With just a week to go before the autumn Budget, it has become increasingly clear that chancellor Rachel Reeves has “no plan of how to bring down finances”, according to David Zahn, head of European Fixed Income at Franklin Templeton.

She faces the task of addressing a well-established £40bn fiscal black hole and a national debt of £2.9trn, which will require some painful decisions to be made.

Spending cuts are seemingly off the table, with the chancellor refusing to commit to a policy of austerity and the government having previously committed to increased spending on things such as defence, Zahn said.

This means that the “only option in Reeves' toolbox seemed to be raising taxes”. Rumours swirled on how this might be achieved, but some analysts have suggested that an increase in income tax looked possible.

Increasing income tax by 1 percentage point could have raised an additional £8.2bn while a 5-percentage point rise on the top earners could have contributed a further £1.4bn, according to Michael Brown, global investment strategist at Franklin Templeton.

While this policy would have broken a manifesto pledge, it would have been well received by the market, according to Zahn.

“It would have shown that we have a government that is serious about getting the budget balanced, with a long-term plan and that would help bring down rates.” As the market would have gained more confidence, the Bank of England would be given more scope to cut interest rates to help the economy grow faster.

However, the announcement earlier this week that she has U-turned on this has damaged her credibility, “proving that she has no plan and is being entirely reactive.”

This leaves the government with a financial black hole and few options left to fill it. With the government being “seemingly unwilling” to break manifesto pledges and committing to not cutting spending, the upcoming Budget may “tinker around the edges” to balance the books.

However, trying to find “a billion here, or a billion there” will not be enough to address a gap of this size and only serves to make the taxation process more complicated, he said.

This reduces certainty among investors and consumers and is part of why most people do not want to invest their money, because the government’s policy seems “completely unpredictable”.

This “nickel and dime” approach to raising taxes means the chancellor will struggle to provide enough fiscal headroom.

In the Spring Statement, the chancellor had committed to a £9.9bn fiscal headroom against changes in the forecast, but this will not be sufficient over the long term, Zahn said. It is much lower than the average of £25bn - £30bn that chancellors usually aim for, so “if anything happens, that buffer will go”, forcing the chancellor into another tax-raising Budget in 2026.

“I wouldn’t be surprised if next year she’s back with another £40bn black hole to fill. It’s difficult to believe there’s any fiscal rigour if Reeves keeps coming back for more taxes.”

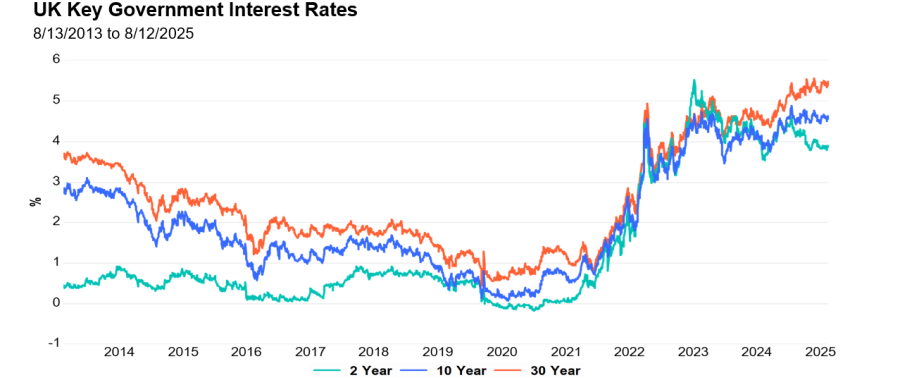

As a result of this lack of credibility, yields on UK gilts have spiked this year, the Franklin Templeton manager said, with the 30-year gilt yield hitting 5.73%, the highest level in over three decades.

Additionally, the two-year, 10-year and 30-year interest rates are near their highest levels in more than a decade, as seen in the chart below.

Source: Franklin Templeton.

This might look like a “bond investors' dream”, with the opportunity to buy UK gilts at high yields before the Bank of England cuts rates, but this is overly optimistic, according to Zahn.

“The problem with buying gilts right now is that you have a government that lacks credibility.”

The government is “unpredictable” and seems to lack any clear plan for how to bring finances in order or to reduce “sticky inflation”. Indeed, inflation remains persistently high at 3.6%, a drop from last month but still one of the highest inflation rates in the G7, which limits the Bank of England's ability to cut rates.

“We’re not talking about a big rate-cutting cycle, it’s just not possible when inflation is this sticky, and I think that’s part of the reason the bond market is so jittery.” As a result, investors who bought gilts expecting a series of aggressive rate cuts may be disappointed when only one or two occur, he said.

Instead, rates “could probably go higher from here”.

If the government does not raise enough revenue to reduce debt and continues to struggle to fund existing deficits, the bond markets will keep losing confidence. This could push bond yields to around 6% on the 30-year gilt, he said.

“At that point, gilts will be a great buying opportunity, but right now we’re pessimistic,” he concluded.