With its concentrated exposure to high-growth US stocks, the £2.9bn Baillie Gifford American fund can dominate a portfolio – for better or worse.

It is a high-conviction, bottom-up fund that seeks to invest in exceptional US growth companies.

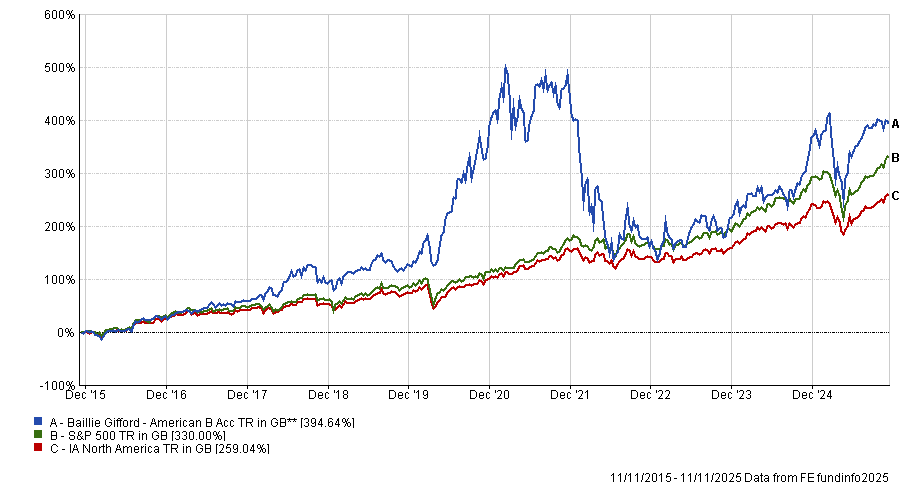

This approach has largely paid off, with the fund in the first quartile for returns in the IA North America sector over one, three and 10 years – gaining 393.7% over the decade – but it dropped to the fourth quartile over five years, gaining just 8.5% versus the sector average of 82.1%.

Performance of the fund vs sector and benchmark over 10yrs

Source: FE Analytics

Although it remains popular, the heavy US growth bias, concentration risk and high volatility mean that the fund ultimately works best as part of a diversified portfolio of more value-driven funds with less concentration risk, according to fund experts.

As such, they have outlined their suggestions for funds to hold alongside Baillie Gifford American.

Ben Yearsley, director at Fairview Investing, said: “As everyone should know, Baillie Gifford takes a high growth approach, so it’s quite easy coming up with complimentary funds.”

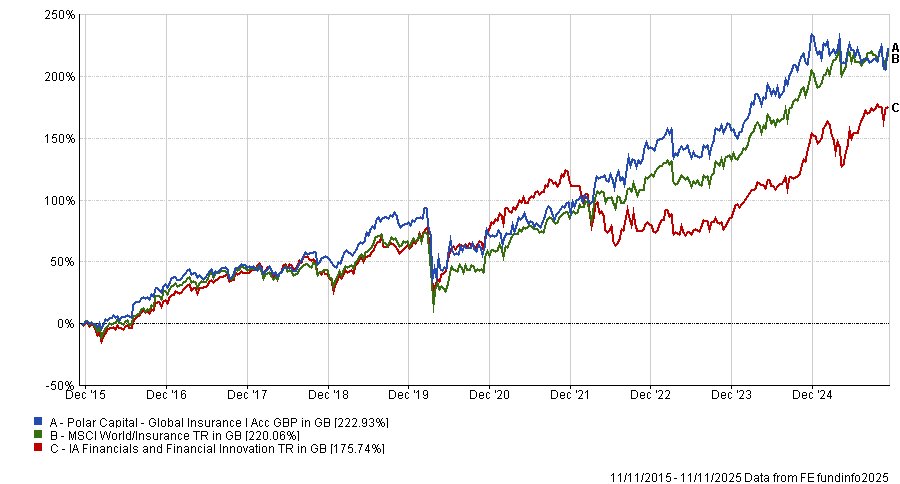

He first suggested pairing the Baillie Gifford fund with the £2.5bn Polar Capital Global Insurance, noting that the fund normally benefits from higher interest rates, in direct contrast to Baillie Gifford American.

The fund invests in 30 to 35 quality companies, leading to a bias towards small- and mid-cap companies more focused on underwriting than larger insurance names.

