Emerging markets face a barrage of challenges, from geopolitical instability to currency swings. Given their volatile nature, investors who are interested in the space may be looking for managers with the skill to navigate choppier waters.

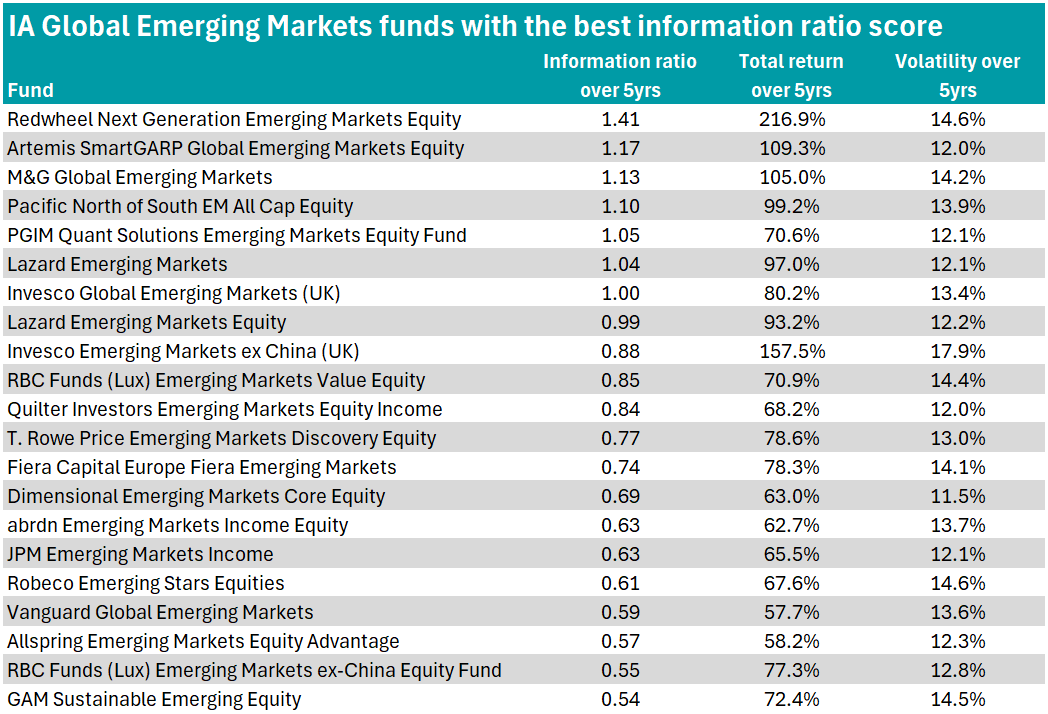

Following a recent look at global funds, Trustnet has identified funds in the IA Global Emerging Markets sector with the highest information ratio score over the past five years.

The information ratio calculates the extent to which a fund’s performance derives from natural market fluctuations versus manager skill by dividing the portfolio’s active return by the tracking error. A score of 0.5 or higher indicates a better risk-adjusted performance.

To allow for a fair comparison, we selected one of the most common indices – MSCI Emerging Markets – against which to calculate scores, finding that 21 actively managed funds achieved an information ratio score of 0.5 or higher.

Source: FE Analytics

Drilling down further, seven managed a score of 1 or more.

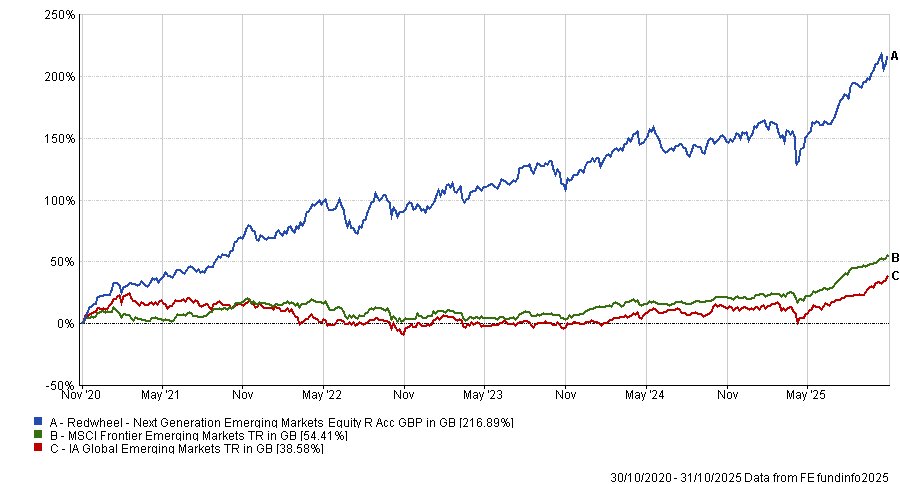

Top of the table was the $1.8bn Redwheel Next Generation Emerging Markets Equity fund, with an information ratio score of 1.4.

