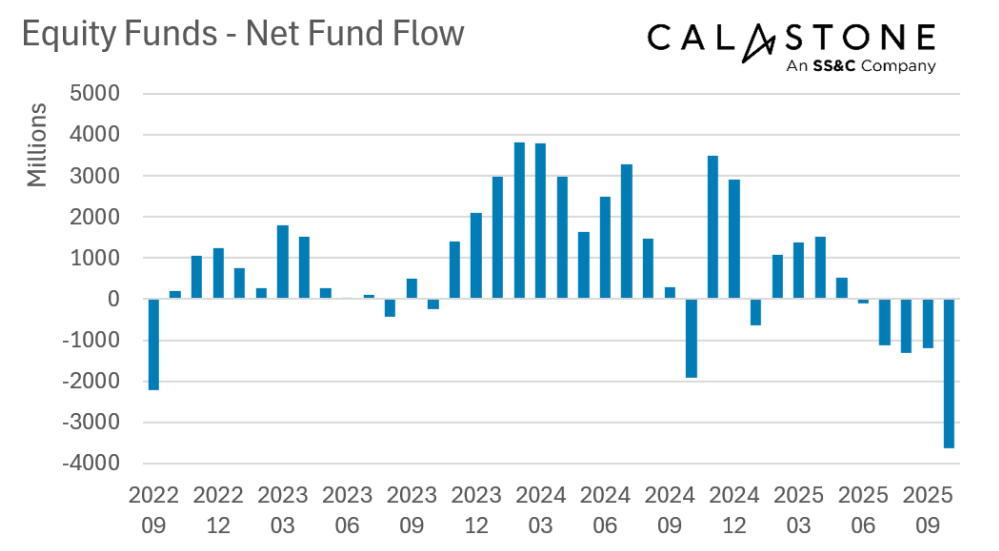

UK-based investors withdrew a net £3.6bn from equity funds during October in the largest single-month outflows on record, according to Calastone’s Fund Flow index.

This means the cumulative outflow from equity funds since June has reached £7.4bn, with all equity categories experiencing net selling. Investors have been selling equity funds for five months straight.

Source: Calastone Fund Flow Index, Oct 2025

UK equity funds were hit with £1.2bn in redemptions, contributing to a total of £10.4bn withdrawn since pre-Budget jitters began earlier in the year.

Global funds posted a record £911m outflow for the month, while North American equity funds shed £649m. Technology-focused funds accounted for nearly all of the £220m withdrawn from sector-based strategies.

However, money market funds took in £955m, the highest monthly inflow ever recorded by Calastone, as investors moved capital into low-risk assets.

Fixed income funds had £589m in net inflows, primarily directed toward corporate bonds and flexible mandates. Sovereign debt funds remained out of favour.

Edward Glyn, head of global markets at Calastone, attributed the equity sell-off to two factors: investor caution over high equity valuations, especially in the US, and concerns over potential tax changes in the UK’s upcoming Budget.

Investor nerves about global equity prices, especially in the US, are viewed as the driving force behind outflows from global, US and tech funds.

This also explains why money market and fixed income funds both had a strong month - the cash coming out of equity funds has to be reinvested elsewhere, especially for investors who want to retain the tax protection of an ISA or pension wrapper.

Glyn added: “The other force stems from growing concern about Rachel Reeves’s Budget and the anticipated tax implications. For some, it’s a simple matter of crystallising capital gains in case rates go up. This drove a huge uptick in selling this time last year and it’s clearly round two in 2026.

“For many others, it’s about pensions. The tax-free lump sum that over 55s may draw from their pensions is such a vital part of most people’s retirement planning that the risk it will be scrapped or drastically scaled back is simply too concerning for many diligent pension savers in their 50s and beyond to contemplate.

“Speculation on policy has made this drastic step the only rational choice for many, even if it may ultimately harm their longer-term financial goals.”

Calastone’s Fund Flow index is based on real trading data from UK-based investors and captures more than 85% of UK fund flows. It excludes fund-of-funds to avoid duplication and uses FE fundinfo data for classification.