Over the past five years, UK equities have faced persistent macro uncertainty, sector rotations and valuation headwinds, yet a handful of active managers have navigated these challenges well and delivered strong risk-adjusted returns for investors.

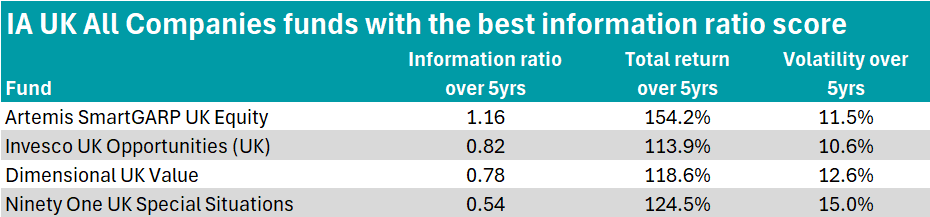

In the final part of an ongoing series, Trustnet identified funds in the IA UK All Companies sector with the highest information ratio score in the five years ending November 2025.

This score calculates the extent to which a fund’s performance derives from natural market fluctuations versus manager skill by dividing the portfolio’s active return by the tracking error. A score of 0.5 or higher indicates a better risk-adjusted performance.

To allow for comparison between funds across the sector, we selected one of the most common indices – FTSE All Share – against which to calculate scores.

Four actively managed funds in the sector scored 0.5 or higher.

While all four funds invest in UK equities, the approaches taken by their managers differ markedly – from quantitative discipline with a growth tilt to valuation-led large-caps, systematic breadth and contrarian deep-value opportunities.

Artemis SmartGARP UK Equity emerged as the top scorer in the IA UK All Companies sector, boasting an information ratio of 1.2, alongside a five-year return of 154.2% and volatility of 11.5%.

The £1.2bn fund, which also has an FE fundinfo Crown Rating of five, is managed by Philip Wolstencroft – the architect of Artemis’ proprietary quantitative process, SmartGARP.

SmartGARP involves screening thousands of UK companies for undervalued growth potential, narrowing the universe based on factors such as liquidity and market capitalisation, growth, value, momentum and ESG. The top quintile makes it into the 70 to 100-stock portfolio.

RSMR analysts said the process introduces several contrarian factors through its focus on value and avoids “following the herd”.

“The approach’s strength is founded on not overpaying for growth and recognising when the fundamentals of a company have been overlooked, suiting most market environments,” they said.

The fund’s conviction in financials has been a major driver of returns, with nearly half the portfolio allocated to large-caps such as Barclays, Lloyds and NatWest. Industrials and consumer discretionary stocks also feature prominently.

The fund was in the top quartile of the IA UK All Companies sector for returns over one, three, five and 10 years, gaining 221.2% over the decade and managing annualised returns of 10.4%. The sector average over 10 years was 86.3%.

Performance of the fund vs sector and benchmark over 5yrs

Source: FE Analytics

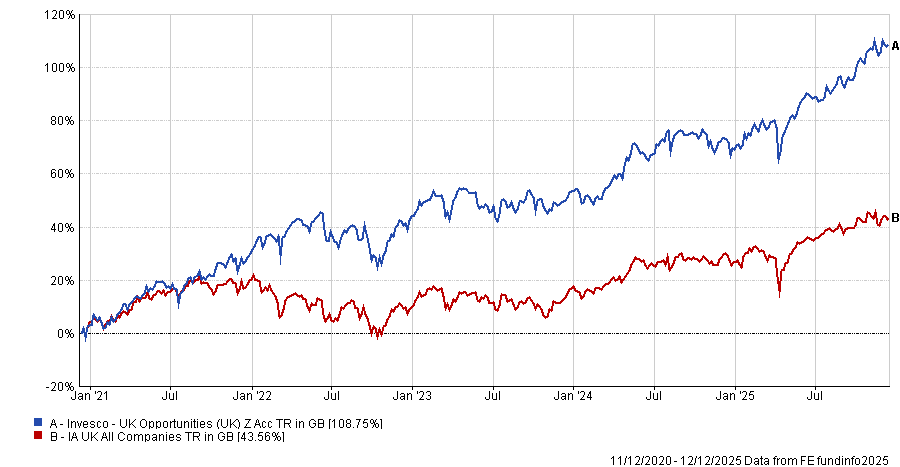

While Artemis leans on quantitative discipline, for the management team of Invesco UK Opportunities (UK), valuation has been the cornerstone of success. The £1.8bn fund has an information ratio score of 0.8.

Martin Walker has led the strategy since 2008 and also heads Invesco’s wider UK equities team. His approach is built on the belief that buying companies below intrinsic value is key to long-term success. Bethany Shard was appointed deputy manager in March 2023.

The portfolio typically holds 35 to 45 stocks and ignores benchmark constraints, allowing the fund to focus on under-the-radar opportunities rather than consensus picks.

The fund targets large-cap UK names with value characteristics, with holdings such as Shell, AstraZeneca and Lloyds Banking Group forming the backbone of the strategy.

RSMR analysts said the management team’s bottom-up fundamental proprietary research “leads to a high conviction fund that should outperform the peer group average over a full cycle”.

