Rolls-Royce has rapidly become one of the best-performing stocks in the UK market, surging more than 1,100% over the past three years. Now representing 3.4% of the FTSE All Share, the jet maker has benefitted from a corporate reform story, promises of higher defence spending and rebounding air travel.

But for Imran Sattar, manager of the Edinburgh Investment Trust, Rolls-Royce was one of his biggest missed opportunities. Sattar, who has been managing money since 2003 – first at BlackRock then Majedie, before it was acquired by Liontrust – took over the Edinburgh Investment Trust at the beginning of 2024. Since then, the portfolio is up 26.6% – a good absolute result, but underperforming relative to the FTSE All Share.

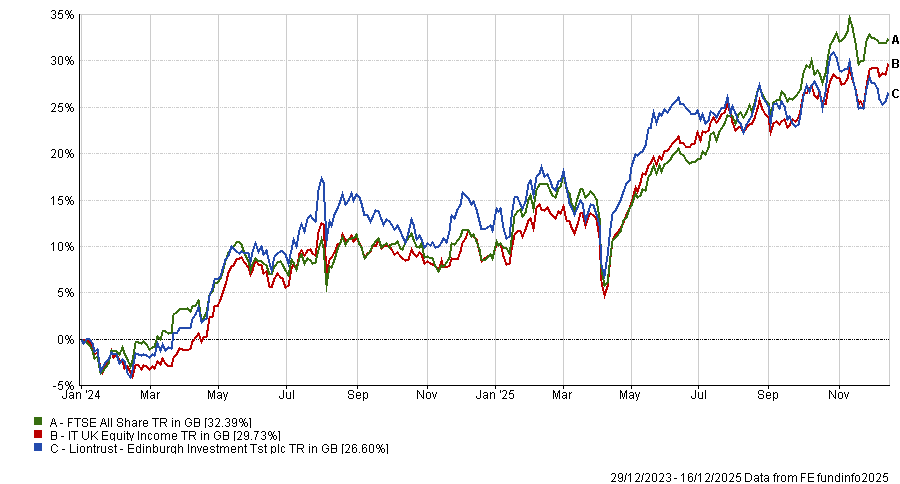

Performance of trust vs sector and benchmark since manager start date

Source: FE Analytics.

A large part of this underperformance was the decision not to own Rolls-Royce, the manager said.

“I’ll put my hands up and say I missed Rolls-Royce. I wish I had got involved in it.”

At the time, he said that he had underestimated the extent of its recovery and the success of its turnaround.

But missing out on Rolls-Royce taught Sattar a valuable lesson about re-examining the investment case for companies, he said.

“When there are companies which you’ve done well by avoiding, you should spend a bit more time looking at your long-standing view that they’re not right to own.”

Below, Sattar also explains why he has not given up on Greggs, why flexibility is crucial to his process and why investors have developed some “laughable” assumptions on certain UK stocks.

What’s the process of Edinburgh Investment Trust?

The trust has laser focus on total returns; the dividend income from the portfolio matters, but that’s only one part of the equation.

It’s very much a bottom-up strategy, but we try to build up a picture of the macro environment through meeting companies because we recognise markets don’t operate in a vacuum.

We have a quality growth bias, but if the market and macro conditions are such that we need a value-tilted portfolio, we’ll tilt towards value.

What differentiates the trust and why should investors own it?

Investors like to be bucketed into one style, whether that’s quality growth, value or quality at a reasonable price. I don’t like to be bucketed; I want to be flexible.

The other differentiator is that we focus on companies with powerful economic moats, by which we mean businesses that are capital-light and can maintain their competitive advantage.

What’s been your best-performing holding in recent years?

Industrial businesses such as Halma and Diploma have been some of our best performers.

I really like the growth of both businesses and I think both have powerful moats.

Both have first-class management teams and generate lots of cash. Plenty of businesses do that, but few can reinvest the cash at consistently high returns on capital. The teams have allocated capital fabulously for years and I’ve owned them in my previous portfolios.

They’re up roughly 30%-35% over the past year and I expect them to keep compounding well.

And your worst?

We’ve had a tougher time this year, and one of the primary reasons is Greggs [which is down 35.8% over the year to date].

It’s a wonderful business that performed so well for the past two or three years that comparisons became very difficult.

Its consumers are usually on the lower end of the income band and the fact that it has been tougher for that cohort has been a headwind. It also invested in two manufacturing and supply chain plants in Kettering and Derby. Doing this, as trading has softened, meant a big capex hump for the business.

But we’re very supportive of the management team, which always invests ahead of growth, so we’ve kept it as a medium-sized holding.

Why has the portfolio lagged over the past year?

There’s another cohort of stocks that I’ll bunch together because they’ve all underperformed for the same reason: Rightmove, Auto Trader, LSEG and Verisk.

Those are all data companies that are getting stronger with analytical overlays and AI, improving their businesses. The market is taking a different view, saying that a lawyer might use Chat GPT and search for case law from publicly available data, but that assumption is laughable.

I can’t disprove the thesis that these businesses will get killed by AI, but taking a different view from the average investor is how you make money in markets.

Why is flexibility such an important part of your process?

It’s important not to be dogmatic. I understand that there are areas of the market where there’s money to be made and it’s incumbent on me to search for those interesting ideas, whether they are in growth or in value.

There are times when growth just doesn’t work and value is leading the market. I learnt early in my career that it was important to remain pragmatic, rather than being wedded to one company or opportunity set.

You don’t always get it right – for example, it would have been better to be more value-tilted this year. But at least I’m not dogmatic enough to think there’s only one area to make money in the market.

What do you do outside of fund management?

Travelling for food is a big part of my life, so recently I went to San Sebastian for the food and I often go to a seafood restaurant in Lisbon.

I’m very family-oriented and spend a lot of time with my three children and family.