It has an FE fundinfo Crown Rating of five out of five and a Titan Square Mile ‘A’ rating.

Managed by James Johnstone since its 2019 launch, the fund’s top 10 holdings are dominated by mining names, including Anglo American Platinum, Hochschild Mining and First Quantum Minerals.

The fund typically holds between 60 and 80 all-cap stocks, with the management team deploying top-down macroeconomic and thematic research to target opportunities across the frontier and smaller emerging markets space.

Given its regional focus, returns can be more volatile on an absolute and relative basis.

Nonetheless, Titan Square Mile analysts said the fund’s “flexible style of management, which is grounded on robust fundamental analysis, can be a powerful way to generate strong excess returns over the long term”.

The fund delivered the best return of the sector over the assessed period, gaining 216.9%, with the next best being Invesco Emerging Markets ex China (UK), which gained 157.5% and achieved an information ratio score of 0.9.

Although the fund is more expensive, with an ongoing charges figure (OCF) of 1.4%, it has been highlighted as an emerging market fund justifying its higher cost by tripling investors’ money. It has also proven effective at consistently performing well when markets are on the rise and when they are falling.

Fund performance vs sector and benchmark over 5yrs

Source: FE Analytics

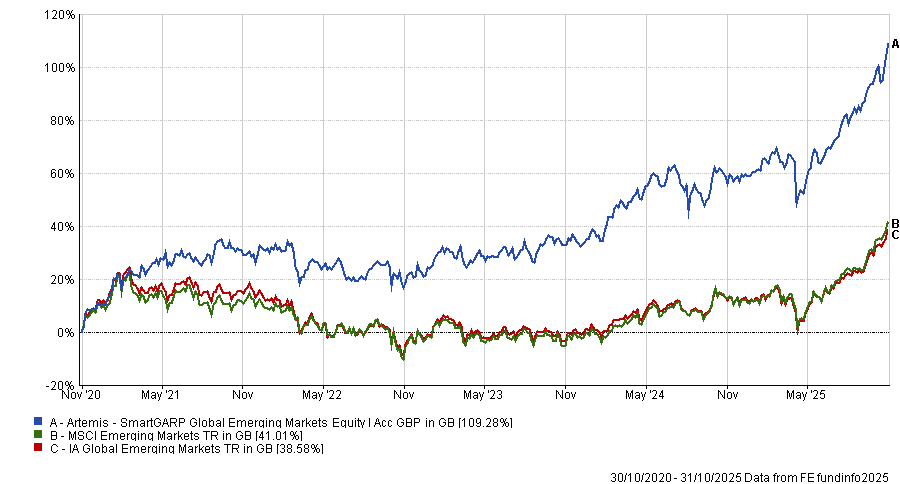

Artemis SmartGARP Global Emerging Markets Equity was second best in the table, with an information ratio score of 1.2. The value-focused, contrarian fund also has a Crown Rating of five and has been managed by FE fundinfo Alpha Manager Raheel Altaf since it was launched in 2015.

Multi-cap and well-diversified, the fund comprises 80-120 stocks, utilising Artemis’ SmartGARP investment process. This looks at both micro and macro factors to identify the top 5% to 10% prospective cheap stocks growing faster than the market which are then turned into a portfolio using manager judgement.

Despite its multi-cap status, top holdings swing to large-caps, with familiar emerging market names including Taiwan Semiconductor Manufacturing Company, Samsung Electronics, Alibaba and Tencent.

RSMR analysts said: “The fund is likely to perform best in trending markets and is generally suited by periods of improving economic growth prospects.

“In the past, the fund has been vulnerable at market inflection points or during periods of economic stress, although the team have now refined the process to reduce the impact of rapid changes in market sentiment.”

Despite periods of vulnerability, the Artemis fund achieved top-quartile returns in the sector over one, three, five and 10 years, gaining 280.3% over the decade. Although the £2.1bn fund made investors less money than the Redwheel fund over the five-year period – gaining 109.3% – it was over two percentage points less volatile at 12%.

