Fundamental analysis is not sufficient for navigating today’s equity markets, as sentiment has become a far stronger force in driving returns. This is the view of FE fundinfo Alpha Manager Amadeo Alentorn, who runs the Jupiter Merian Global Equity fund.

His team’s stock-picking model blends intuitive insights, data modelling and behavioural signals to identify which investing styles are most likely to work at any point in the cycle.

Below, Alentorn explains how the experience of 2019 led him to give sentiment a greater role within the process, why Jupiter Merian Global Equity has maintained a material overweight to European banks and why he is focused today on avoiding overpayment for quality.

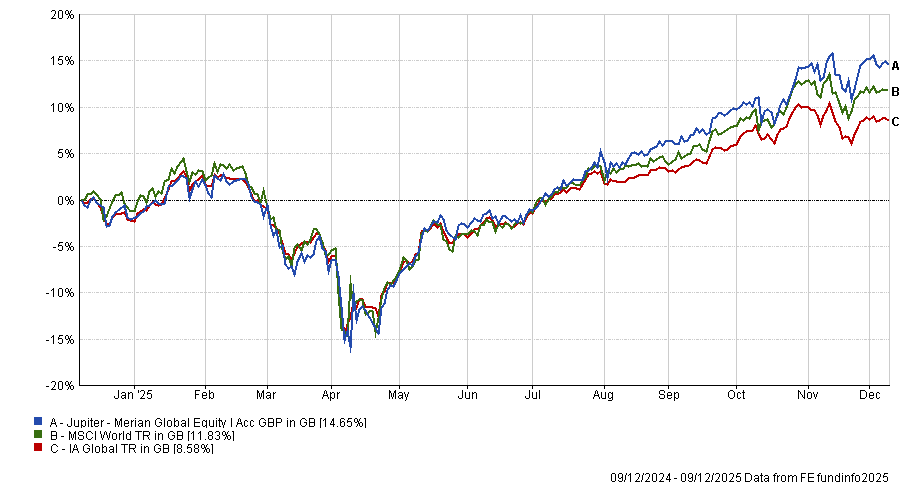

Performance of fund against index and sector over 1yr

Source: FE Analytics

How does Jupiter Merian Global Equity invest?

To be a successful stock picker you need to use different investing styles at different moments, because research suggests that there is no single style that's going to be successful across an entire market cycle. This is the core of our philosophy.

The fund follows a style-agnostic, systematic process to allow us to dynamically shift into the styles that are going to be more prominent. This is done by capturing the market environment and learning through history what has worked well in similar historic environments.

We use data modelling and intuitive insights to drive stock picking.

What do you mean by ‘intuitive insights’?

Some funds use artificial intelligence or machine learning to identify and exploit patterns in markets. We instead go through five stock-selection criteria and three of them are based around intuitive, fundamental ideas: valuation, growth and the quality of the management team. We measure these systematically without our personal opinions coming into play but then we go beyond fundamentals.

To be a successful stock picker, fundamental analysis is not enough, especially when you go through very sentiment-driven markets like the ones we've been seeing in recent years. So we incorporate metrics of sentiment that help us to understand where the buying and selling pressures are across the equity market, as well as price-driven signals, recognising that trends and reversals can also be very powerful forces in markets. This is one of our key differentiators.

How do you measure sentiment and what’s your reading of the market today?

You can think of our models as a thermometer that’s taking the market’s temperature across those two dimensions, optimism and uncertainty. Then, it travels back through time 40 years to identify environments where there was a similar investor behaviour.

This year, particularly in the summer, the model has correctly identified a high-optimism, risk-on sentiment where historically, investing in expensive, high-quality names didn’t typically work. Instead, it’s more profitable to focus on stocks that are attractively valued, even if their balance sheet is not the highest in the universe.

We’re still considering balance sheet strength, but crucially, not overpaying for quality. This has been one of the key drivers of performance this year.

How did this information shape your allocation this year?

Today, the valuation component represents approximately 15% of the model, whereas the balance-sheet quality signals represent about 3%. So we have five times more emphasis to valuation as opposed to higher quality names.

The model recalculates daily and we are allowing the fund to trade for less than 1% turnover per day. We are very careful with transaction costs, so we need to ensure that when we are trading in and out of stocks, the expected payoff of those trades is profitable.

At the end of a year this fund has typically a two-times turnover, so it’s like having two complete different portfolios every year through this very gradual process of trading.

In which environments does this strategy work less well?

2019 is an example of an environment that was more difficult for us than many fundamental managers, as markets, especially in the US, were going through an abnormal and profitable tech bubble.

Loss-making, poorly run but expensive companies with very large growth potential were very rallying very strongly and markets were chasing that growth. For our philosophy it is more difficult to make sense of periods like that, when people are disregarding fundamentals.

Since then, we have made a number of improvements to our systematic process to expand the role of sentiment and capture more sentiment-driven signals. This has helped us to better navigate the last two to three years very successfully, as there are parallels today to what happened in 2019.

What were your best calls of the past year?

Banks, and in particular European banks, have been a great example of applying our data-driven, style-agnostic process to identify stocks with a nice alignment of signals.

European banks have been an overweight of as much as 4% at points, and it was particularly accretive – better than tech, which added 10 basis points to our performance.

However the more positive sector relative to the benchmark has been consumer staples, which added 20 basis points to performance.

And the worst?

Our healthcare positioning has been slightly negative in terms of contribution – it’s one of the very few dimensions that hasn’t worked out so well. We started the year being underweight healthcare, which did very well as a sector at the end of the year. That resulted in us losing 10 basis points.

As part of its dynamism, the fund readjusted and the relative allocation went from -2% to 2%, a 4% swing. The position has now started to work more positively.

What do you do when you’re not working?

I'm quite sporty – I run and play tennis. To relax, I play acoustic guitar.