Performance of the fund vs sector and benchmark over 10yrs

Source: FE Analytics

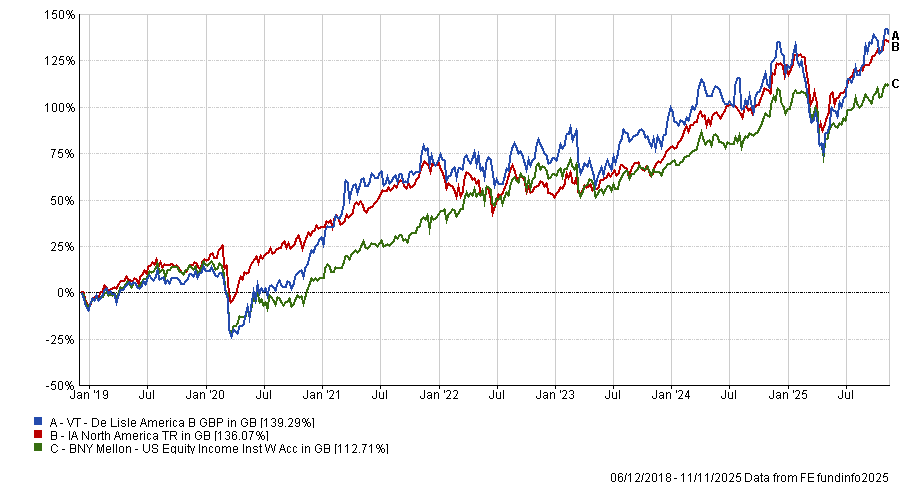

As for another options, Yearsley said investors could explore funds that offer more small-cap exposure, such as De Lisle America, or equity income funds, such as BNY US Equity Income.

“Both funds complement Baillie Gifford America as neither invests in large-cap, high-growth stocks,” said Yearsley.

“But the BNY fund is for the more cautious investor, whereas De Lisle is for those seeking much closer exposure to the domestic US market and economy.”

The £603.2m De Lisle America was launched in 2010 and aims to achieve capital and income growth over five years. It has been managed by Richard De Lisle since launch, with top holdings including toy retailer Build a Bear Workshop.

The larger and value-oriented BNY US Equity Income – which has £1.2bn in assets under management – targets a yield of at least 50% in excess of the S&P 500, with between 30 and 60 holdings which include well-known financials, such as JPMorgan Chase and Bank of America.

Both funds delivered first quartile returns in the IA North America sector over five years, with the BNY fund gaining 116.1% and the De Lisle fund making 112.9%.

Performance of the funds vs sector over 10yrs

Source: FE Analytics

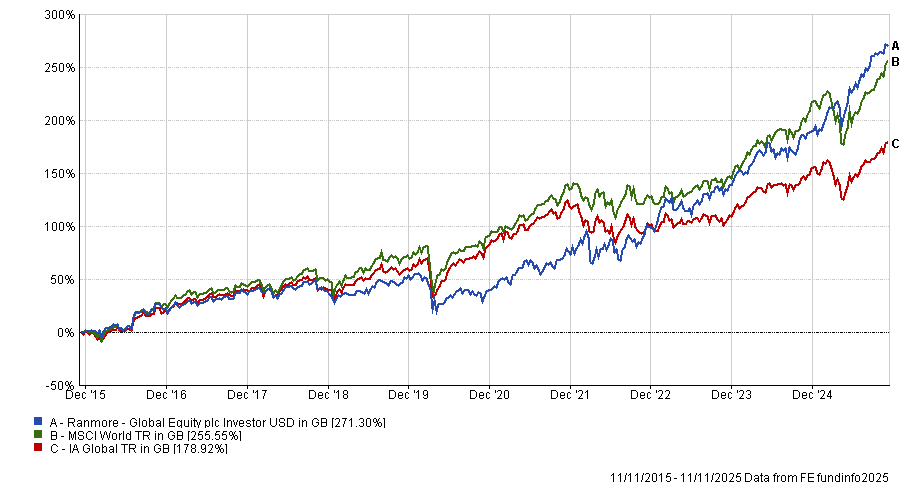

Jason Hollands, managing director at Bestinvest, said he would first look to funds that are underweight the US to ensure diversification.

First up, he suggested the unconstrained $1.8bn value fund Ranmore Global Equity.

It has an FE fundinfo Crown Rating of five out of five and has been managed by Sean Peche since its launch in 2008.

Hollands pointed to its diverse mix of holdings, which include ecosystem brand Haier Smart Home, UK fast food chain Greggs and American toy manufacturer Mattel.

