In theory, paying a lower price for a stock should lead to better returns over the long term, but fixating on valuation can be just as dangerous as overpaying, according to Samantha Fitzpatrick and Martin Connaghan, co-managers of the Murray International Trust.

“In the past, we didn’t buy stocks we liked because they seemed too expensive for us, and we missed out. In hindsight, we should have just gone for it,” Fitzpatrick said.

Investors will rarely find a perfect time to buy a stock, which means that when managers find a company they like, it is important to “go for it” even if it looks a bit expensive.

“As a long-term investor, does it really matter in the grand scheme of things if you buy a stock at 17x earnings compared to buying it at 15x earnings? Probably not,” they said.

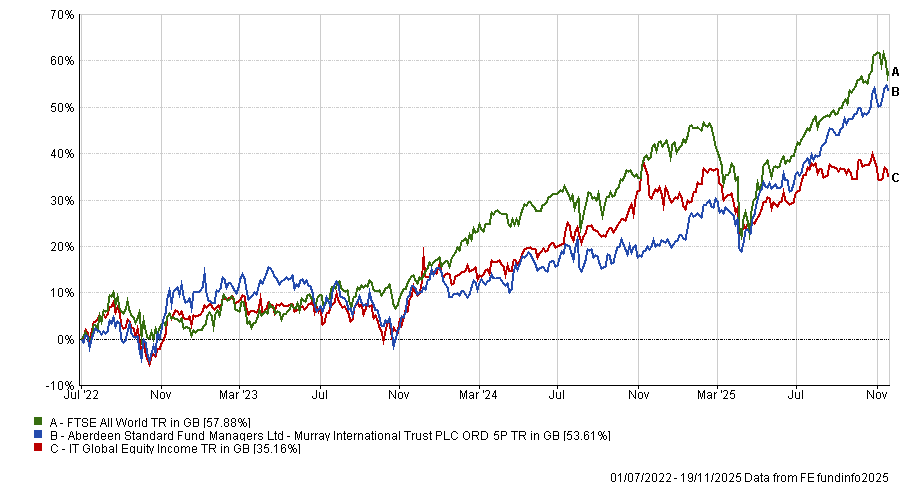

This approach may seem unusual for an income trust that has been traditionally tilted towards value stocks, but it has proven effective. Since the managers joined Murray International Trust in July 2022, the trust has delivered a 53.6% total return, beating the average sector peer.

Performance of trust vs sector and benchmark since managers start

Source: FE Analytics

However, it should be noted that some of this performance was under the former lead Manager, Bruce Stout, who retired last year.

Below the managers explain why Latin American equities are being ignored by other investors, why they own a large US artificial intelligence (AI) winner and how they lost 80% of their investment on a Chinese property company.

What is the process of the Fund?

Fitzpatrick: We aim to deliver an above-average dividend yield of 4.5% and, over time, grow both capital and the dividend in real terms.

Because we want that income to come from the underlying investments, we want every company in the portfolio to be able to contribute to the income side as well as the capital appreciation.

We make full use of our global remit; we don’t want to bank on one particular part of the world or any single sector doing all the work, so we tend to invest in areas we think are underappreciated.

What differentiates the fund?

Connaghan: The fact that we cover the dividend with capital has led to some fairly unique outcomes. When you’re trying to cover this 4.5% you can allocate to higher growth areas, or you can allocate towards higher-yielding areas of the market that we think some other funds might be ignoring.

We also tend to tilt towards the value end of the market because, while people have no shortage of growth exposure, clients could benefit from a more value-tilted portfolio.

What are the areas that people are missing out on?

Fitzpatrick: Latin America is a category that we think is vastly ignored by a lot of people, because it has a reputation for volatility and currency risk, but there are some great businesses there.

We like Grupo Asur, a Mexican airport operator, which we’ve held since IPO. It's been supported by steady income and been prudently managed, which caused us to hold onto it during the pandemic because we thought it would make a recovery.

Because of our global remit, we have the flexibility to look to these areas for opportunities and we’re not scared of parts of the market that people think are too much work to be worthwhile.

What was your best-performing holding in the past three years

Fitzpatrick: Broadcom. We bought it years ago when it wasn’t involved in AI and was a high-yielding stock at about 7%, which was more focused on acquiring businesses and turning them around as more efficient operators.

Nowadays, it’s all about AI and the rationale for owning it has changed, but we still like the fundamentals and it’s performed fantastically for us over the past three years, with an annualised return of 86%.

However, because the dividend has reduced so much, we’ve had to pull some profits otherwise the income side of the portfolio would start to look quite tight.

And your worst?

Connaghan: Vanke, a Chinese real estate developer. The thesis was that it was one of the higher-quality property companies in the Chinese market and so would benefit from consolidation to grow sustainably. This never really happened.

The share price became essentially guided by what the Chinese government did or didn’t do, which was frustrating for bottom-up stock pickers. We exited the stock in late 2024, at which point it probably cost us 80%.

What’s the biggest lesson you learnt from running the fund?

Connaghan: To kill stocks that we’ve lost confidence in. It’s all well and good being a long-term investor, but you don't want that to turn into giving management teams and share prices the benefit of the doubt when the evidence doesn’t support that.

Sometimes you need to have the courage of conviction to put your hands up, say you’ve made a mistake and sell out of something. Combined with Sam’s point about not quibbling over value underpins how we like to approach the portfolio.

If you wait for the stock to be at the right price, you can watch it go up for a long time while you don’t hold it. But you can also watch a stock go down for a long time and resist selling it, so sometimes you need to trade accordingly rather than waiting for some perfect moment.

What do you do outside of fund management?

Fitzpatrick: I love singing and dancing. I’m in a choir which is gearing up for a Christmas concert.

Connaghan: My son is about to be six in a few weeks, so I’ve become a glorified taxi driver taking him to swimming or dance lessons.