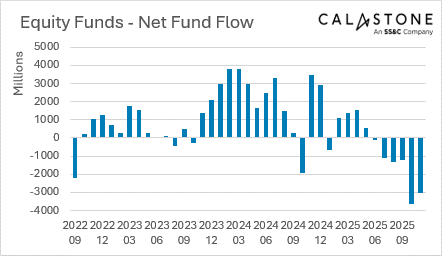

UK investors pulled £3bn from equity funds in November, the second-largest monthly net withdrawal on record behind October’s net £3.6bn, data from Calastone’s Fund Flow index has revealed.

It is the sixth month in a row that nervous investors have pulled money from stock market funds, totalling an eye-watering net withdrawal of £10.4bn, making this the longest and most severe period of net selling since the firm began collating data.

Source: Calastone

As in previous months, active funds were hit harder than passives. In total, more than £3bn was removed from active strategies, compared with £74m being added to trackers.

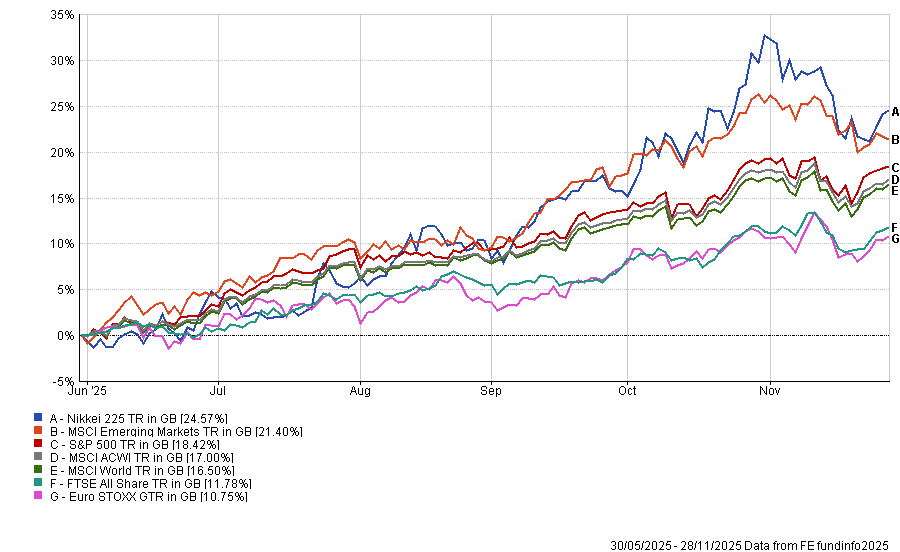

This comes at a time when markets have been on an upward trajectory. All major equity market indices have positive gains in this period, with the Japanese Nikkei 225 topping the charts, up 24.6%.

Even the worst performers are up double-digits in this timeframe, as the below chart shows. The Euro Stoxx index languishes at the bottom of the pile despite its 10.8% rise.

Performance of indices over 6 months

Source: FE Analytics

Edward Glyn, head of global markets at Calastone, said: “A strong US earnings season was positively received by the markets, which were further buoyed by renewed bets on a near-term interest-rate cut. The US and global stock indices closed November near record highs. Yet investors are clearly nervous.”

Drawing the ire of investors in particular was domestic UK funds. Investors withdrew some £847m from these funds in November.

UK funds were out of favour in the run up to the latest Budget as investors waiting with bated breath for chancellor Rachel Reeves’ address. In fact, there were net inflows on the day of the Budget (26 November) and the two days after. However, there was only one other day of net inflows in the month, which was dominated by politics.

Glyn said: “The political narrative has played havoc with UK savers in recent months. Never have we seen such consistent or large-scale selling before.

“The sudden halt in equity-fund outflows that took place after the Budget was delivered is clear evidence that many investors were selling their holdings as concerns rose at the possible curtailment of pension lump sum withdrawals or of further capital gains tax hikes.”

The recent period of uncertainty in the run-up to the Budget had “clearly unsettled” some investors, although Glyn said this was not the sole reason for the sales.

“It’s hard to disentangle Budget jitters from nerves about equity valuations, but the inflows to safe-haven money-market funds do indicate rising risk aversion,” he noted.

Elsewhere, a net £812m was pulled from North American equity portfolios, while global funds, which are heavily US-weighted, were also hit hard in November in an “unprecedented” sixth consecutive month of selling for the sector, shedding £747m.

Among all the equity-fund sectors, only Europe-focused funds enjoyed net inflows, which totalled just £78m.

Conversely, a record £1.25bn was added to money-market funds. It topped the previous high set in October of £955m. In addition, fixed income funds remained popular, with net inflows of £643m, the fourth month in a row that investors put more money into bond funds than they withdrew.

Corporate and high-yield bond funds absorbed most of this capital, although investors steered clear of sovereign bond funds.

Investors removed £53m from property funds during the month, a slowing of net withdrawals. It was the 18th month in a row investors have moved money out of the asset class on a net basis.

“Hopes of interest-rate cuts in the UK and elsewhere may have deterred the urge to sell, although concern remains over the sector as a whole and the long-term viability of the open-ended property fund structure,” said Glyn.