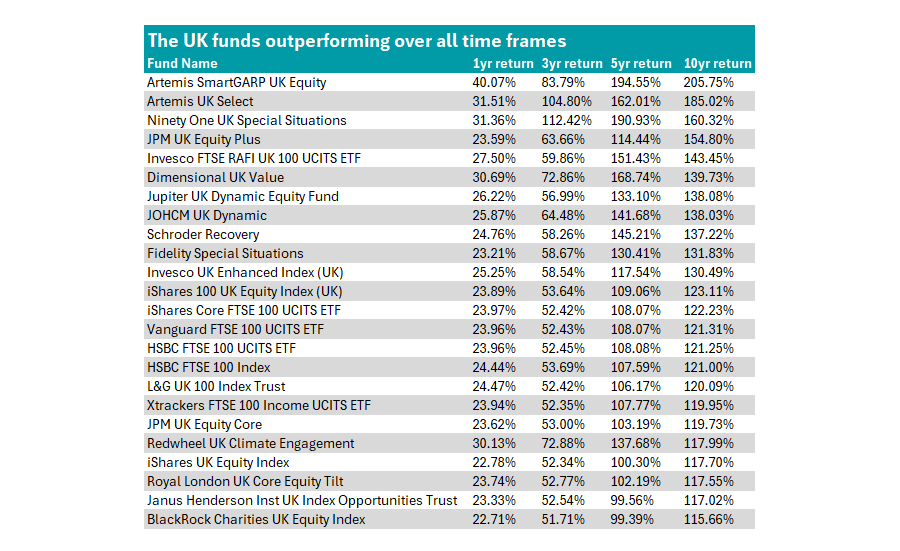

Twenty four UK funds have delivered top-quartile returns over the past one, three, five and 10 years, Trustnet research has found.

Consistent outperformance can be challenging, particularly when funds had to navigate difficult backdrops, with four different prime ministers in five years, a disastrous mini-Budget in 2022 and Brexit.

But this has not stopped some UK funds from delivering for investors. As part of an ongoing Trustnet series, we examined which IA UK All Companies funds posted top-quartile returns over one, three, five and 10 years (the standard time frames used by investors).

Source: FE Analytics. Performance to the end of October. Chart sorted by 10 year return.

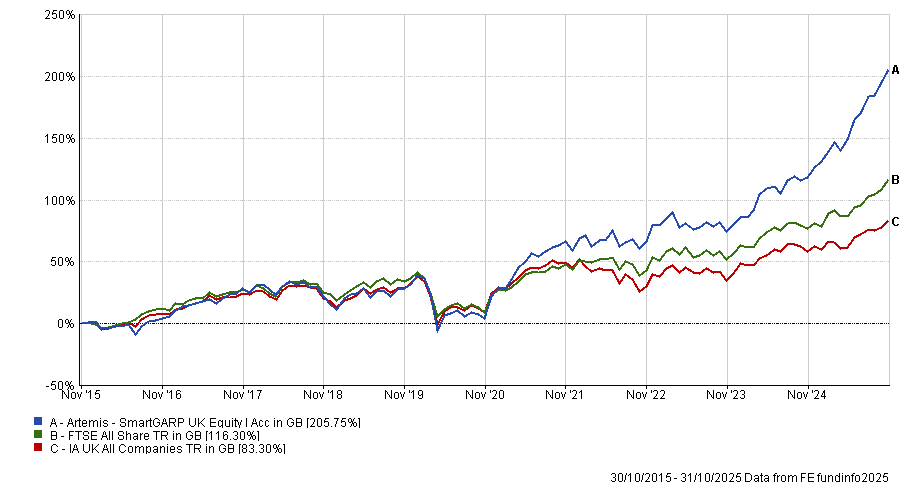

Topping the chart of consistent outperformers is an active fund – the Artemis SmartGARP UK Equity fund.

Led by veteran stockpicker Philip Wolstencroft, the strategy targets companies that are attractively valued compared to their growth prospect, using financial and macroeconomic metrics.

Analysts at Rayner Spencer Mills Research (RSMR) said: “The strength of the approach is founded on not overpaying for growth and recognising when fundamentals of a company have been overlooked, suiting most market environments.”

While this can make it a good choice as a core holding for investors, the “significant allocation” to mid-caps (currently 30.5%) means it can also help diversify a more traditional UK portfolio, according to RSMR.

Performance of fund vs sector and benchmark over 10yr

Source: FE Analytics

Its stablemate, the Artemis UK Select fund, also appeared on the table. Led by FE fundinfo Alpha Manager Ed Leggett and Ambrose Faulks, it has posted top-quartile returns in six of the past 10 calendar years.

The fund experienced a particularly strong 2024, when it was the best-performing strategy in the sector, up 25.3%.

Performance of fund vs sector and benchmark over 10yr

Source: FE Analytics

The strategy invests in 40 to 60 UK companies across the market cap spectrum, with the ability to short up to 10% of its allocation to generate additional returns.

