The Artemis Global Income fund is a favourite among income seekers, who poured £1.4bn into it over the year to the end of October, according to flows data from FE Analytics.

Combined with strong performance, the fund has more than doubled in size over the past year, reaching £3.8bn in assets under management and becoming the third-largest strategy in the IA Global Equity Income sector.

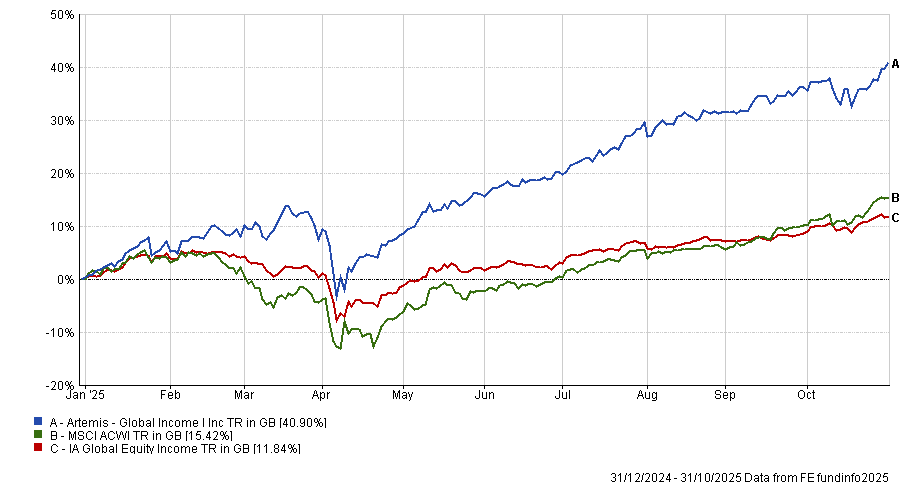

Led by veteran investors Jacob de Tusch-Lec and James Davidson, Artemis Global Income is the best-performing portfolio in the IA Global Equity Income sector so far this year, up 40.9%.

Performance of the fund vs sector and benchmark year-to-date

Source: FE Analytics

However, its contrarian approach means it should not be treated as a typical global equity strategy, according to James Rowlinson, associate investment governance director at Forvis Mazars.

The fund is currently overweight “out of favour” areas such as financial stocks and European equities, which differentiates it from the US and tech-focused market. Indeed, technology and US stocks represent just 6.7% and 28.5% of the portfolio respectively, compared to the MSCI ACWI’s 22% in tech and 64% in the US.

On top of this, the fund is “relatively dynamic”, with De Tusch-Lec and Davidson happy to cycle out of winners, which means that fund performance can vary significantly depending on market conditions.

For this reason, it should be paired wisely with funds that complement these characteristics, with Rowlinson pointing to T.Rowe Price US Large Cap Growth Equity.

T. Rowe Price US Large Cap Growth

As a US-focused strategy, this fund can thrive if US mega-caps such as the Magnificent Seven continue to outperform the market.

Indeed, it holds six of them in its top 10 allocations, which has led to top-quartile performance over the past one and three years.

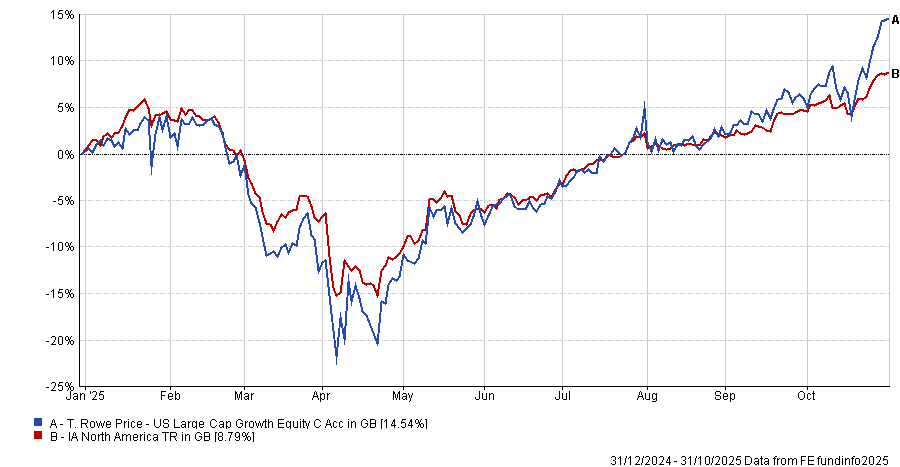

While this led to the portfolio falling 21.8% as ‘Liberation Day’ tariffs hit, it has rallied since and is now up 14.5% following renewed interest in the artificial intelligence (AI) mega trend.

Performance of fund vs sector YTD

Source: FE Analytics

The focus on US large caps also helps diversify Artemis’ emphasis on mid-caps and Europe, providing an equity allocation that is “much more similar to global indices”, said Rowlinson.

“When combined, this pairing helps insulate your portfolio from extremes – whether AI leads to a tech boom or a bust.”

He favoured a 50/50 split between the two.