The fund managed top-quartile returns in the IA Global sector over one, three, five and 10 years, gaining 264.1% over the decade.

Performance of the fund vs sector and benchmark over 10yrs

Source: FE Analytics

“Another unconstrained fund that could work alongside the Baillie Gifford fund would be Fiera Atlas Global Companies,” said Hollands.

Managed by Simon Steele, the $1.1bn fund was launched in 2022 and aims to deliver annualised returns of 10% or greater – with lower risk of capital loss than broader global equity markets – over the long term.

“If you look at the top 10, none of them are the usual names and it’s not got a market cap weighting bias,” said Hollands. “None of those top holdings would appear in an index fund.”

These include technical product and services supplier Diploma, supplier of critical aircraft components and aerospace systems HEICO and financial technology company Tradeweb.

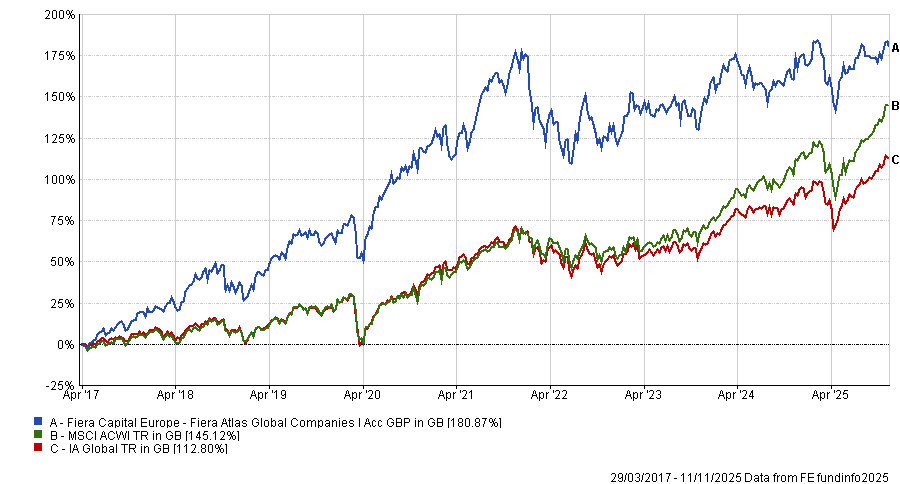

Performance of the fund vs sector and benchmark over 10yrs

Source: FE Analytics

Hollands also suggested the £1.4bn IFSL Evenlode Global Income because it targets high-quality, dividend paying companies and is also underweight the US.

It has a Titan Square Mile ‘AA’ rating, with the analysts noting they have “a favourable view of the outcome-oriented focus and ultimately believe the preference for reliable income compounders should not give investors too many surprises”.

When pitted against the rest of the IA Global Equity Income sector, the fund has languished in the fourth quartile for returns over one, three and five years.

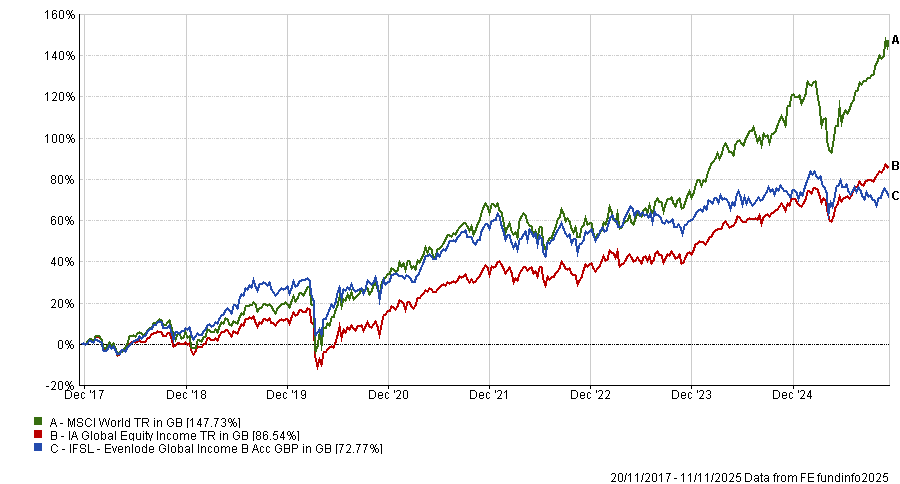

Performance of the fund vs sector and benchmark over 10yrs

Source: FE Analytics

Meanwhile, Alex Watts, senior investment analyst at interactive investor, suggested holding Neuberger Berman US Multi-Cap Opportunities.