The fund has beaten the sector average for returns over one, three, five and 10 years.

Performance of the fund vs sector over 5yrs

Source: FE Analytics

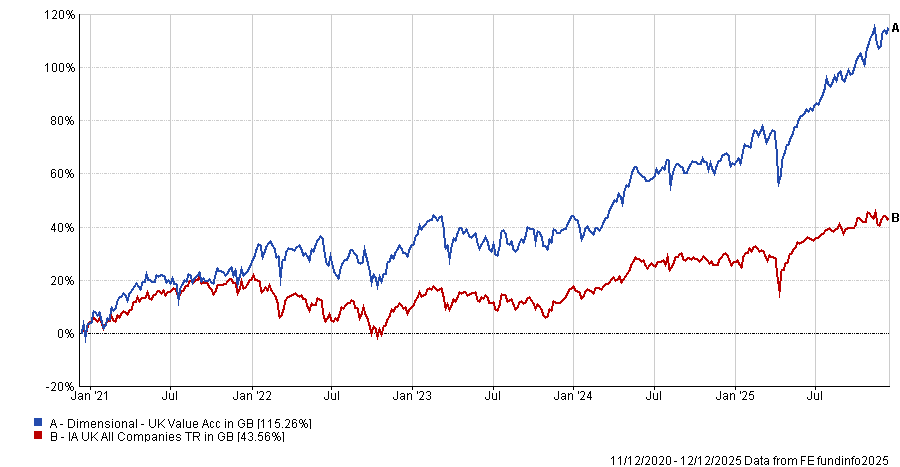

Meanwhile, Dimensional UK Value takes a systematic route, using academic research and broad diversification to capture the long-term value premium. It has achieved an information ratio of 0.8 and a five-year return of 118.6%, albeit with slightly higher volatility at 12.6%.

The £287.5m fund is managed by Nathan Lacaze and overseen by Dimensional’s wider portfolio team. They apply academic research to capture long-term drivers of returns rather than relying on traditional stock-picking.

As such, the strategy currently tilts toward value and small-cap factors, maintaining broad diversification with more than 200 holdings and ensuring consistent exposure to value premium while controlling risk and trading costs.

Similarly to other funds in the list, financials and energy companies dominate the portfolio, with names such as HSBC, Shell and Barclays among its largest positions. Tesco’s also features in the top holdings, with the supermarket chain posting a strong 2024/25 financial year and returning £1.9bn to shareholders through dividends and buybacks.

This fund has also beaten the sector average return over one, three, five and 10 years.

Performance of the fund vs sector over 5yrs

Source: FE Analytics

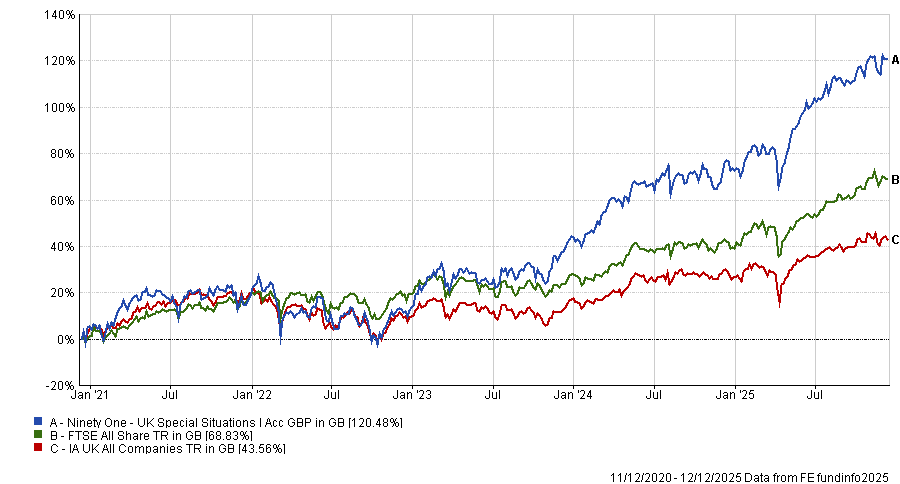

The final fund in the list takes a more contrarian stance, with deep-value investing underpinning its long-term success.

The £773.8m Ninety One UK Special Situations posted an information ratio score of 0.5 and five-year return of 124.5%. It is the most volatile of the four funds at 15% and has a Crown Rating of five.

Originally helmed by veteran contrarian manager Alastair Mundy, the fund passed into the hands of Alessandro Dicorrado in April 2020, who continues its deep-value, bottom-up process, buying unloved UK companies he sees as having recovery potential.

The portfolio typically comprises between 40 to 70 stocks held for the long-term, with turnover averaging 20-25%, which contributes to the volatility of fund performance.

RSMR analysts noted that the fund is likely to underperform in markets driven by growth-oriented companies, particularly when sentiment is less valuation-sensitive.

“When there is a rally in value stocks, this fund should be a major beneficiary and outperform the market and peer group,” they added.

The fund has gained 168.8% over 10 years and is in the top quartile in the sector.

Performance of the fund vs sector and benchmark over 5yrs

Source: FE Analytics