay dividends and, increasingly, buy back shares as opposed to making large acquisitions or significantly expanding capital expenditure.

To the best of our knowledge, no UK corporate has yet announced plans to spend hundreds of billions of dollars to build data centres in rural Texas – maybe that is where we are going wrong.

Government finances are important and they do affect the spending patterns of consumers and corporates, but they are only one factor in the wider investing environment.

The anxiety over the national balance sheet is one of the key reasons why UK equities have been shunned and, as a result, valuations are outright cheap, both in relation to their own history and in comparison with other global equity markets.

And in the more domestically focused areas of the market, such as mid-caps, the valuation is even more attractive. The forward dividend yield of 4.3% on the FTSE 250, ex investment trust index, is much higher than most global benchmarks, whilst typically being backed by stronger balance sheets.

It is also higher than that of the more internationally focused FTSE 100, which is historically very unusual. The economic environment in the UK might not be the best in the world, but it is certainly not the worst and it doesn’t need to be the best to generate healthy equity returns from these valuations.

Our regular appointment with the chancellor is coming shortly and the anxiety is building but we feel confident that any pain is unlikely to hurt the balance sheets that matter to us.

James Bowmaker is deputy manager of the VT Tyndall Unconstrained UK Income fund. The views expressed above should not be taken as investment advice.