From the first quarter of 2025 to the third quarter, defence exchange-traded funds (ETFs) dominated European thematic ETF flows accounting for nearly $10bn of the $13.1bn total flows year-to-date.

Defence allocations are evolving at a time when technological advancement is redefining how nations prepare for and respond to modern threats.

Traditional defence exposures typically focus on legacy contractors and arms manufacturers. Whilst many of those companies play an important role in defence and security, new players are emerging in a world increasingly shaped by hypersonics, autonomous systems and space-based reconnaissance.

The convergence of those technologies is blurring the boundaries between space and defence. Space matters more than ever: it underpins the infrastructure on which modern defence systems depend.

Satellites now deliver intelligence, surveillance, reconnaissance, communications, navigation and missile warning capabilities that support hypersonic defence, autonomous operations and artificial intelligence (AI)-enabled targeting – fundamental components of national security.

For example, SpaceX’s Starlink network is rapidly expanding its constellation of more than 8,000 satellites, dramatically increasing global broadband coverage at a fraction of historical costs.

At the same time, companies such as Rocket Lab are providing more flexible and affordable access to orbit, accelerating the pace of innovation across the sector.

Those developments are transforming the economics of space-based data, communications and earth observation. Many of the breakthroughs promote dual-use growth that ultimately drives national security and defence advancement.

So what breakthroughs are happening now?

The convergence of aerospace innovation, satellite technology and defence systems is transforming both technology and economics. Falling launch costs and rapid progress in reusable rocket technology have opened space access to a wider range of participants, catalysing new industries and use cases.

According to our research, this trend is accelerating as the combination of AI, robotics and autonomous systems reshapes industrial production and national security.

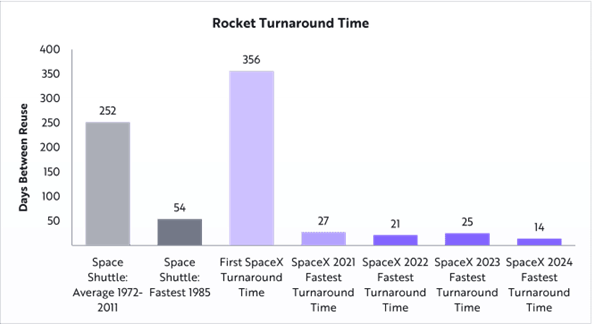

When the Space Shuttle cost around $1.5bn per launch, most experts believed reusable rockets were economically impossible. SpaceX overturned that view. The first stage of its Falcon 9 costs less than $1m to refurbish.

This breakthrough has reduced launch costs dramatically and has set a new benchmark for global aerospace economics. Lower refurbishment costs shorten turnaround times, allowing faster, less expensive access to orbit and encouraging a new cadence of satellite deployment.

Source: ARK Invest

This cost compression has created a powerful feedback loop. Each additional launch drives manufacturing efficiencies, spreads fixed costs and encourages further private investment in satellite infrastructure.

As launch costs fall, new commercial applications emerge, from Earth observation and communications to logistics and navigation.

The new economics of orbit

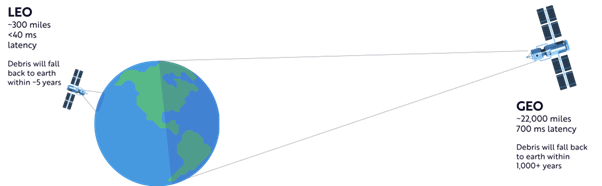

The satellite industry is shifting from limited, high-latency networks to dense constellations that offer continuous global coverage. Historically, latency constraints made it difficult for geostationary orbit (GEO) satellites to deliver compelling broadband.

Low Earth orbit (LEO) constellations now provide low-latency connections at significantly lower cost, enabling continuous coverage and direct-to-device connectivity.

Source: ARK Invest

The constellations enable faster data transfer, real-time intelligence and resilient communications infrastructure. They also support critical applications like remote sensing, climate monitoring and emergency response.

By integrating AI with satellite networks, operators can optimise routing, improve predictive maintenance and automate fleet management.

As LEO networks expand, their influence extends far beyond traditional telecommunications to enhancing productivity in logistics, agriculture and transport. Continuous, low-latency data flow allows industries to monitor assets and environments at a scale previously impossible. We identify this as a central driver of the space economy’s growth over the next decade.

From manned platforms to machine intelligence

Meanwhile, defence systems are entering an era defined by autonomy, cost efficiency and AI-powered decision-making. The current state of warfare has exposed the vulnerability of expensive, manned aircraft against low-cost, internationally produced drones. AI now enhances decision-making, shortens reaction times and reduces the need for human military personnel.

The US Department of War recognises the need for smaller, smarter, less expensive systems.

The emphasis is shifting from a few large, manned platforms to swarms of intelligent, expendable systems instead. AI integration will improve battlefield awareness, automate defence logistics and enable adaptive systems that learn in real time.

It follows that this transformation will alter defence procurement and industrial strategy. Decision advantage increasingly depends on data processing speed and autonomy.

AI-driven systems that can operate independently, integrate multiple sensor inputs and coordinate with minimal human oversight are set to define next-generation military capability.

Disruption and opportunity

The downstream effects of space and defence convergence already extend across civilian industries. Space-based networks now underpin global logistics, improve agricultural productivity and enable precision monitoring in sectors ranging from construction to energy.

These advances illustrate how defence-related technologies often spill over into commercial markets, accelerating progress in automation and connectivity.

Declining satellite and launch costs will unlock continuous global connectivity, improve communication reliability and expand access to real-time data.

The beneficiaries of this transformation include companies that design, launch and operate the infrastructure, as well as those developing AI and analytics tools that extract value from the resulting data streams.

Rahul Bhushan is global head of investment products at ARK Invest. The views expressed above should not be taken as investment advice.