Fund performance vs sector and benchmark over 5yrs

Source: FE Analytics

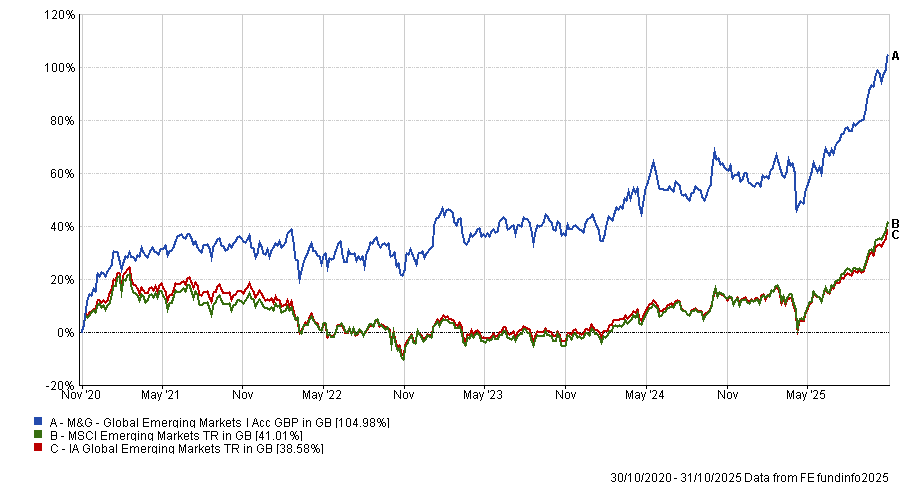

Rounding out the top three is M&G Global Emerging Markets, which has been managed by Michael Bourke since 2018.

It achieved an information ratio score of 1.1, a five-year total return of 105% and five-year volatility of 14.2%.

Its main sector focus is split across consumer products (24.9%), financials (22%) and telecom, media and technology (19.3%) across companies based in the Pacific Basin (61.3%), Americas (15.5%) and South Africa (6.2%).

As such, top holdings include Indian private sector bank HDFC Bank, Brazilian electric utilities Eletrobas and South Korean multinational automotive manufacturer Hyundai.

The $1.2bn fund was first quartile for returns over three, five and 10 years against its peers but has dropped to the second quartile over one year, despite being highlighted for its strong 2025 gains.

Fund performance vs sector and benchmark over 5yrs

Source: FE Analytics

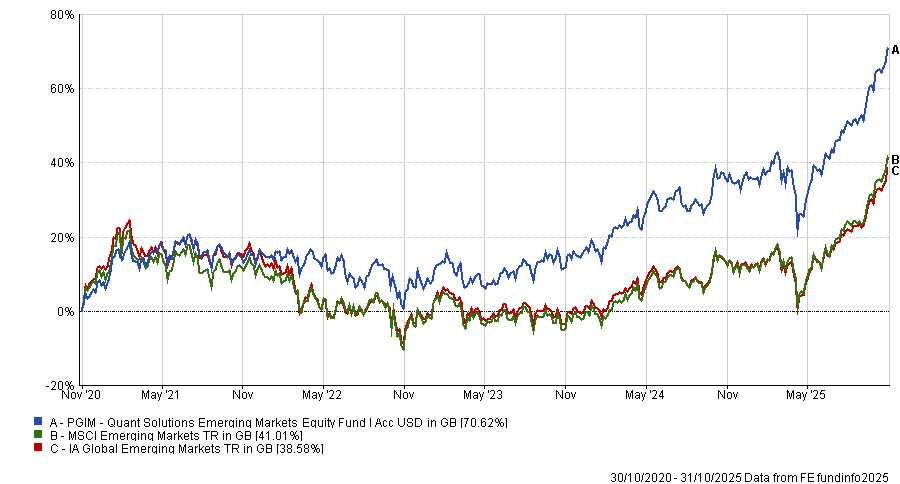

For investors more interested in lesser known, smaller funds, PGIM Quant Solutions Emerging Markets Equity Fund was the smallest of the seven by some margin, with $199.8m in assets under management.

Despite its size, the fund logged a five-year information ratio score of 1.1, alongside a 70.6% return and volatility of 12.1%.

Managed by Wen Jin and Ken D’Souza, its investment objective is long-term capital appreciation derived from companies headquartered, domiciled or incorporated in emerging markets. In particular, over two-thirds of assets are invested in companies based across the Pacific Basin region.

It has the biggest sector weighting in telecom, media and technology at 35.2%, followed by 23.3% allocated to financials and 15.7% to consumer products.

Fund performance vs sector and benchmark over 5yrs

Source: FE Analytics

Other funds that achieved an information ratio score of 1 or higher over the five-year period are Pacific North of South EM All Cap Equity, Lazard Emerging Markets and Invesco Global Emerging Markets (UK).