This year will be remembered as a strange but overall positive one for investors (providing no serious shocks over its final month).

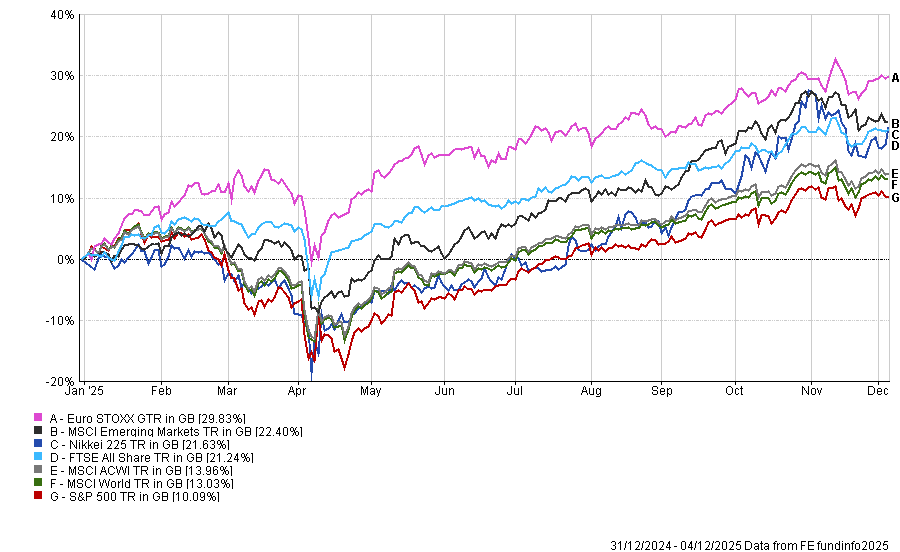

Headlined by US president Donald Trump’s ‘Liberation Day’ tariffs, there have been a number of macroeconomic and geopolitical factors that could have upset markets in 2025, yet every major index has risen by more than double digits in sterling terms, as the below chart shows.

Performance of indices over YTD

Source: FE Analytics

While next year could also be a strong one for markets, there are risks investors need to be aware of. Below, macroeconomic experts outline what people might be underappreciating heading into next year.

The first signs of a sovereign debt crisis

The world is heading for a sovereign debt crisis, according to Gerard Lyons, chief economic strategist at Netwealth. While this may not materialise quite as soon as next year, he warned there could be early warning signs in 2026.

He warned that “six of the G7 are heading for a debt trap by the end of the decade”, a phenomenon that occurs when a country’s debt becomes greater than the size of its GDP.

“Quite a few countries already there,” he noted, highlighting France as an example. This has also impacted the UK, where a high risk premium has been built into UK gilts to reflect “sticky inflation and uncertainty over fiscal positions”.

“It matters more for France and Britain, because both are more dependent on international investors to buy their debt than anyone else. So hence in France and in the UK, it's more of a live issue,” he said.

The issue, however, is that countries have historically been poor at getting themselves out of debt. Indeed, at the current rate Lyons suggested countries would need to run a primary surplus (meaning they bring in more money than they spend).

“That's very difficult to achieve. When you think of Britain, we've only had seven Budget surpluses, never mind primary surpluses, since 1969. So it's very difficult for governments to actually get themselves in a position when they're in the debt trap to stabilise it and it's proving difficult to actually stop us heading in the direction of a debt problem,” he warned.

This was turbocharged by the financial crisis in 2008 and then the Covid pandemic in 2020, with countries taking out debt to deal with the financial impacts of these shocks.

Western democracies “seem incapable or unable to address the underlying issues that are causing debt to keep on rising”, he argued.

“So the debt crisis is likely by the end of this decade, but we might start to see that as we saw with France a few months ago, [when] it factored into market thinking much sooner than that.”

Tech companies need to start showing earnings

Artificial intelligence (AI) has been the defining investment theme over the past couple of years, with US tech giants soaring as investors channelled cash towards the transformational technology.

These stocks have risen to expensive valuations and now the emphasis will be on the fundamentals of the AI boom, said Luke Barrs, chief business and client officer for fundamental equity at Goldman Sachs Asset Management.

This year companies building the hardware behind the technology have started to make real money (rather than just speculative forecasted returns), which is improving the fundamentals of the large tech businesses. But now “the focus on return on capital for that cohort of hyperscalers is becoming much more paramount,” he said.

Indeed, with some $370bn expected to be invested by the US hyperscalers alone in this year and a further 30-35% uplift in spending forecast again next year, it could be a strong year for these hardware builders again. And that is before factoring in governments starting to step in to build out their own infrastructure.

While this is a “reasonably positive tailwind”, Barrs noted that “the variance of outcome here is substantial”.

With the large technology hyperscalers now approaching 40% of the S&P 500 index, any “misstep” could have big implications for many investors.

Although not his base case, if investors don't see progression in earnings “that's where the market will start to react”, particularly given these companies’ already “elevated” valuations.

Even a run-of-the-mill recession would be a shock to many

Lastly, Aaron Anderson, senior vice president of research at Fisher Investments, is “starting out with a reasonably optimistic view of going into next year” but warned that it has been “an awfully long time since most investors have experienced just a run-of-the-mill, normal business cycle recession”.

While he does not think a recession is necessarily coming in 2026, the US market has not had an ordinary bear market since the 1990s, with market falls caused by huge shock events instead, such as the financial crisis and the tech bubble.

As such, “I don't think a lot of people have their eye on excesses that have built up over the course of a pretty long economic cycle that could ultimately lead them into a minor, but not insignificant, recession”, Anderson said.

Whether it be in private markets, public markets or in credit or debt, “there are a number of things to keep an eye on that could spark an economic downturn,” he said.

He suggested investors keep an eye on economic indicators “that just might be leading you down the path of a pretty normal recession”. While this may not be as dramatic as the points above, he noted there is “not a lot of institutional experience” with how to deal with this scenario, which could prove “disruptive to the market”.