Currently, it has a significant weighting to financials (41.2%), an overweight of 13 percentage points versus the FTSE All Share. Banks such as Standard Chartered, Barclays, Lloyds, NatWest and HSBC all appear in its top 10.

Ninety One UK Special Situations took the crown as the top performer in the past three years, while maintaining first-quartile returns over one, five and 10 years.

Managed by Alessandro Dicorrado, the team screens for stocks where the share price has fallen by 50% from its peak compared to the FTSE All Share over the past seven years.

The strategy currently favours industrial and consumer discretionary stocks, both of which are double-digit overweight compared to the FTSE All Share. This gives it a differentiated allocation, underweighting large names such as AstraZeneca in favour of less popular stocks such as Melrose Industries.

It is favoured by the team at RSMR due to its “contrarian, value-biased approach” and well-resourced and established team.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

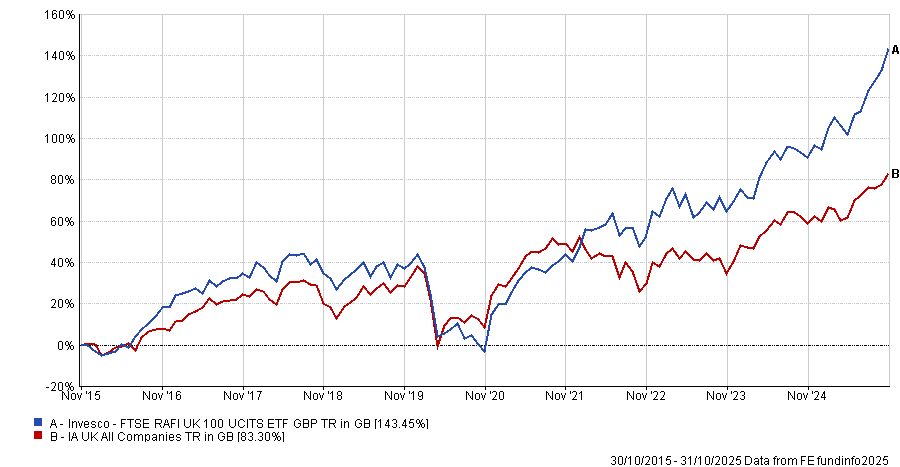

But not only active managers made the list (indeed, according to research by AJ Bell earlier this year, 69% of UK active funds failed to outperform the common passive alternative over the past decade).

Almost half of the funds that delivered top-quartile returns over one, three, five and 10 years, were trackers, the majority of which tracked some variant of the FTSE 100, reflecting the outperformance of UK large caps.

The top passive fund over 10 years is the Invesco FTSE RAFI (Research Affiliates Fundamental Index) UK 100 UCITS ETF, which is up 143.5%.

This tracks a modified version of the FTSE 100, which is weighted on a combination of sales, cash flow, book value and dividends, rather than market capitalisation.

Performance of fund vs sector over 10yrs

Source: FE Analytics

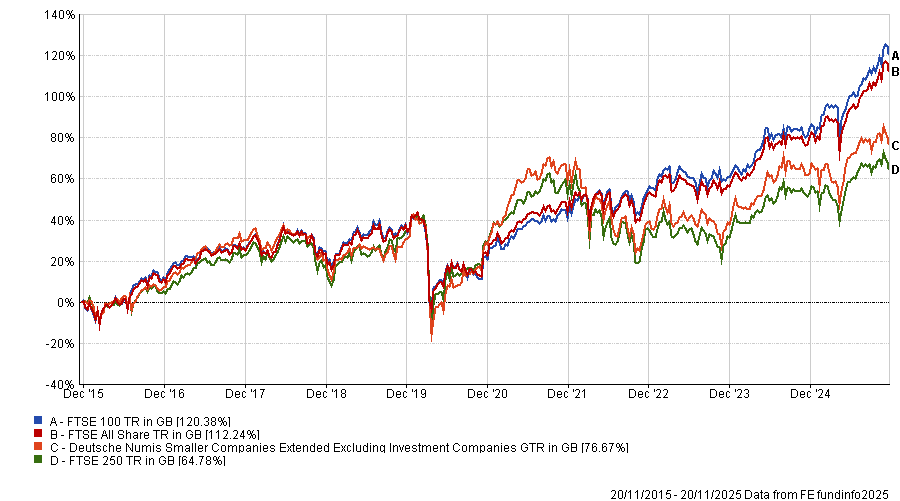

Over this period, the FTSE 100 has surged 120.4%, outperforming the FTSE All Share, as well as the FTSE 250 and Deutsche Numis Small Cap indexes.

Performance of indices over past 10yrs

Source: FE Analytics

The Invesco UK Enhanced index, iShares 100 UK Equity index and Vanguard FTSE 100 UCITS exchange-traded fund (ETF) also made the list.

Previously in this series, we examined the funds that delivered top quartile results over one, three, five, and 10 years in global markets, Europe, and the US.