He pointed to the “flexible” investment strategy, which allocates across three buckets of stocks: proven companies with consistent free cashflow, less-in-favour value opportunities, and special situations.

“On aggregate, the fund has retained a relatively neutral stylistic exposure through the years,” said Watts.

“While the allocation to technology (around 21%) is substantial, in contrast to the S&P 500 benchmark the fund leans towards the financials sector (25%), while also being overweight industrials (12.3%) names.”

It has a good track record of returns against flex-cap peers but does fall short of its benchmark S&P 500 returns over many time periods, Watts said, “which is not a surprise given the lesser exposure to large- and mega-cap companies that have driven the index”.

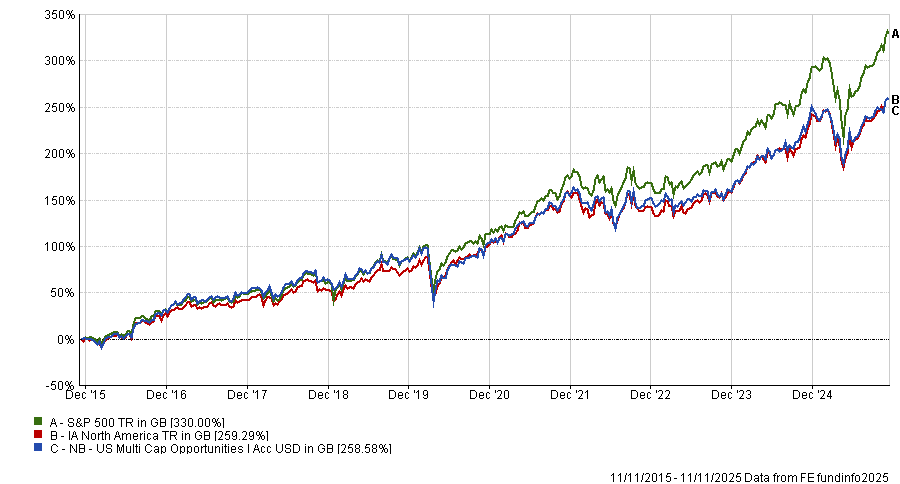

Performance of the fund vs sector and benchmark over 10yrs

Source: FE Analytics

As Baillie Gifford American is a fund typically invested in faster growing and more richly valued companies, Paul Angell, head of investment research at AJ Bell, said he would look to counterbalance this in portfolios with the $4bn value-oriented and bottom-up Dodge & Cox US Stock fund.

The strategy, which has been in place since 1930, stands out for its high active share and low portfolio turnover.

Over 10 years, the fund is in the third quartile for returns in the IA North America sector, gaining 231.1% versus the sector average of 256.9%.

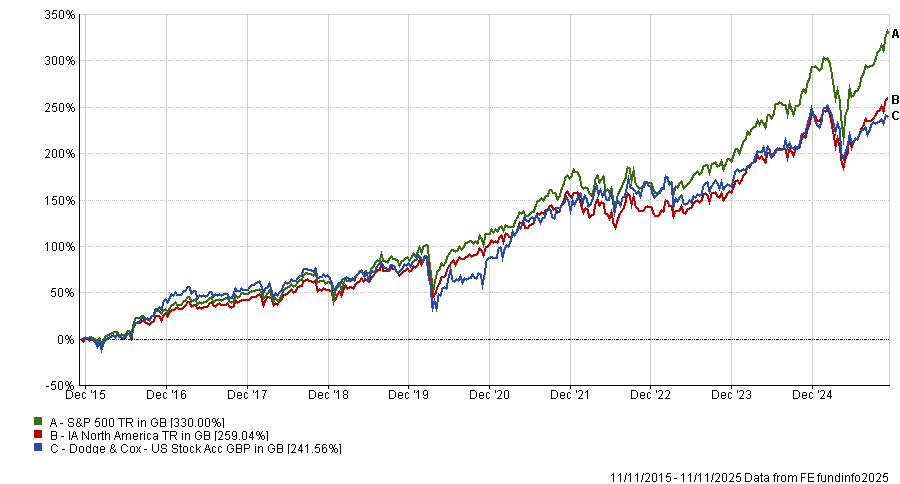

Performance of the fund vs sector and benchmark over 10yrs

Source: FE Analytics