Rathbone Global Opportunities

Kate Marshall, lead investment analyst at Hargreaves Lansdown, said Rathbone Global Opportunities “pairs perfectly” with Artemis Global Income.

Led by FE fundinfo Alpha Manager James Thomson, the Rathbones strategy is distinct from Artemis in several ways.

For example, the two have no overlap in their top 10 holdings, with Thomson prioritising more well-known multi-nationals, such as Nvidia, Walmart or Microsoft, compared to Artemis’ focus on “lesser known” names in sectors such as financials or energy.

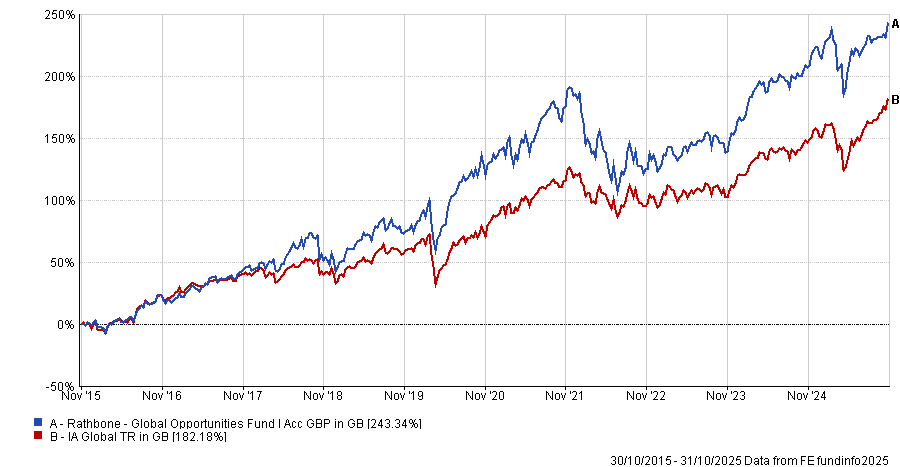

Performance of fund vs sector over past 10yrs

Source: FE Analytics

As a result of these differences in style, the funds “should perform well at very different times”, the HL analyst noted.

Artemis Global Income will thrive in periods of rising inflation, which tend to favour value stocks, particularly financial stocks such as banks, she explained. Meanwhile, Rathbones' growth focus makes it an excellent choice for “lower inflation and interest rate environments”.

“Different investment styles come in and out of favour, so these funds could dovetail well and provide solid diversification in a portfolio,” Marshall concluded.

Trojan Global Income

Finally, Rob Morgan, chief analyst at Charles Stanley, said a “more core defensive holding” such as Trojan Global Income is his preferred choice for a pairing.

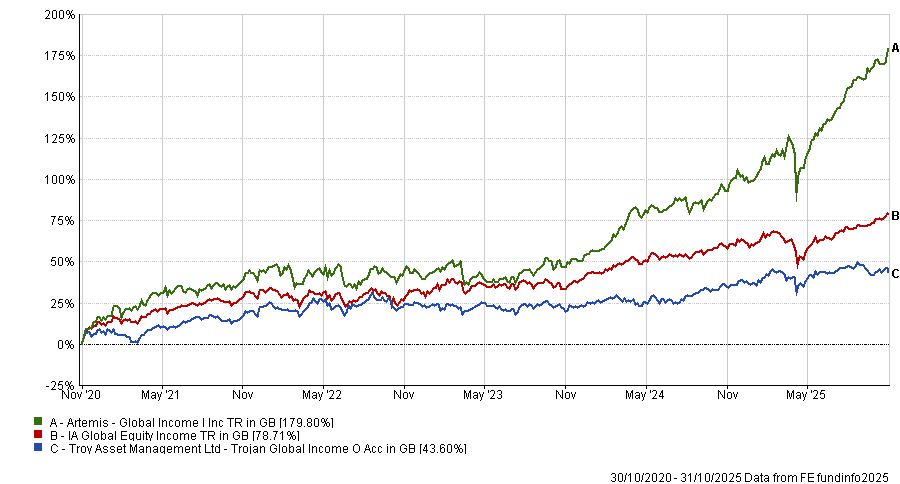

Morgan explained that while Artemis’ high conviction approach and emphasis on economically sensitive businesses have worked out well in recent years, it can lead to the fund “displaying more volatility than the average peer over time”.

Indeed, Artemis Global Income has a top-quartile volatility of 13.2% in the global equity income sector over the past five years, according to data from FE Analytics.

Meanwhile, Trojan Global Income managers James Harries and Tomasz Boniek aim to provide growing income while minimising the risk of capital loss.

This leads them to focus on “quality and resilience first”, preferring businesses with low earnings volatility, such as consumer goods companies. While this has led to it trailing Artemis Global Income over most standard timeframes, Trojan Global Income is much less volatile as a result, with just 9.1% volatility over the past five years.

Performance of funds vs sector over 5yrs

Source: FE Analytics

For a more defensively minded investor willing to trade some returns for capital preservation, Morgan suggested a 60/40 split in favour of Trojan, while investors happy to accept more volatility could split evenly between the two.