The Baillie Gifford’s Shin Nippon investment trust is undergoing several changes under its new manager, Brian Lum.

Following a prolonged period of underperformance, the manager plans to revive the portfolio while keeping the trust’s long-term growth philosophy intact.

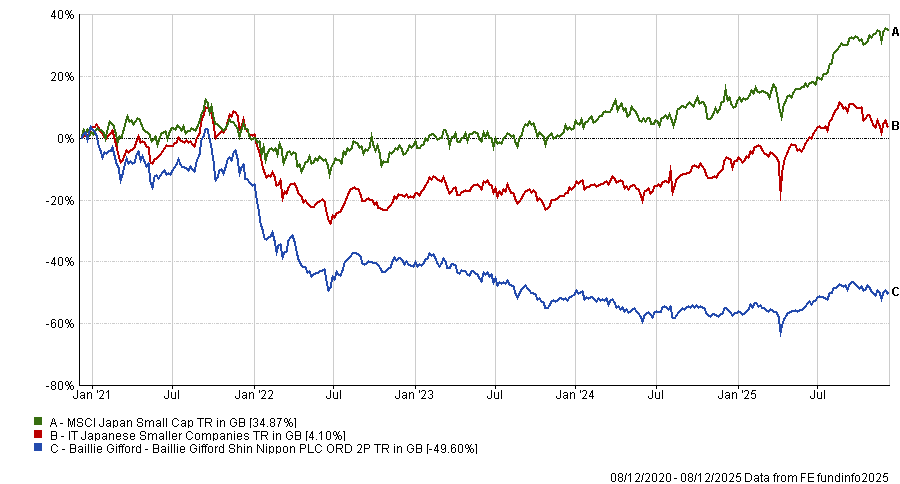

The trust’s medium-term performance has been dire, having lost almost 50% over a five-year period and close to 15% over three years. It has gained less than half of the IT Japanese Smaller Companies sector average over the decade at 52.7% versus 125.7%.

Performance of the trust vs sector and benchmark over 5yrs

Source: FE Analytics

“[Shin Nippon] is currently the dog of the investment trust world,” said Lum, who worked as deputy manager on the trust until May 2025, when he was promoted to lead. “We have gone through a period of horrendous performance and there is no getting away from that. But there is opportunity there – it is an incredibly exciting and daunting challenge.”

He noted that the trust’s focus on growth has had a negative impact at a time when value has outperformed. In addition, large-caps have dominated while small-caps have lagged.

“And, when it comes to geography, Japan has not been the most attractive place to be over the past few years,” Lum said. “Yet I believe Japanese small-caps are probably the most overlooked corner of the global equities market.”

Despite the trust’s “absolutely horrendous track record over the past five years”, Lum said he will retain the trust’s historic focus on long-term growth, even while he implements changes.

First off, the previously 70-stock portfolio has been shaved down to 60, exiting a number of names where the investment case did not work out, valuation upside was no longer there or due to companies being acquired.

“There is a level of churn here that is slightly above average but we remain very long-term oriented,” Lum said.

He added that too many holdings had been “too similar in nature”.

“When things went down, they went down together, compressing valuations,” Lum said. “As such, one thing I am keen to do is continue looking for growth but across a wider variety of industries that may not scream growth investing, such as real estate.”

The trust has also relaxed its market capitalisation bias, with Lum noting previous management teams “really shot themselves in the foot” by limiting the prospective investment universe to companies below a ¥150bn (£720m) market cap.

“We have revised this now, aligning with the benchmark [MSCI Japan Small Cap index], which gives me a bit more flexibility to find the best investment opportunities,” he said.

In addition, Lum said he is trying to better articulate to clients why a company is in the portfolio, breaking each investment case into five attributes: opportunity, edge, scalability, alignment and sustainability.

Capitalising on opportunities

Lum argued that there are plenty of opportunities to be found in the niche asset class which are often ignored due to a “laundry list of problems” with the Japanese market at large.

“People point to Japan’s ageing society, huge lack of labour – specifically IT expertise which is in very short supply – and the fact it is sandwiched between China, which is increasingly dominant in the region, and the US, which is becoming a less reliable partner,” said Lum.

“And there are other problems, from currency to interest rates to structural deflation now turning to stagflation and so on.”

He acknowledged there are “valid observations” but that small-caps are far less impacted by these issues than larger companies in the region.

“Social challenges are an opportunity for a lot of smaller companies, which can benefit by fixing them,” he said.

As an example, he turned to Japan’s lack of labour issue, pointing to top 10 holding Katitas, a 2.8% position in the portfolio.

“In Japan, there is a cultural dislike of old properties, with 15% of the market pre-owned versus 85% being new houses,” Lum said.

“That is partly because of the number of earthquakes meaning people want to be sure their property has structural integrity but there is also a deep dislike of things that have been used by others before.”

For a society with a structural lack of labour, it is far more efficient to refurbish an old house rather than build new all the time, he argued.

“Katitas is dominant in [the retrofitting and refurbishment market]. After all, what do you do with abandoned pre-owned houses when you have a declining population and ghost towns in rural areas? These can be bought for next to nothing, done up and then sold on using a fraction of the labour needed to build new houses.”