Extreme US tariffs and UK banks outperforming global technology stocks are just two of the market shocks that have surprised investors over 2025 so far, according to Hargreaves Lansdown’s Hal Cook.

Cook, senior investment analyst at Hargreaves Lansdown, said the past year had “delivered a number of surprises and, like Christmas crackers, some ended up being underwhelming”. Below are his top five.

Liberation Day

News that US president Donald Trump would push tariffs to levels reaching up to 50% shocked markets in early 2025. Cook said it was “well-telegraphed that the US was going to implement higher tariffs" but "not well-telegraphed that these were going to be of levels up to 50%”.

The immediate market reaction to Trump’s so-called Liberation Day was severe, wiping a reported $9.5trn off global markets. The US raised its average tariff rate from 2.3% at the end of 2024 to somewhere in the mid to late teens.

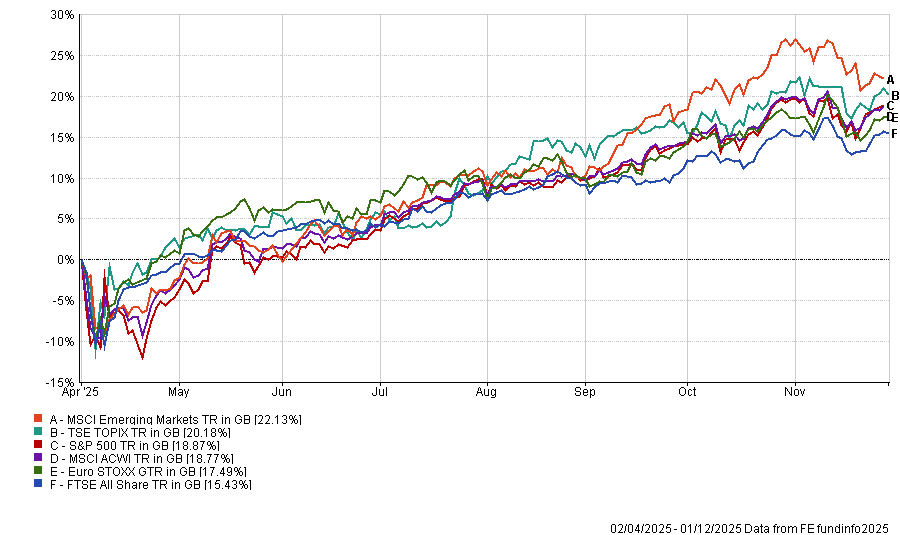

Performance of stock markets since Liberation Day

Source: FE Analytics. Total return in sterling between 2 Apr and 2 Dec 2025

But what followed proved even more surprising than the tariff announcement itself. Between Liberation Day on 2 April and 2 Dec, the MSCI AC World index is up 18.3%, with emerging markets gaining 22.2%, Japan 20.2%, the US 18.2%, Europe 17.5% and the UK 15.4%.

Just looking at those figures, investors would not think the US had implemented such substantial tariff increase, Cook said. “Perhaps the biggest surprise here isn’t actually what was announced on Liberation Day, but the market reaction since,” he added.

Indian stocks slump

The MSCI India index has fallen 1% for 2025 to 27 November, a sharp departure from the strong gains seen across most global markets. This underperformance followed several years of exceptional returns, with the MSCI India index returning 36% over the three years to the end of 2024, compared to just 3% for the MSCI Emerging Markets index.

Cook said it might not be too much of a surprise that the returns from Indian stocks have slowed in 2025, given the extent of their outperformance in the recent past.

He continued: “At the same time, emerging market investors have been rotating their investments into China, which has had a strong year. Even so, in the context of broad stock market gains during 2025 and the Indian economy recently announcing 8.2% growth in the latest quarter, negative returns for the Indian stock market are a bit surprising.”

Gold’s continued upward march

Gold reached $2,000 in August 2020 and hovered around that price until the start of 2024. It stood at $2,600 by the end of 2024 but has since surged to around $4,200 during 2025.

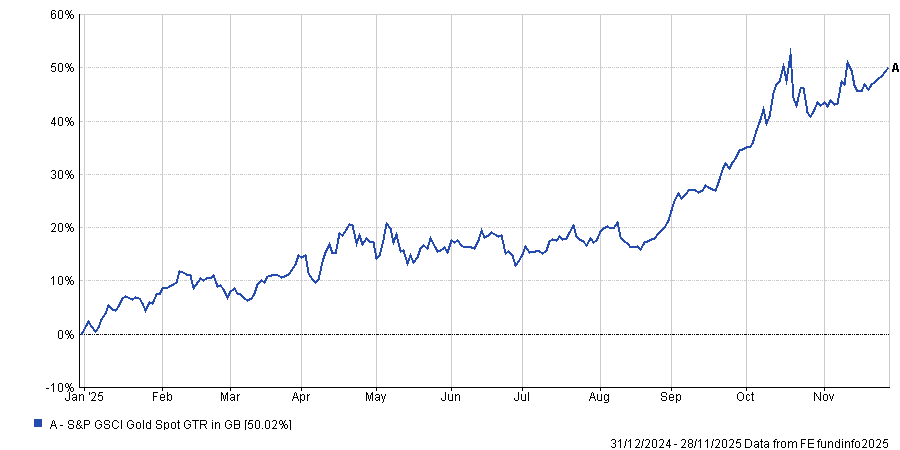

Performance of gold in 2025

Source: FE Analytics. Total return in sterling between 1 Jan and 2 Dec 2025

“We flagged that gold had potential to continue rising this year as part of our outlook issued at the end of 2024 – and I’m very happy we made that call,” Cook said.

“But the level of the continued rises in 2025 has most certainly been a surprise, even for the gold bulls at HL.”

No manifesto-breaking Budget

The UK Budget in late November ultimately proved quite uneventful from an investment market perspective. Gilt yields, the FTSE All Share and the pound barely reacted following chancellor Rachel Reeves’ announcements, with all three at similar levels to where they were at the start of November.

Cook attributed the calm market reaction to “the very high volume of leaks about what might be contained in the Budget, including the OBR data immediately before chancellor Reeves took to the podium”.

Reeves did not break the manifesto pledge of no increases on income tax, National Insurance or VAT, despite early concerns. Cook said “the outcome has been calm and somewhat underwhelmed investment markets, which is probably exactly what the government wanted”.

UK banks smash global tech

Share prices of UK banks rose over 2.5 times more than global technology firms in 2025. The FTSE All Share Banks index gained 56% for the year to 27 November, compared with the FTSE World Technology index’s 22% return.

Profits at UK banks soared following interest rate increases in recent years, alongside lower levels of loan defaults from both companies and individuals. Share prices followed profits during 2025, Cook said.